Axis Gold Loan Application Form

What is the Axis Gold Loan Application Form

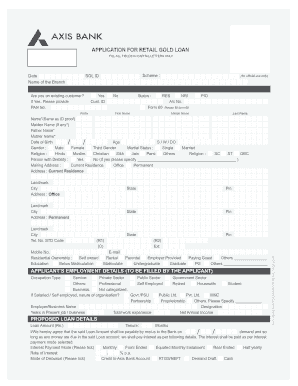

The Axis Gold Loan Application Form is a crucial document used by individuals seeking to secure a gold loan from Axis Bank. This form collects essential information about the applicant, including personal details, financial status, and the specifics of the gold being pledged. Completing this form accurately is vital for the approval process, as it helps the bank assess the applicant's eligibility and the value of the gold collateral.

How to use the Axis Gold Loan Application Form

Using the Axis Gold Loan Application Form involves several straightforward steps. First, obtain the form, which can typically be accessed online or at a bank branch. Next, fill out the required fields with accurate information, ensuring all details match your identification documents. After completing the form, review it for any errors or omissions. Finally, submit the form either online or in person at the bank, depending on your preference and the bank's guidelines.

Steps to complete the Axis Gold Loan Application Form

Completing the Axis Gold Loan Application Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as identification proof, address proof, and details of the gold being pledged.

- Fill in personal information, including your name, contact details, and occupation.

- Provide financial information, including income and existing loans, to help the bank evaluate your application.

- Detail the gold items being pledged, including weight and purity.

- Review the form thoroughly for accuracy before submission.

Legal use of the Axis Gold Loan Application Form

The Axis Gold Loan Application Form must be completed in compliance with relevant legal standards to ensure its validity. This includes adhering to regulations set forth by financial authorities regarding loan agreements and collateral. When submitted electronically, the form must meet eSignature regulations, ensuring that the applicant's consent is legally binding. Compliance with laws such as the ESIGN Act and UETA is essential for the form to be recognized in legal contexts.

Required Documents

To successfully complete the Axis Gold Loan Application Form, several documents are required. These typically include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of residence, which can be a utility bill or lease agreement.

- Details of the gold being pledged, including any certificates of authenticity.

- Income proof, such as pay stubs or tax returns, to assess repayment capability.

Eligibility Criteria

Eligibility for a gold loan through the Axis Gold Loan Application Form depends on several factors. Applicants must be at least eighteen years old and possess valid identification. The value and purity of the gold being pledged will also influence eligibility. Additionally, the applicant's credit history and financial stability are considered during the evaluation process, ensuring that the bank can assess the risk associated with the loan.

Quick guide on how to complete axis gold loan application form

Complete Axis Gold Loan Application Form effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly replacement for conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides all the necessary tools to generate, alter, and electronically sign your documents quickly without any hold-ups. Manage Axis Gold Loan Application Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Axis Gold Loan Application Form effortlessly

- Find Axis Gold Loan Application Form and click on Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Axis Gold Loan Application Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the axis gold loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current Axis Gold Loan interest rate?

The Axis Gold Loan interest rate varies depending on several factors including loan tenure and amount. Generally, it's tailored to provide competitive rates that make borrowing more affordable for customers. For the latest updates on Axis Gold Loan interest, it is advisable to check directly with Axis Bank or on their official website.

-

How is the Axis Gold Loan interest calculated?

The Axis Gold Loan interest is calculated based on the principal loan amount and the tenure of the loan. Axis Bank uses a predetermined interest rate that applies to the outstanding balance throughout the loan period. Understanding this calculation can help you manage your repayments more effectively.

-

What are the benefits of taking an Axis Gold Loan?

One of the main benefits of an Axis Gold Loan is the lower interest compared to unsecured loans. Additionally, it offers quick disbursal and minimal documentation, making it a convenient option for customers. Borrowers can also utilize their gold assets without parting with them, ensuring liquidity.

-

Are there any processing fees associated with an Axis Gold Loan?

Yes, there may be processing fees when you apply for an Axis Gold Loan. These fees vary based on the loan amount and terms set by the bank. It's important to review these fees as they contribute to the overall cost of borrowing against the Axis Gold Loan interest.

-

Can the Axis Gold Loan interest rate increase in the future?

While the Axis Gold Loan interest rate is usually fixed at the time of loan disbursement, fluctuations in market rates can influence future offerings. It's crucial to discuss the specifics with an Axis Bank representative to fully understand any possible changes in terms.

-

How long does it take to get an Axis Gold Loan approved?

The approval process for an Axis Gold Loan is typically swift, often taking just a few hours to a couple of days. The quick turnaround is largely due to the minimal paperwork and reliance on valued gold assets. This allows borrowers to access funds quickly, making it a viable option for urgent financial needs.

-

What happens if I miss a payment on my Axis Gold Loan?

Missing a payment on your Axis Gold Loan could result in penalties and increase your overall financial burden due to accruing interest on the missed payment. Continued defaults may lead to the re-evaluation of your loan terms or, in worst cases, the liquidation of the pledged gold. Maintaining timely payments is essential to avoid these consequences.

Get more for Axis Gold Loan Application Form

Find out other Axis Gold Loan Application Form

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile