1099g Form

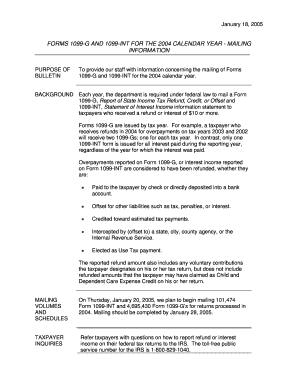

What is the 1099-G Form?

The 1099-G form is a tax document that reports certain government payments made to individuals. In Missouri, this form is primarily used to report unemployment compensation, state tax refunds, and other government payments. Recipients of these payments must include this information when filing their federal tax returns. The form provides essential details, including the amount received and the type of payment, ensuring that taxpayers accurately report their income to the IRS.

How to Obtain the 1099-G Form in Missouri

To obtain the 1099-G form in Missouri, individuals can access it through the Missouri Department of Revenue's official website. The form is typically available online for download, allowing taxpayers to print it directly. Additionally, if you received unemployment benefits, the Missouri Division of Employment Security may send the form automatically to your registered address. It is advisable to check your mail and online accounts regularly to ensure you have the most current version of the form.

Steps to Complete the 1099-G Form

Completing the 1099-G form involves several straightforward steps:

- Gather all necessary information, including your Missouri state identification number and the amounts received.

- Fill in your personal details, such as your name, address, and social security number.

- Report the total amount of unemployment compensation or other government payments received in the designated box on the form.

- Double-check all entries for accuracy to avoid potential issues with the IRS.

- Sign and date the form to validate it before submission.

Legal Use of the 1099-G Form

The 1099-G form holds legal significance as it is used to report income to the IRS. It must be accurately completed and submitted to ensure compliance with federal tax laws. The form serves as an official record of government payments, and failure to report this income can result in penalties or audits. When filled out correctly, the 1099-G can help taxpayers substantiate their claims and avoid discrepancies with tax authorities.

Filing Deadlines for the 1099-G Form

Filing deadlines for the 1099-G form are crucial for compliance. Typically, the form must be issued to recipients by January 31 of the year following the tax year in which the payments were made. Additionally, the filed copies must be submitted to the IRS by the end of February if filed by paper, or by March 31 if filed electronically. Meeting these deadlines helps avoid penalties and ensures that taxpayers can accurately report their income on time.

Who Issues the 1099-G Form?

The 1099-G form is issued by government agencies that provide payments to individuals. In Missouri, this includes the Missouri Department of Revenue for state tax refunds and the Division of Employment Security for unemployment benefits. These agencies are responsible for ensuring that recipients receive their forms in a timely manner, enabling them to report their income accurately when filing taxes.

Quick guide on how to complete 1099g

Fill out 1099g effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without interruptions. Manage 1099g on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric workflow today.

The easiest way to modify and eSign 1099g effortlessly

- Find 1099g and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Revise and eSign 1099g and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable Missouri 1099 G form?

The printable Missouri 1099 G form is a tax document used to report certain types of income, including unemployment benefits and state tax refunds. This form is essential for both taxpayers and the Missouri Department of Revenue. You can easily generate and print this form using airSlate SignNow to ensure all your tax liabilities are accurately reported.

-

How can I obtain a printable Missouri 1099 G form?

You can obtain a printable Missouri 1099 G form directly from the Missouri Department of Revenue's website or by using airSlate SignNow's efficient document creation tools. Just fill out the required fields and print it out for your records. This easy-to-use process simplifies your tax documentation needs.

-

Is the printable Missouri 1099 G form free to use?

While the form itself is available at no cost, airSlate SignNow offers affordable features for managing your document signing and eSigning needs. These services streamline the entire process, ensuring you can prepare and send your printable Missouri 1099 G form with ease. Check our pricing plans for the best solution that fits your business needs.

-

Can I eSign the printable Missouri 1099 G form using airSlate SignNow?

Yes, with airSlate SignNow, you can easily eSign your printable Missouri 1099 G form securely. This platform provides a user-friendly interface for adding signatures and managing documents electronically, making the entire process efficient and legally binding. You can also share the completed form via email or print it out.

-

What are the benefits of using airSlate SignNow for my printable Missouri 1099 G form?

Using airSlate SignNow for your printable Missouri 1099 G form provides a range of benefits, including streamlined document management, enhanced security, and access to various integrations. Our platform ensures that your documents are encrypted and securely stored, giving you peace of mind when handling sensitive tax information.

-

Are there any integrations available with airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various integrations with leading accounting and tax software, making it easier to manage your printable Missouri 1099 G form alongside other financial documents. These integrations enhance workflow efficiency by allowing seamless data transfer between applications, saving you time on document handling.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers robust features such as customizable templates, automated workflows, and secure storage for your printable Missouri 1099 G form and other documents. With intuitive tools for collaboration and tracking, our platform enhances your overall document management experience, leading to increased productivity.

Get more for 1099g

- Oregon lease form

- Oregon prenuptial premarital agreement uniform premarital agreement act with financial statements oregon

- Oregon prenuptial premarital agreement without financial statements oregon form

- Amendment to prenuptial or premarital agreement oregon form

- Financial statements only in connection with prenuptial premarital agreement oregon form

- Revocation of premarital or prenuptial agreement oregon form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children oregon form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497323528 form

Find out other 1099g

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF