Where to Mail Oregon State Income Tax Form

What is the Oregon State Income Tax Form?

The Oregon state income tax form, commonly referred to as the Oregon 40, is used by residents to report their annual income and calculate the amount of state tax owed. This form is essential for individuals who have earned income in Oregon and need to fulfill their tax obligations. It includes various sections for reporting income, deductions, and credits, ensuring accurate tax calculations. The Oregon 40 V, or the Oregon tax payment voucher, is often used in conjunction with this form to make estimated tax payments or to pay any taxes owed when filing.

Steps to Complete the Oregon State Income Tax Form

Completing the Oregon state income tax form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Accurately report all sources of income in the designated sections of the form.

- Claim deductions and credits: Identify any applicable deductions or credits to reduce your taxable income.

- Calculate tax owed: Use the provided tables or formulas to determine the total tax liability.

- Complete the Oregon 40 V: If applicable, fill out the payment voucher to accompany your tax payment.

- Review and sign: Carefully review all entries for accuracy before signing and dating the form.

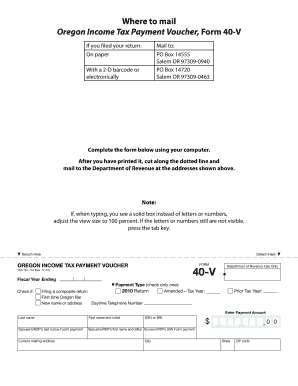

Where to Mail the Oregon State Income Tax Form

After completing the Oregon 40, it is important to mail it to the correct address to ensure timely processing. The mailing address varies depending on whether you are including a payment or not:

- If you are not enclosing a payment, mail your completed form to:

- Oregon Department of Revenue

P.O. Box 14780

Salem, OR 97 - If you are enclosing a payment, send your form to:

- Oregon Department of Revenue

P.O. Box 14950

Salem, OR 97

Legal Use of the Oregon State Income Tax Form

The Oregon 40 form is legally valid for reporting income and paying state taxes, provided it is completed accurately and submitted on time. Compliance with state tax laws is crucial to avoid penalties and ensure that your tax filings are recognized by the Oregon Department of Revenue. Electronic signatures are accepted if you choose to file online, ensuring that your submissions are both secure and legally binding.

Filing Deadlines for the Oregon State Income Tax Form

It is essential to be aware of the filing deadlines for the Oregon state income tax form to avoid late fees and penalties. Generally, the deadline for filing the Oregon 40 is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for Filing the Oregon State Income Tax Form

To complete the Oregon 40, you will need several key documents:

- W-2 forms: These are provided by your employer and report your annual earnings and tax withholdings.

- 1099 forms: These are used for reporting income received from non-employment sources, such as freelance work or interest income.

- Receipts for deductions: Keep records of any expenses you plan to deduct, such as medical expenses or education costs.

- Last year's tax return: This can help you ensure consistency and accuracy in your reporting.

Quick guide on how to complete where to mail oregon state income tax

Effortlessly Prepare Where To Mail Oregon State Income Tax on Any Device

Managing documents online has gained signNow traction among both businesses and individuals. It presents a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Where To Mail Oregon State Income Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and Electronically Sign Where To Mail Oregon State Income Tax

- Locate Where To Mail Oregon State Income Tax and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Modify and electronically sign Where To Mail Oregon State Income Tax to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where to mail oregon state income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where can I mail Oregon 40 forms?

You can mail Oregon 40 forms to the appropriate address based on your specific circumstances, such as whether you are submitting a payment or just the form. It’s important to verify the latest mailing information from the Oregon Department of Revenue to ensure your form arrives at the correct location.

-

What is the cost to eSign Oregon 40 forms with airSlate SignNow?

Using airSlate SignNow to eSign Oregon 40 forms is very cost-effective. The solution offers various pricing plans to fit any budget, allowing you to manage your eSigning needs without breaking the bank while ensuring compliance with local regulations, like where to mail Oregon 40.

-

What features does airSlate SignNow offer for Oregon 40 submissions?

airSlate SignNow provides a user-friendly interface for eSigning your Oregon 40 forms, with features such as customizable templates, secure storage, and real-time tracking. This means you can manage your submissions efficiently, from knowing where to mail Oregon 40 to getting instant notifications when your document is completed.

-

Can I integrate airSlate SignNow with my existing tools for processing Oregon 40?

Yes, airSlate SignNow offers seamless integrations with various tools like CRM systems, project management software, and cloud storage services. This flexibility simplifies the process of handling Oregon 40 submissions, ensuring you know exactly where to mail Oregon 40 without any hassle.

-

What are the benefits of using airSlate SignNow for Oregon 40?

Using airSlate SignNow for your Oregon 40 submissions streamlines the process, making it not only faster but also more secure. You will enjoy the ease of eSigning and gaining access to your documents anywhere, while also being assured of knowing where to mail Oregon 40 safely and effectively.

-

Is airSlate SignNow compliant with Oregon regulations for eSigning?

Absolutely, airSlate SignNow is fully compliant with Oregon laws regarding electronic signatures. This compliance ensures that your eSigned Oregon 40 forms can be legally accepted, saving you time and making it easy to determine where to mail Oregon 40 forms effortlessly.

-

How can I track the status of my Oregon 40 submissions?

With airSlate SignNow, you can track the status of your Oregon 40 submissions in real-time. You’ll receive notifications and can easily see when your documents have been opened and signed, providing peace of mind that your forms are on their way to where to mail Oregon 40.

Get more for Where To Mail Oregon State Income Tax

Find out other Where To Mail Oregon State Income Tax

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed