53 301 1094a Sf 1094a PDF Form

What is the 53a Sf 1094a Pdf Form

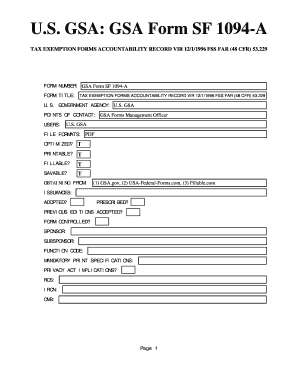

The 53a Sf 1094a pdf form is a tax exemption form used primarily by organizations seeking to claim tax-exempt status under specific regulations. This form is essential for entities that want to operate without incurring federal income tax liabilities. Understanding its purpose and requirements is crucial for compliance with IRS regulations.

How to use the 53a Sf 1094a Pdf Form

Using the 53a Sf 1094a pdf form involves several steps to ensure proper completion and submission. First, gather all necessary information, including your organization's legal name, address, and tax identification number. Next, fill out the form accurately, ensuring that all sections are completed. Once filled, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS.

Steps to complete the 53a Sf 1094a Pdf Form

Completing the 53a Sf 1094a pdf form requires careful attention to detail. Follow these steps:

- Download the latest version of the form from a reliable source.

- Provide your organization’s contact information in the designated fields.

- Indicate the type of tax-exempt status being requested.

- Attach any required documentation that supports your request.

- Review the form for accuracy before submission.

Legal use of the 53a Sf 1094a Pdf Form

The legal use of the 53a Sf 1094a pdf form is governed by IRS regulations. To be considered valid, the form must be completed in accordance with the guidelines provided by the IRS. This includes ensuring that the information provided is truthful and accurate, as any discrepancies can lead to penalties or denial of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the 53a Sf 1094a pdf form can vary based on the organization’s fiscal year and specific circumstances. It is important to be aware of these deadlines to avoid penalties. Typically, the form must be submitted by the fifteenth day of the fifth month after the end of the organization’s fiscal year. Keeping track of these dates is essential for maintaining compliance.

Who Issues the Form

The 53a Sf 1094a pdf form is issued by the Internal Revenue Service (IRS). The IRS provides guidelines and updates regarding the form, ensuring that organizations have access to the most current information necessary for filing. It is crucial to refer to the IRS website or official publications for any changes or updates related to the form.

Quick guide on how to complete 53 301 1094a sf 1094a pdf form

Complete 53 301 1094a Sf 1094a Pdf Form smoothly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage 53 301 1094a Sf 1094a Pdf Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 53 301 1094a Sf 1094a Pdf Form effortlessly

- Find 53 301 1094a Sf 1094a Pdf Form and click on Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate worries over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign 53 301 1094a Sf 1094a Pdf Form while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 53 301 1094a sf 1094a pdf form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sf1094 and how does it function within airSlate SignNow?

The sf1094 is a key feature within airSlate SignNow that allows businesses to electronically sign and manage documents efficiently. This tool streamlines the signing process, enabling users to gain approvals quickly while maintaining security and compliance.

-

How much does airSlate SignNow cost when using sf1094?

airSlate SignNow offers competitive pricing plans that include access to the sf1094 functionality. You can choose from monthly or annual subscriptions, with various features included to suit both small businesses and larger enterprises.

-

What are the key benefits of using sf1094 with airSlate SignNow?

Using sf1094 with airSlate SignNow provides several benefits, including increased efficiency, enhanced document security, and compliance with legal standards. This tool simplifies workflows, allowing teams to focus more on their core tasks.

-

Can I integrate sf1094 with other tools or platforms?

Yes, airSlate SignNow allows seamless integration of sf1094 with various applications such as CRM software, project management tools, and more. This flexibility enhances your document management processes and boosts productivity.

-

Is there a mobile app for accessing sf1094 in airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to access sf1094 on the go. Whether you're at a meeting or working remotely, you can easily sign and send documents right from your smartphone.

-

What types of documents can I manage with sf1094?

With sf1094 in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and consent forms. This versatility ensures that your document signing needs are met regardless of the industry.

-

How secure is the sf1094 feature in airSlate SignNow?

The sf1094 feature in airSlate SignNow prioritizes security by utilizing advanced encryption protocols to protect your data. Compliance with industry standards ensures that all transactions and document management tasks are safe and secure.

Get more for 53 301 1094a Sf 1094a Pdf Form

- Revocation of power of attorney for care of child or children south dakota form

- Newly divorced individuals package south dakota form

- Contractors forms package south dakota

- Power of attorney for sale of motor vehicle south dakota form

- Wedding planning or consultant package south dakota form

- Hunting forms package south dakota

- South dakota durable form

- Identity theft recovery package south dakota form

Find out other 53 301 1094a Sf 1094a Pdf Form

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document