Ar Et185a Form

What is the AR ET185A?

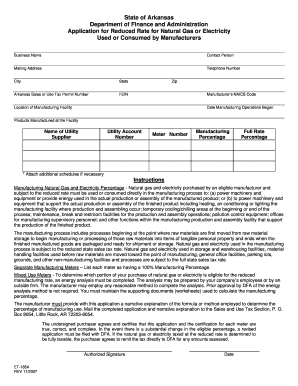

The AR ET185A is a specific form utilized within the state of Arkansas, primarily for tax-related purposes. This form is essential for individuals or entities seeking to report certain tax information accurately. Understanding its purpose is crucial for compliance with state regulations. The AR ET185A serves as a declaration of specific tax obligations and may be required for various financial activities.

How to Use the AR ET185A

To effectively use the AR ET185A, individuals must first ensure they have the correct version of the form. It is important to complete all required fields accurately, as incomplete information may lead to processing delays. Users should carefully follow the instructions provided with the form, ensuring that all necessary documentation is attached. This will help facilitate a smooth submission process.

Steps to Complete the AR ET185A

Completing the AR ET185A involves several key steps:

- Download the form from an official source or obtain a physical copy.

- Fill in your personal or business information as required.

- Provide any necessary financial details pertinent to the form.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form via the preferred method, whether online, by mail, or in person.

Legal Use of the AR ET185A

The legal use of the AR ET185A is governed by state tax laws. It is important for users to be aware that submitting this form incorrectly may result in penalties or fines. The form must be filled out in accordance with Arkansas state regulations to ensure its validity. Compliance with these laws not only protects the individual or business but also contributes to the overall integrity of the tax system.

Required Documents

When submitting the AR ET185A, certain documents may be required to support the information provided. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Financial statements relevant to the tax obligations being reported.

- Any previous tax returns that may be necessary for context.

Gathering these documents in advance can streamline the submission process and reduce the likelihood of errors.

Form Submission Methods

The AR ET185A can be submitted through various methods, depending on the preferences of the user. Common submission methods include:

- Online submission through the state’s tax portal.

- Mailing the completed form to the appropriate tax office.

- Delivering the form in person to a designated location.

Choosing the right submission method can help ensure timely processing and compliance with state deadlines.

Quick guide on how to complete ar et185a

Complete Ar Et185a effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Ar Et185a on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ar Et185a with ease

- Obtain Ar Et185a and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Ar Et185a and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar et185a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow AR ET185A?

The airSlate SignNow AR ET185A is a powerful eSignature solution designed to streamline document workflows for businesses. With AR ET185A, users can easily send and sign documents electronically, ensuring quick and secure transactions. This feature is ideal for businesses looking to enhance productivity and improve client engagement.

-

How much does the airSlate SignNow AR ET185A cost?

Pricing for the airSlate SignNow AR ET185A varies based on the subscription plan you choose. We offer flexible pricing options to accommodate businesses of all sizes. For detailed pricing information and to find the right plan for you, please visit our website.

-

What features are included with the airSlate SignNow AR ET185A?

The airSlate SignNow AR ET185A includes features such as customizable templates, reusable workflows, and secure storage of signed documents. It also offers comprehensive tracking and audit trails for added security and transparency. These features ensure that your document signing process is both efficient and reliable.

-

How can the airSlate SignNow AR ET185A benefit my business?

Using the airSlate SignNow AR ET185A can signNowly reduce the time and cost associated with traditional paper signing processes. Businesses benefit from increased efficiency, reduced errors, and improved customer satisfaction. Additionally, the AR ET185A helps ensure a legally binding and secure signing experience.

-

Can I integrate the airSlate SignNow AR ET185A with other applications?

Yes, the airSlate SignNow AR ET185A supports integration with numerous popular applications such as Google Drive, Dropbox, and CRM systems. This flexibility allows you to streamline your workflows and enhance productivity by connecting the AR ET185A with tools you already use. This means you can manage your documents more efficiently across multiple platforms.

-

Is the airSlate SignNow AR ET185A suitable for businesses of all sizes?

Absolutely! The airSlate SignNow AR ET185A is designed to cater to businesses of all sizes, from startups to enterprise-level companies. Its scalable features and pricing options make it a versatile solution that can grow with your business needs. No matter your organization's scale, AR ET185A has the tools to enhance your document signing process.

-

What types of documents can I sign using the airSlate SignNow AR ET185A?

With the airSlate SignNow AR ET185A, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports various file formats, making it easy to work with the documents you use most frequently. Whatever your signing needs, the AR ET185A has you covered.

Get more for Ar Et185a

Find out other Ar Et185a

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT