Hotel Tax Remittance Form Dauphin County Dauphincounty

What is the Hotel Tax Remittance Form Dauphin County Dauphincounty

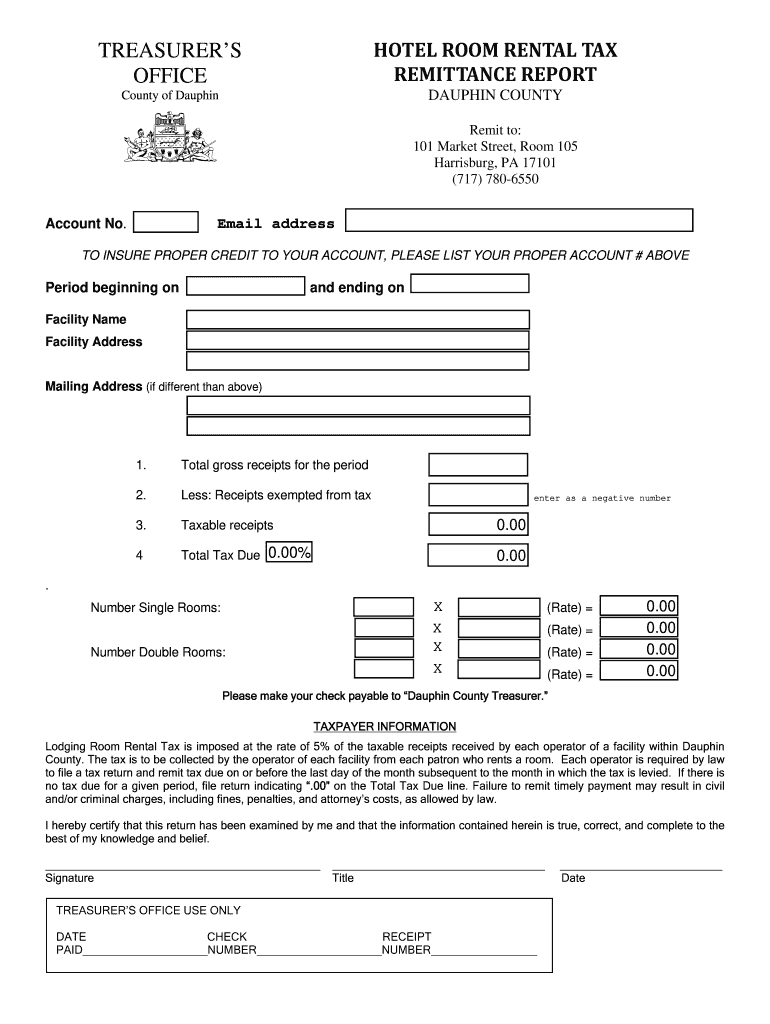

The Hotel Tax Remittance Form for Dauphin County is a document that hotels and lodging establishments use to report and remit the hotel occupancy tax collected from guests. This form is essential for ensuring compliance with local tax regulations and helps maintain transparency in the collection of taxes that support community services and infrastructure. The form typically includes details such as the total amount of tax collected, the reporting period, and the establishment's identification information.

How to use the Hotel Tax Remittance Form Dauphin County Dauphincounty

Using the Hotel Tax Remittance Form involves several straightforward steps. First, gather all necessary financial records, including the total room revenue and the corresponding tax collected during the reporting period. Next, accurately fill out the form, ensuring that all required fields are completed, including your hotel's name, address, and the total tax amount due. Once completed, the form can be submitted online or via mail, depending on the preferred submission method of the county.

Steps to complete the Hotel Tax Remittance Form Dauphin County Dauphincounty

Completing the Hotel Tax Remittance Form involves the following steps:

- Collect all relevant financial data, including room revenue and taxes collected.

- Download or access the form from the Dauphin County website.

- Fill in your hotel's information, including name, address, and tax identification number.

- Calculate the total tax amount based on the revenue reported.

- Review the form for accuracy and completeness.

- Submit the form online or send it by mail to the appropriate county office.

Legal use of the Hotel Tax Remittance Form Dauphin County Dauphincounty

The legal use of the Hotel Tax Remittance Form is governed by local tax laws and regulations. It is crucial that hotels complete and submit this form accurately to avoid penalties. The form serves as a legal document that verifies the collection and remittance of hotel taxes, and it may be subject to audits by tax authorities. Ensuring compliance with the legal requirements not only protects the business but also contributes to the community's financial health.

Filing Deadlines / Important Dates

Filing deadlines for the Hotel Tax Remittance Form are typically set by the Dauphin County tax authority. It is important for hotel operators to be aware of these deadlines to avoid late fees or penalties. Generally, forms are due on a monthly or quarterly basis, depending on the county's regulations. Keeping track of these dates ensures timely submission and compliance with local tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Hotel Tax Remittance Form can be submitted through various methods, including online submission, mailing a hard copy, or delivering it in person to the appropriate county office. Online submission is often the most efficient and secure method, allowing for immediate processing. For those opting to mail the form, it is advisable to use certified mail to confirm delivery. In-person submissions can provide an opportunity to ask questions or clarify any uncertainties directly with tax officials.

Quick guide on how to complete hotel tax remittance form dauphin county dauphincounty

Prepare Hotel Tax Remittance Form Dauphin County Dauphincounty easily on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent sustainable alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and electronically sign your documents promptly without delays. Manage Hotel Tax Remittance Form Dauphin County Dauphincounty on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Hotel Tax Remittance Form Dauphin County Dauphincounty effortlessly

- Locate Hotel Tax Remittance Form Dauphin County Dauphincounty and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form browsing, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Hotel Tax Remittance Form Dauphin County Dauphincounty and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hotel tax remittance form dauphin county dauphincounty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hotel Tax Remittance Form Dauphin County Dauphincounty?

The Hotel Tax Remittance Form Dauphin County Dauphincounty is a legal document required by the county for hotels to report and remit collected hotel taxes. This form ensures compliance with local tax regulations and helps maintain transparent financial practices within the hospitality industry.

-

How can I complete the Hotel Tax Remittance Form Dauphin County Dauphincounty?

You can easily complete the Hotel Tax Remittance Form Dauphin County Dauphincounty using airSlate SignNow. Our platform provides a user-friendly interface that simplifies the process, allowing you to fill out the form digitally, ensuring accuracy and efficiency.

-

Is there a cost associated with using airSlate SignNow for the Hotel Tax Remittance Form Dauphin County Dauphincounty?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, including the convenience of completing the Hotel Tax Remittance Form Dauphin County Dauphincounty. With various subscription options, you can choose a plan that fits your budget while enjoying comprehensive features.

-

What features does airSlate SignNow offer for the Hotel Tax Remittance Form Dauphin County Dauphincounty?

airSlate SignNow provides a range of features for the Hotel Tax Remittance Form Dauphin County Dauphincounty, including eSigning capabilities, document templates, and secure storage. These tools allow you to streamline your remittance process and ensure you never miss a deadline.

-

How does airSlate SignNow ensure the security of my Hotel Tax Remittance Form Dauphin County Dauphincounty?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your sensitive information related to the Hotel Tax Remittance Form Dauphin County Dauphincounty, ensuring your documents are safe and confidential.

-

Can I integrate airSlate SignNow with other tools for the Hotel Tax Remittance Form Dauphin County Dauphincounty?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, enhancing your workflow when completing the Hotel Tax Remittance Form Dauphin County Dauphincounty. You can connect with other software tools you already use, making document management efficient and cohesive.

-

What are the benefits of using airSlate SignNow for the Hotel Tax Remittance Form Dauphin County Dauphincounty?

Using airSlate SignNow for the Hotel Tax Remittance Form Dauphin County Dauphincounty brings numerous benefits, including time savings, increased accuracy, and enhanced compliance. Our digital solution streamlines the remittance process, allowing you to focus more on your core business operations.

Get more for Hotel Tax Remittance Form Dauphin County Dauphincounty

- Blank printable care plan template form

- Eco maps form

- Family systems license dhs form

- Authorization for release of child support information to files dnr state mn

- Mo adoption form

- Pdf of adhd parent scale form

- Employment bridgeton mo ampamp granite city il st louis heart form

- Fillable affidavit of identifying witness form

Find out other Hotel Tax Remittance Form Dauphin County Dauphincounty

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple