MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

What is the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

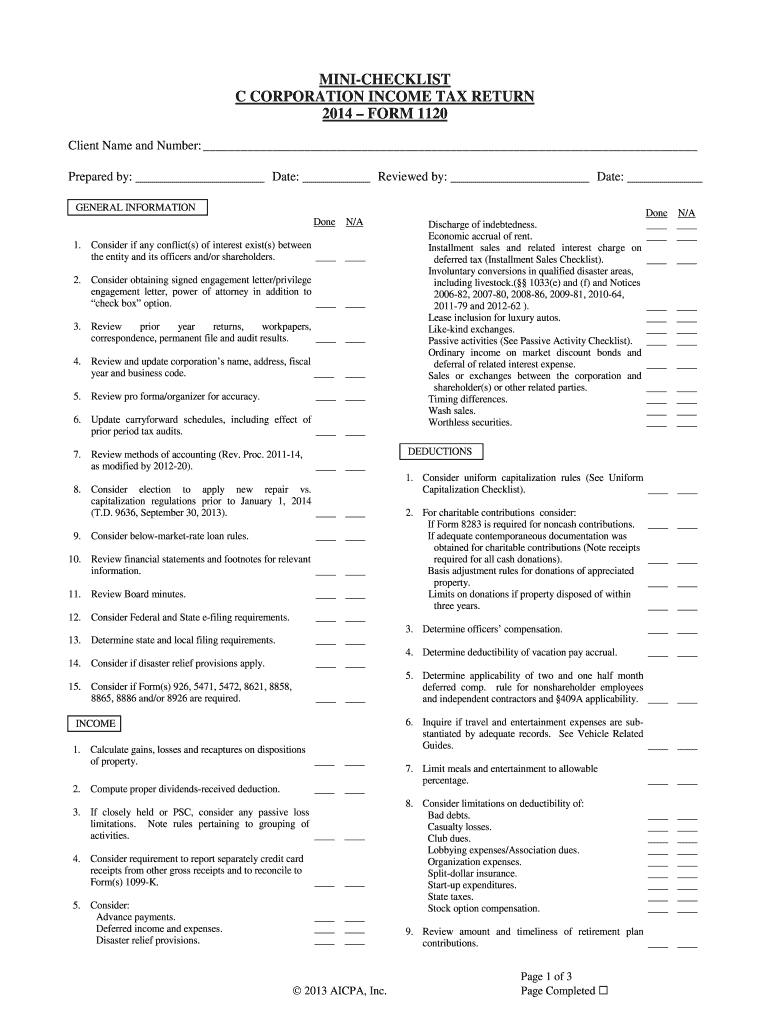

The MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 is a simplified version of the standard Form 1120, designed to assist C corporations in preparing their tax returns. This checklist serves as a guide to ensure that all necessary information and documentation are collected and organized before filing. It includes essential items such as income, deductions, and credits, which are crucial for accurate tax reporting. Using this checklist helps streamline the tax preparation process and minimizes the risk of errors that could lead to penalties or audits.

How to use the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

Utilizing the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 involves several steps. First, gather all relevant financial documents, including income statements, expense records, and prior tax returns. Next, follow the checklist sequentially to ensure all sections are completed. Each item on the checklist corresponds to a specific section of the Form 1120, guiding you through the necessary data entry. It is advisable to double-check each entry for accuracy, as this will help avoid mistakes that could complicate the filing process.

Steps to complete the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

Completing the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 involves a series of methodical steps:

- Review the checklist to understand the required information.

- Collect all financial records, including revenue and expenses.

- Fill out each section of the checklist, ensuring all required fields are addressed.

- Cross-reference your entries with the supporting documents to ensure accuracy.

- Consult with a tax professional if you have questions or need clarification on specific items.

- Finalize the checklist and prepare to submit the full Form 1120 based on the information gathered.

Legal use of the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

The legal use of the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 is essential for compliance with IRS regulations. This checklist is not a substitute for the actual tax return but rather a preparatory tool that ensures all necessary information is collected. When completed accurately, it supports the legitimacy of the tax return filed. Adhering to IRS guidelines and maintaining accurate records is critical to avoid legal issues, such as audits or penalties for non-compliance.

Required Documents

To effectively use the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120, several documents are required:

- Income statements detailing revenue sources.

- Expense reports outlining operational costs.

- Prior year tax returns for reference.

- Any relevant financial statements, such as balance sheets.

- Documentation for deductions and credits claimed.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for timely submission of the MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120. Generally, C corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For corporations operating on a calendar year, this means the deadline is April 15. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to verify specific deadlines each year, as they may vary based on individual circumstances.

Quick guide on how to complete mini checklist c corporation income tax return 2014 form 1120

Manage MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 effortlessly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the accurate form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, amend, and eSign your documents promptly without interruptions. Handle MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 with ease

- Find MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select pertinent portions of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your document, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120 and ensure superior communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the IRS address to send Delaware C-corp Income Tax return form 1120?

For returns filed from Jan 1, 2019 through June 17, 2019DelawareLess than $10 million and Schedule M-3 is not filedDepartment of the TreasuryInternal Revenue Service CenterCincinnati, OH 45999-0012$10 million or more, or less than $10 million and Schedule M-3 is filedDepartment of the TreasuryInternal Revenue Service CenterOgden, UT 84201-0012For returns filed after June 17, 2019DelawareLess than $10 million and Schedule M-3 is not filedDepartment of the TreasuryInternal Revenue Service CenterKansas City, MO 64999-0012$10 million or more, or less than $10 million and Schedule M-3 is filedDepartment of the TreasuryInternal Revenue Service CenterOgden, UT 84201-0012source: https://www.irs.gov/pub/irs-pdf/...

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the mini checklist c corporation income tax return 2014 form 1120

How to generate an eSignature for your Mini Checklist C Corporation Income Tax Return 2014 Form 1120 in the online mode

How to make an eSignature for your Mini Checklist C Corporation Income Tax Return 2014 Form 1120 in Chrome

How to generate an eSignature for signing the Mini Checklist C Corporation Income Tax Return 2014 Form 1120 in Gmail

How to generate an eSignature for the Mini Checklist C Corporation Income Tax Return 2014 Form 1120 right from your smart phone

How to create an eSignature for the Mini Checklist C Corporation Income Tax Return 2014 Form 1120 on iOS devices

How to make an eSignature for the Mini Checklist C Corporation Income Tax Return 2014 Form 1120 on Android devices

People also ask

-

What is the AICPA checklist and how can it help my business?

The AICPA checklist is a comprehensive guide designed to assist businesses in meeting the American Institute of CPAs standards for financial reporting. By utilizing the AICPA checklist, you can ensure compliance with regulatory requirements, minimize risks, and streamline your auditing processes.

-

How does airSlate SignNow support the use of the AICPA checklist?

airSlate SignNow provides features that facilitate the efficient management and electronic signing of documents required by the AICPA checklist. With our platform, you can easily upload, share, and eSign relevant documents, ensuring that your team stays compliant while saving time and reducing paper waste.

-

What are the pricing options available for airSlate SignNow?

We offer flexible pricing plans for airSlate SignNow to accommodate businesses of all sizes. Our pricing is competitive and designed to offer maximum value while supporting your compliance with the AICPA checklist, making it an investment that pays off in efficiency and compliance.

-

Can I integrate airSlate SignNow with other tools for AICPA checklist compliance?

Yes, airSlate SignNow seamlessly integrates with various software applications that can support your compliance initiatives related to the AICPA checklist. Popular integrations include cloud storage services, CRMs, and project management tools, allowing you to enhance collaboration and streamline your workflows.

-

What features does airSlate SignNow offer that relate to the AICPA checklist?

airSlate SignNow offers a suite of powerful features like reusable templates, audit trails, and automated reminders that can aid in adhering to the AICPA checklist. These tools enhance your document management process, guaranteeing that all necessary steps are taken to fulfill compliance requirements.

-

How does airSlate SignNow improve the signing process for the AICPA checklist?

airSlate SignNow simplifies the signing process for documents associated with the AICPA checklist by providing a user-friendly interface that allows for quick and secure eSigning. Our platform ensures that signers can access and sign documents on any device, making it easier for teams to collaborate and meet deadlines.

-

Is airSlate SignNow suitable for small businesses needing to comply with the AICPA checklist?

Absolutely! airSlate SignNow is designed to be a cost-effective and straightforward solution for businesses of all sizes, including small businesses facing AICPA checklist compliance. Our platform empowers small teams to efficiently manage their document workflows and maintain compliance without breaking the bank.

Get more for MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

- Minor trust fund application winnebago tribe of nebraska form

- Equipment delivery form 27380461

- 45 hour driving log form

- Element scavenger hunt form

- After school program parents handbook phone 9495596868 ext 581 fax 9495599922 www sccca form

- Mind map template form

- Hhs hrsa photoimage video release form photography subject release form

- Artwork license agreement template form

Find out other MINI CHECKLIST C CORPORATION INCOME TAX RETURN FORM 1120

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT