Form Sc 2756

What is the Form SC 2756?

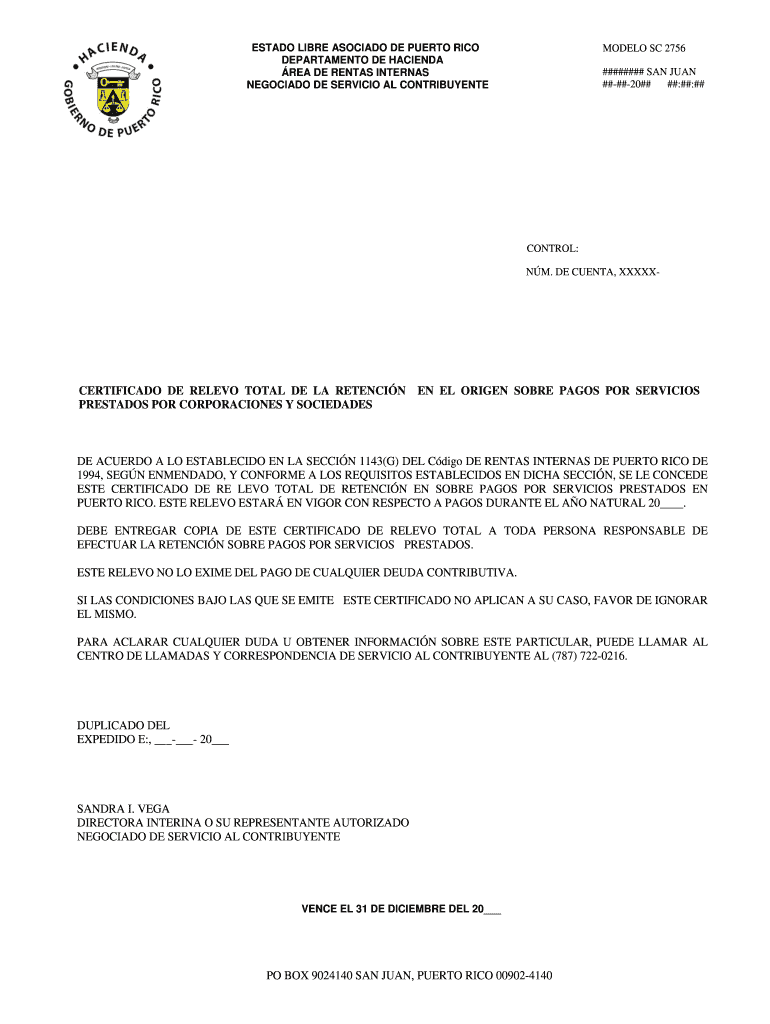

The Form SC 2756 is a document used primarily in Puerto Rico for tax purposes, specifically related to the certification of tax relief. This form is crucial for individuals and businesses seeking to establish their eligibility for certain tax benefits or exemptions. Understanding the purpose and requirements of the Form SC 2756 is essential for ensuring compliance with local tax regulations.

How to Use the Form SC 2756

Using the Form SC 2756 involves several steps to ensure that all necessary information is accurately provided. First, gather all required documents that support your claim for tax relief. This may include income statements, previous tax returns, and any relevant identification. Next, fill out the form completely, ensuring that all sections are addressed. Once completed, the form can be submitted electronically or via mail, depending on the specific guidelines provided by the Puerto Rico Department of Treasury.

Steps to Complete the Form SC 2756

Completing the Form SC 2756 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Provide details about your income and any deductions you are claiming.

- Attach supporting documentation that verifies your eligibility for tax relief.

- Review the form for accuracy and completeness before submission.

Legal Use of the Form SC 2756

The legal use of the Form SC 2756 is governed by tax laws in Puerto Rico. It is important to ensure that the information provided on the form is truthful and accurate, as submitting false information can lead to penalties. The form serves as a declaration of eligibility for tax benefits and must be filled out in accordance with the guidelines set forth by the local tax authorities.

Key Elements of the Form SC 2756

Several key elements must be included in the Form SC 2756 to ensure its validity:

- Taxpayer identification information.

- Details of income and deductions.

- Supporting documentation for claims made.

- Signature and date to verify the authenticity of the submission.

Form Submission Methods

The Form SC 2756 can be submitted through various methods. Taxpayers have the option to file the form online through the Puerto Rico Department of Treasury's website, which allows for quicker processing. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to choose the method that best suits your needs and ensures compliance with submission deadlines.

Quick guide on how to complete form sc 2756

Complete Form Sc 2756 seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources to draft, modify, and eSign your documents promptly without interruptions. Manage Form Sc 2756 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-driven operation today.

How to modify and eSign Form Sc 2756 effortlessly

- Locate Form Sc 2756 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Form Sc 2756 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sc 2756

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form as 2756 2755?

The form as 2756 2755 is a specific document template used in various business processes. It allows organizations to standardize their workflows and ensure compliance with regulatory requirements. AirSlate SignNow makes it easy to create, manage, and eSign this type of form.

-

How can airSlate SignNow help with the form as 2756 2755?

AirSlate SignNow provides an intuitive platform for businesses to seamlessly create and eSign the form as 2756 2755. Users can customize the form to meet their specific needs while ensuring a smooth user experience. This helps save time and enhances productivity.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers various pricing plans that cater to different organizational needs, ensuring that you can manage documents like the form as 2756 2755 affordably. Plans range from individual to enterprise levels, allowing for scalability. Check the website for the most current pricing structures.

-

Is it easy to integrate airSlate SignNow with other applications?

Yes, airSlate SignNow provides seamless integrations with numerous applications, making it easy to manage the form as 2756 2755 across different platforms. You can integrate it with CRM systems, document storage, and other business tools to streamline workflows. This enhances collaboration and reduces manual entry errors.

-

What features does airSlate SignNow offer for the form as 2756 2755?

AirSlate SignNow offers features such as customizable templates, automated workflows, and advanced security for the form as 2756 2755. These features ensure that your documents are not only compliant but also easily accessible for multiple users. The platform also supports mobile access making it convenient for on-the-go signing.

-

Can I track the status of the form as 2756 2755 using airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of the form as 2756 2755 in real-time. This feature enables you to see who has viewed, signed, or completed the document, ensuring that you are always updated. This transparency helps in managing deadlines and compliance efficiently.

-

What are the benefits of using airSlate SignNow for the form as 2756 2755?

Using airSlate SignNow for the form as 2756 2755 enhances efficiency and reduces turnaround time for document signing. It eliminates the need for physical paperwork and streamlines processes with eSignatures. Additionally, the platform enhances security, ensuring that your sensitive documents are protected.

Get more for Form Sc 2756

Find out other Form Sc 2756

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free