Drs Form Ct 941 Hhe

What is the DRS Form CT 941 HHE?

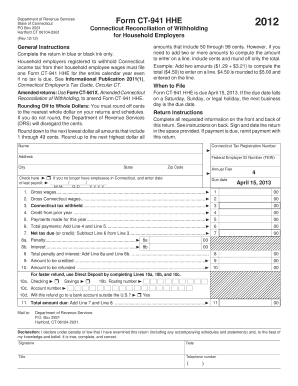

The DRS Form CT 941 HHE is a tax form used in the state of Connecticut for reporting wages and withholding for employees. This form is essential for employers to accurately report their payroll tax obligations to the Connecticut Department of Revenue Services (DRS). The form captures critical information such as total wages paid, the amount of state income tax withheld, and any adjustments that may be necessary for the reporting period. Understanding this form is crucial for compliance with state tax laws.

How to Use the DRS Form CT 941 HHE

Using the DRS Form CT 941 HHE involves several steps to ensure accurate reporting. Employers must first gather all necessary payroll data for the reporting period, including total wages and taxes withheld. Once the information is compiled, it should be entered into the form accurately. After completing the form, employers can submit it electronically or by mail, depending on their preference. It is essential to review the form for accuracy before submission to avoid potential penalties.

Steps to Complete the DRS Form CT 941 HHE

Completing the DRS Form CT 941 HHE requires careful attention to detail. Here are the steps involved:

- Gather payroll records for the reporting period, including total wages and taxes withheld.

- Fill out the form with accurate figures, ensuring that all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically through the DRS online portal or mail it to the appropriate address.

- Keep a copy of the submitted form for your records.

Legal Use of the DRS Form CT 941 HHE

The DRS Form CT 941 HHE is legally binding and must be filed in accordance with Connecticut state laws. Failure to file this form accurately and on time can result in penalties, including fines and interest on unpaid taxes. Employers are responsible for ensuring that the information reported is truthful and complete, as inaccuracies can lead to audits or further legal action from the state. It is advisable to consult with a tax professional if there are uncertainties regarding the form's completion or submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the DRS Form CT 941 HHE. Typically, the form is due quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the filing deadline for the first quarter is April 30, the second quarter is July 31, the third quarter is October 31, and the fourth quarter is January 31 of the following year. Staying aware of these deadlines is crucial for maintaining compliance and avoiding penalties.

Required Documents

To complete the DRS Form CT 941 HHE, employers need to gather various documents and information, including:

- Payroll records for the reporting period.

- Employee W-2 forms to verify wages and withholding.

- Any previous tax filings that may affect current reporting.

- Documentation of any adjustments or corrections made during the reporting period.

Quick guide on how to complete drs form ct 941 hhe

Complete Drs Form Ct 941 Hhe effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Drs Form Ct 941 Hhe on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Drs Form Ct 941 Hhe with ease

- Find Drs Form Ct 941 Hhe and click on Get Form to begin.

- Use the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether it be via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Drs Form Ct 941 Hhe to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drs form ct 941 hhe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 941 and how does it relate to airSlate SignNow?

CT 941 is a specific form used for reporting withholding taxes in Connecticut. airSlate SignNow can help businesses streamline the process of signing and submitting CT 941 documents quickly and securely, ensuring compliance with state regulations.

-

How can I use airSlate SignNow for my CT 941 submissions?

You can use airSlate SignNow to electronically sign and send your CT 941 forms directly to the Connecticut Department of Revenue Services. This ensures a faster submission process and reduces the hassle of paperwork.

-

What features does airSlate SignNow offer for completing CT 941 forms?

airSlate SignNow offers intuitive features such as document templates, eSignature capabilities, and secure cloud storage. These features make it easy to prepare and manage your CT 941 forms efficiently.

-

Is airSlate SignNow cost-effective for filing multiple CT 941 forms?

Yes, airSlate SignNow provides a cost-effective solution for businesses that need to file multiple CT 941 forms. With competitive pricing plans, you can save on administrative costs and increase productivity.

-

Can airSlate SignNow integrate with accounting software for CT 941 management?

Absolutely! airSlate SignNow integrates with various accounting software that can simplify your CT 941 management. This integration helps in maintaining accurate records and ensuring timely filings.

-

What are the benefits of using airSlate SignNow for CT 941 documents?

Using airSlate SignNow for your CT 941 documents provides enhanced security, faster processing times, and improved compliance. It eliminates the need for physical paperwork, making the entire process more efficient.

-

Is training available for using airSlate SignNow for CT 941 submissions?

Yes, airSlate SignNow offers comprehensive training resources to help you understand how to manage your CT 941 submissions effectively. With user-friendly guides and support, you'll be up and running in no time.

Get more for Drs Form Ct 941 Hhe

- Department of neurologypatient referral intake form

- Online shopping order forms made easy with aidaform

- Ssm financial assistance form

- Caresource hierarchy form

- Upmc lung transplant program personal data sheet upmccom form

- Records release authorization to shirer family dentistry llc form

- Consent for release of information ticket to work social security

- Authorization for release of information colleton medical

Find out other Drs Form Ct 941 Hhe

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed