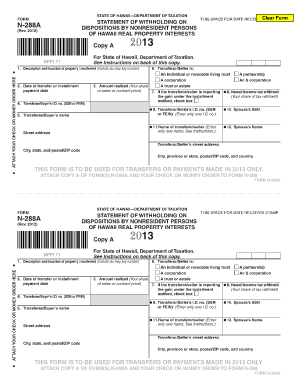

N 288a Form

What is the N 288a Form

The N 288a Form is a specific document used in the United States, primarily for reporting certain tax-related information. It is often utilized by individuals and businesses to disclose income, deductions, and other financial details to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for compliance with federal tax laws and regulations.

How to use the N 288a Form

Using the N 288a Form involves several key steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form with precise information, ensuring that all entries are clear and legible. Once completed, review the form for any errors or omissions before submission. It is important to retain a copy of the form for personal records.

Steps to complete the N 288a Form

Completing the N 288a Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents.

- Begin filling out the form with your personal information, including name and address.

- Report all sources of income accurately.

- List any applicable deductions and credits.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the N 288a Form

The legal use of the N 288a Form hinges on its compliance with IRS regulations. This form must be filled out truthfully and submitted by the designated deadlines to avoid penalties. The information provided is subject to verification by the IRS, and any discrepancies can lead to audits or legal consequences. Therefore, it is essential to ensure that all information is accurate and complete.

Key elements of the N 288a Form

Several key elements are essential to the N 288a Form, including:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Details of all income sources.

- Deductions: Information on any eligible deductions.

- Signature: A signature is required to validate the form.

Form Submission Methods

The N 288a Form can be submitted through various methods, including:

- Online: Many users opt to file electronically through authorized e-filing services.

- By Mail: The form can be printed and mailed to the appropriate IRS address.

- In-Person: Some individuals may choose to deliver the form directly to their local IRS office.

Quick guide on how to complete n 288a form

Complete N 288a Form effortlessly on any device

Virtual document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents swiftly without any holdups. Manage N 288a Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign N 288a Form with ease

- Find N 288a Form and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or black out sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds exactly the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device of your choice. Alter and electronically sign N 288a Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 288a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the N 288a Form and why is it important?

The N 288a Form is a crucial document used for addressing specific legal requirements in various processes. Businesses often need to ensure compliance with regulations, making this form essential for smooth operations. airSlate SignNow simplifies the signing process for the N 288a Form, ensuring you can complete and send it efficiently.

-

How can airSlate SignNow help me with the N 288a Form?

airSlate SignNow provides a platform to easily eSign, send, and track your N 288a Form. With its intuitive interface, you can prepare the document quickly, reducing the time spent on paperwork. This ensures that you focus on your business while we handle the signing logistics.

-

Is there any cost associated with using airSlate SignNow for the N 288a Form?

Yes, using airSlate SignNow comes with a subscription fee that varies based on the features you select. However, the cost is often justified by the efficiency and convenience it brings to managing the N 288a Form. We offer various plans to meet the needs of businesses of all sizes.

-

What features does airSlate SignNow offer for managing the N 288a Form?

airSlate SignNow offers features such as template creation, automatic reminders, and real-time tracking for your N 288a Form. These tools streamline the signing process, ensuring you never miss a deadline. Additionally, you can securely store all signed forms for easy access and compliance.

-

Can I integrate airSlate SignNow with other applications for the N 288a Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This integration enhances your workflow when handling the N 288a Form, allowing you to access and store documents across platforms efficiently.

-

What are the benefits of using airSlate SignNow for the N 288a Form?

Using airSlate SignNow for the N 288a Form enables faster processing and increased accuracy in document management. You can save time on printing and scanning while ensuring signatures are collected promptly. This results in more streamlined operations and reduces the risk of paperwork errors.

-

Is airSlate SignNow compliant with legal standards for the N 288a Form?

Yes, airSlate SignNow complies with all necessary legal standards for electronic signatures, making it a trusted solution for handling the N 288a Form. This compliance ensures that your signed documents are legally valid and recognized. You can conduct your business confidently, knowing that you meet legal requirements.

Get more for N 288a Form

Find out other N 288a Form

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement