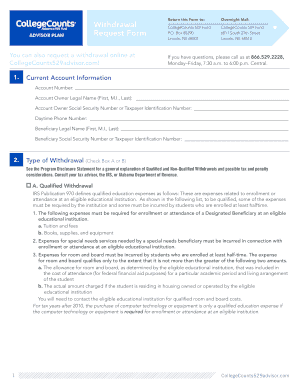

Collegecounts 529 Advisor Form

Understanding the Collegecounts 529 Advisor

The Collegecounts 529 Advisor is a tax-advantaged savings plan designed to help families save for future education expenses. This plan allows account holders to invest in a variety of investment options, which can grow tax-free. Contributions to the account can be made by anyone, including family members and friends, making it a flexible option for funding education. Funds can be used for qualified higher education expenses, including tuition, fees, books, and room and board, providing significant financial benefits for students.

Steps to Complete the Collegecounts 529 Advisor

Completing the Collegecounts 529 Advisor form involves several straightforward steps:

- Gather Required Information: Collect personal information such as Social Security numbers, addresses, and details about the beneficiary.

- Choose an Investment Option: Decide on an investment strategy that aligns with your savings goals and risk tolerance.

- Fill Out the Form: Complete the Collegecounts 529 Advisor form accurately, ensuring all details are correct.

- Review and Sign: Carefully review the completed form for any errors before signing electronically.

- Submit the Form: Send the completed form via the preferred submission method, whether online or by mail.

Legal Use of the Collegecounts 529 Advisor

The Collegecounts 529 Advisor is governed by federal and state laws that outline its legal use. To ensure compliance, it is important to understand the regulations surrounding contributions, withdrawals, and qualified expenses. The plan must adhere to the rules set forth by the IRS and state-specific guidelines, ensuring that the funds are used exclusively for eligible educational expenses. Non-compliance can result in penalties, including taxes and additional fees, making it essential to stay informed about legal requirements.

Eligibility Criteria for the Collegecounts 529 Advisor

Eligibility for the Collegecounts 529 Advisor is generally broad, allowing various individuals to open an account. The following criteria typically apply:

- Beneficiary Age: There are no age restrictions for the beneficiary, but the funds must be used for qualified education expenses.

- Residency: Account holders and beneficiaries must be U.S. residents, though some states may have specific residency requirements.

- Contribution Limits: There are annual contribution limits, which can vary by state, so it is important to check local regulations.

Examples of Using the Collegecounts 529 Advisor

Using the Collegecounts 529 Advisor can be beneficial in various scenarios:

- Saving for College: Families can contribute regularly to build a substantial fund for their child's college education.

- Utilizing Tax Benefits: Contributions may qualify for state tax deductions, enhancing the overall savings.

- Funding Qualified Expenses: Funds can be used for tuition, fees, and other educational costs, easing the financial burden on families.

Form Submission Methods for the Collegecounts 529 Advisor

Submitting the Collegecounts 529 Advisor form can be done through various methods, ensuring convenience for users:

- Online Submission: Many states offer an online platform for completing and submitting the form electronically.

- Mail Submission: Users can print the completed form and send it via postal service to the designated address.

- In-Person Submission: Some individuals may prefer to submit the form in person at designated locations or offices.

Quick guide on how to complete collegecounts 529 advisor

Effortlessly prepare Collegecounts 529 Advisor on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed forms, allowing you to access the right template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without complications. Handle Collegecounts 529 Advisor on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

The simplest method to edit and eSign Collegecounts 529 Advisor with ease

- Locate Collegecounts 529 Advisor and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to finalize your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Collegecounts 529 Advisor and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collegecounts 529 advisor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the collegecounts529advisor program?

The collegecounts529advisor program is a specialized savings plan designed to help families save for future college expenses. It offers tax advantages and a variety of investment options tailored to fit different financial goals. With the collegecounts529advisor, you can grow your savings more efficiently while planning for your child's education.

-

How does the collegecounts529advisor benefit families?

Families using the collegecounts529advisor can benefit from tax-free growth on their investments, as well as tax-deductible contributions in some states. This program helps families build a financial foundation for college expenses, ensuring that they can cover tuition, fees, and other costs. Overall, the collegecounts529advisor promotes effective savings strategies for higher education.

-

What are the pricing options for the collegecounts529advisor?

The collegecounts529advisor typically has low management fees, ensuring that more of your savings go toward your child's education. There may be minimum contribution amounts but no maximum limit, allowing families to save at their own pace. This cost-effective approach makes the collegecounts529advisor accessible for most families.

-

What features does the collegecounts529advisor offer?

The collegecounts529advisor features a range of investment portfolios tailored to various risk tolerances and time horizons. Additionally, it offers online account management, automatic contribution options, and flexible withdrawal choices for qualified education expenses. These features enhance the usability and effectiveness of the collegecounts529advisor program.

-

Can I integrate the collegecounts529advisor with other savings plans?

Yes, the collegecounts529advisor can be integrated with other savings plans such as Coverdell ESAs or custodial accounts. This integration allows families to maximize their education savings while taking advantage of various tax benefits. By combining these plans, families can enhance their strategies for funding college and other educational pursuits.

-

What are the long-term benefits of using the collegecounts529advisor?

Utilizing the collegecounts529advisor can lead to substantial long-term savings for college expenses due to its tax-advantaged growth. The earlier you start saving, the more you benefit from compound interest over time. This can signNowly reduce the financial burden associated with higher education costs.

-

How can I set up an account with the collegecounts529advisor?

Setting up an account with the collegecounts529advisor is easy and can be done online through their website. You'll need to provide personal information, choose an investment portfolio, and make an initial contribution to get started. The intuitive process ensures that families can begin saving for education with minimal hassle.

Get more for Collegecounts 529 Advisor

- Interagency application for placement form

- Federal commission uber technologies form

- Non binding estimate only form

- Threading your way through labeling form

- Modified bur 10 limited product warranty inland coatings form

- Sf 515 form

- Standard form 328 2001

- Business tax certificate application city of oxnard form

Find out other Collegecounts 529 Advisor

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now