Auto Loan Application Form

What is the Auto Loan Application

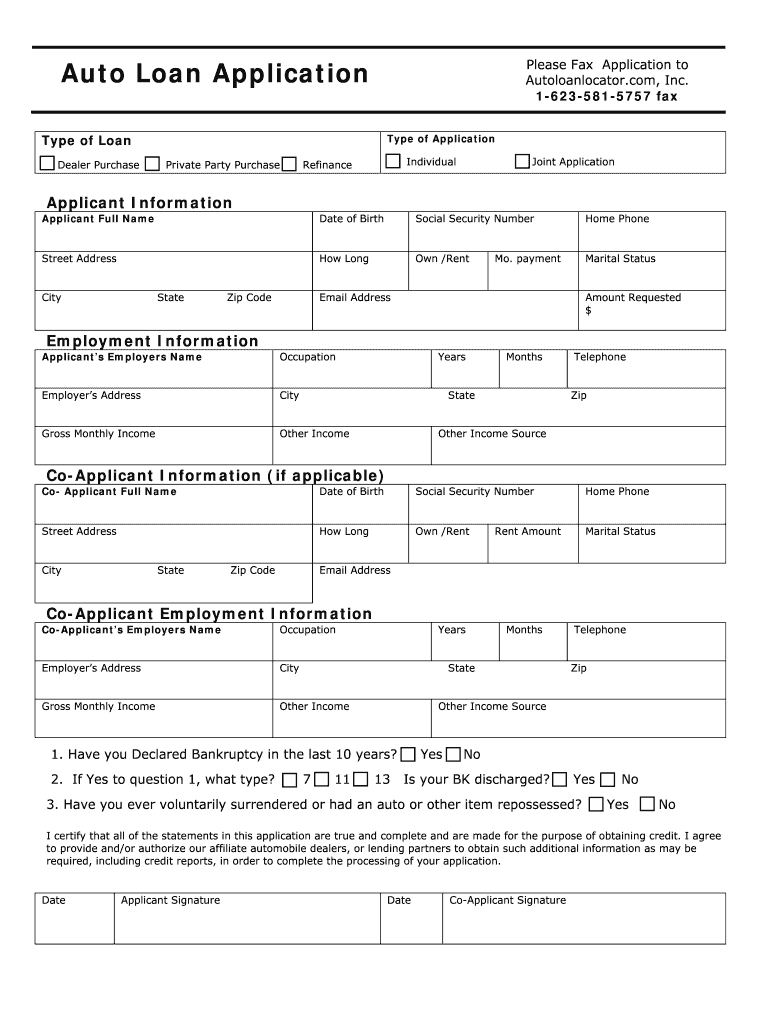

The auto loan application is a formal document used to request financing for purchasing a vehicle. This application collects essential information about the applicant, including personal details, employment history, income, and the specifics of the vehicle being purchased. By submitting this application to Founders Federal Credit Union, individuals can initiate the process of obtaining a loan to finance their auto purchase.

Key Elements of the Auto Loan Application

When filling out the auto loan application, several key elements must be included to ensure a smooth approval process. These elements typically consist of:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Information: Current employer, job title, and length of employment.

- Income Details: Monthly or annual income, including any additional sources of revenue.

- Vehicle Information: Make, model, year, and Vehicle Identification Number (VIN) of the car being financed.

- Loan Amount Requested: The total amount of financing needed for the vehicle purchase.

Steps to Complete the Auto Loan Application

Completing the auto loan application involves several straightforward steps to ensure accuracy and completeness:

- Gather all necessary documents, including proof of income and identification.

- Fill out the application form with accurate personal and financial information.

- Provide details about the vehicle you intend to purchase.

- Review the application for any errors or missing information.

- Submit the completed application to Founders Federal Credit Union through the preferred method.

Required Documents

To successfully complete the auto loan application, certain documents are typically required. These may include:

- Proof of Identity: A government-issued ID, such as a driver’s license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Credit History: Information regarding your credit score and any existing debts.

- Vehicle Documentation: Details about the vehicle, including the purchase agreement or bill of sale.

Form Submission Methods

The auto loan application can be submitted through various methods, providing flexibility for applicants. Common submission methods include:

- Online Submission: Complete and submit the application through the Founders Federal Credit Union website.

- Mail: Print the application, fill it out, and send it via postal service.

- In-Person: Visit a local branch to submit the application directly to a representative.

Eligibility Criteria

To qualify for an auto loan through Founders Federal Credit Union, applicants must meet specific eligibility criteria. These may include:

- Age Requirement: Applicants must be at least eighteen years old.

- Creditworthiness: A satisfactory credit score may be required to secure financing.

- Income Verification: Proof of stable income to ensure the ability to repay the loan.

- Membership Status: Applicants may need to be members of Founders Federal Credit Union.

Quick guide on how to complete auto loan application wilderness adventure books

The optimal method to locate and execute Auto Loan Application

On a business-wide scale, ineffective procedures concerning paper authorization can consume a signNow amount of working hours. Signing documents like Auto Loan Application is an inherent element of operations in any enterprise, which is why the efficiency of each agreement’s lifecycle signNowly impacts the overall efficiency of the organization. With airSlate SignNow, signing your Auto Loan Application is as simple and swift as possible. You will discover with this platform the most recent version of virtually any form. Even better, you can sign it instantly without needing to install external applications on your computer or print anything as physical copies.

Steps to obtain and sign your Auto Loan Application

- Browse our repository by category or utilize the search function to locate the document you require.

- Examine the form preview by clicking on Learn more to ensure it’s the correct one.

- Select Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- When completed, click the Sign tool to endorse your Auto Loan Application.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything required to manage your documents effectively. You can find, complete, edit, and even dispatch your Auto Loan Application in one tab with no difficulty. Optimize your processes by employing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

Create this form in 5 minutes!

How to create an eSignature for the auto loan application wilderness adventure books

How to make an electronic signature for the Auto Loan Application Wilderness Adventure Books in the online mode

How to create an electronic signature for the Auto Loan Application Wilderness Adventure Books in Chrome

How to create an electronic signature for putting it on the Auto Loan Application Wilderness Adventure Books in Gmail

How to generate an eSignature for the Auto Loan Application Wilderness Adventure Books right from your mobile device

How to make an eSignature for the Auto Loan Application Wilderness Adventure Books on iOS devices

How to generate an eSignature for the Auto Loan Application Wilderness Adventure Books on Android

People also ask

-

What is the founders federal credit union application for auto loan?

The founders federal credit union application for auto loan is a streamlined process allowing members to apply for financing to purchase a vehicle. This application typically requires basic personal information, financial details, and information about the vehicle you wish to finance. It's designed to be user-friendly, facilitating quick approvals for eligible members.

-

How does the application process work for the founders federal credit union application for auto loan?

To complete the founders federal credit union application for auto loan, members can visit the official website or a local branch. The application involves filling out an online form or submitting a paper application, including proof of income and identification. Once submitted, the credit union typically reviews applications promptly to provide financing decisions within a short timeframe.

-

What are the benefits of the founders federal credit union application for auto loan?

The founders federal credit union application for auto loan offers competitive interest rates and flexible repayment terms tailored to your financial situation. Additionally, members can benefit from personalized service and support throughout the loan process. This approach not only simplifies financing but also makes it easier to manage monthly payments.

-

Are there any fees associated with the founders federal credit union application for auto loan?

Generally, the founders federal credit union application for auto loan does not have hidden fees. However, applicants should be aware of potential costs such as an origination fee or penalties for late payments. It's recommended to review the terms and conditions before applying to understand any applicable fees.

-

What type of vehicles can I finance with the founders federal credit union application for auto loan?

The founders federal credit union application for auto loan covers a variety of vehicles, including new and used cars, trucks, and SUVs. Members can inquire about specific vehicle requirements and eligibility with the credit union. This flexibility allows you to find a vehicle that suits your needs while securing necessary financing.

-

Can I apply for the founders federal credit union application for auto loan online?

Yes, the founders federal credit union application for auto loan can be completed online for the convenience of members. The online application is designed to be simple and accessible, allowing you to submit your information securely from the comfort of your home. Ensure you have all necessary documents ready to expedite the process.

-

How long does it take to get approved for the founders federal credit union application for auto loan?

Approval times for the founders federal credit union application for auto loan can vary, but many applicants receive decisions within a few hours to a few days. Factors such as the completeness of your application and your creditworthiness can influence the timeline. It’s advisable to check with the credit union for specific processing times.

Get more for Auto Loan Application

- Head start application pdf form

- Waste stream characterization form mccoys hazardous waste

- Fourth grade book report form

- 866 756 9733 form

- Chapter 14 building vocabulary the great depression begins form

- Attorney client agreement template form

- Attendance agreement template form

- Attorney client representation agreement template form

Find out other Auto Loan Application

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed