F1040sc Form

What is the F1040sc

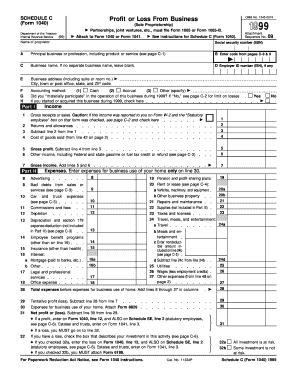

The F1040sc form is a simplified version of the standard IRS Form 1040, specifically designed for certain taxpayers. This form is primarily used by individuals with straightforward tax situations, such as those who do not have complex income sources or extensive deductions. The F1040sc allows for a more streamlined filing process, making it easier for eligible taxpayers to report their income and calculate their tax liability. By using this form, individuals can efficiently fulfill their tax obligations while minimizing the time spent on paperwork.

How to use the F1040sc

Using the F1040sc form involves several straightforward steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, carefully read the instructions provided with the form to ensure you understand the requirements. Fill out the form with accurate information, including your personal details, income, and any applicable deductions or credits. Once completed, review the form for any errors before submitting it to the IRS. The F1040sc can be filed electronically or mailed, depending on your preference.

Steps to complete the F1040sc

Completing the F1040sc form involves a series of methodical steps:

- Gather all relevant tax documents, including income statements and previous tax returns.

- Read the instructions that accompany the F1040sc to familiarize yourself with the requirements.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check for any possible errors or omissions.

- Choose your filing method: electronic submission or mailing the completed form.

- Submit the form to the IRS by the designated deadline.

Legal use of the F1040sc

The F1040sc form is legally recognized by the IRS as a valid means for taxpayers to report their income and calculate their tax obligations. To ensure its legal standing, it is crucial to comply with all IRS regulations and guidelines when completing the form. This includes accurately reporting income, claiming eligible deductions, and signing the form as required. By adhering to these legal requirements, taxpayers can confidently submit their F1040sc, knowing it meets the necessary standards for acceptance by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the F1040sc form align with the standard tax filing schedule set by the IRS. Typically, individual taxpayers must submit their forms by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any potential extensions that may be available, allowing additional time to file. It is essential to stay informed about these deadlines to avoid penalties and ensure timely compliance with tax obligations.

Required Documents

To complete the F1040sc form accurately, certain documents are required. These typically include:

- W-2 forms from employers, detailing annual wages and tax withholdings.

- 1099 forms for any freelance or contract work, reporting additional income sources.

- Records of any other income, such as interest or dividends.

- Documentation for any deductions or credits you plan to claim, such as mortgage interest statements or educational expenses.

Having these documents organized and readily available will facilitate a smoother filing process.

Examples of using the F1040sc

The F1040sc form is particularly beneficial for various taxpayer scenarios. For instance, a single individual with a straightforward income from a single employer may find this form ideal for their tax situation. Similarly, a married couple filing jointly with minimal deductions can efficiently use the F1040sc to report their combined income. Additionally, students or recent graduates with part-time jobs and limited tax obligations may also benefit from using this simplified form to file their taxes easily and accurately.

Quick guide on how to complete f1040sc

Prepare F1040sc seamlessly on any gadget

Digital document management has gained traction with organizations and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can find the appropriate form and securely archive it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage F1040sc on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign F1040sc effortlessly

- Find F1040sc and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign F1040sc and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1040sc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f1040sc form?

The f1040sc form is a specific tax document filed by self-employed individuals to report their income and expenses. airSlate SignNow simplifies the process of filling out the f1040sc by allowing users to eSign and send documents seamlessly. This means you can complete your tax forms quickly and efficiently.

-

How can airSlate SignNow help with f1040sc forms?

airSlate SignNow offers tools to streamline the preparation and submission of f1040sc forms. With user-friendly features, you can easily fill out and eSign your forms, allowing for a faster and more organized filing process. This helps ensure compliance while reducing the stress of tax season.

-

Is there a cost associated with using airSlate SignNow for f1040sc?

Yes, airSlate SignNow offers various pricing plans tailored to different user needs, making it a cost-effective solution for managing f1040sc forms. You can choose a plan that suits your business requirements and budget, providing the right tools and features for signing documents securely.

-

Can I integrate airSlate SignNow with other software while working on f1040sc forms?

Absolutely! airSlate SignNow provides integration capabilities with various applications, enhancing your workflow while dealing with f1040sc forms. This seamless connection streamlines document handling and eSigning processes, making it easier to manage your tax-related tasks.

-

What features does airSlate SignNow offer that are beneficial for f1040sc users?

airSlate SignNow offers essential features like customizable templates, document tracking, and mobile accessibility, which are particularly useful for f1040sc users. These tools allow for efficient document management and make it easier to review and sign your tax forms on the go.

-

Is airSlate SignNow secure for handling sensitive f1040sc information?

Yes, security is a top priority at airSlate SignNow. All documents, including sensitive f1040sc information, are protected with advanced encryption and secure data storage to ensure your information remains confidential and safe throughout the signing process.

-

How can I get started with airSlate SignNow for f1040sc forms?

Getting started with airSlate SignNow is simple; just sign up for an account, and you can begin creating and managing your f1040sc forms immediately. The platform provides easy-to-use tools and resources, allowing you to eSign documents efficiently from day one.

Get more for F1040sc

Find out other F1040sc

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online