Oklahoma Form Ow 15

What is the Oklahoma Form OW 15

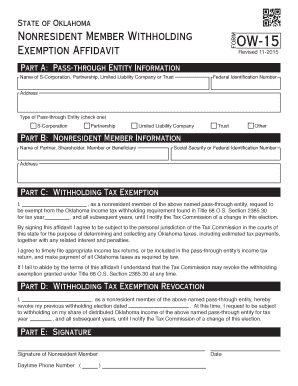

The Oklahoma Form OW 15 is a legal document used primarily for specific administrative purposes within the state of Oklahoma. This form is often associated with various applications, including requests for exemptions or certifications. Understanding the purpose and requirements of the form is essential for individuals and businesses to ensure compliance with state regulations.

How to Use the Oklahoma Form OW 15

Using the Oklahoma Form OW 15 involves several steps to ensure proper completion and submission. First, gather all necessary information required to fill out the form accurately. This may include personal identification details, business information, or other relevant documentation. Once the form is completed, it can be submitted electronically or via traditional mail, depending on the specific instructions provided by the issuing authority.

Steps to Complete the Oklahoma Form OW 15

Completing the Oklahoma Form OW 15 requires careful attention to detail. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in all required fields, ensuring accuracy in the information provided.

- Review the completed form for any errors or omissions.

- Sign the form as required, which may include a digital signature if submitted electronically.

- Submit the form according to the specified submission method, either online or by mail.

Legal Use of the Oklahoma Form OW 15

The legal use of the Oklahoma Form OW 15 is governed by state regulations that outline its validity and requirements. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with the relevant laws. This includes adhering to any deadlines and ensuring that all necessary signatures are obtained.

Key Elements of the Oklahoma Form OW 15

Key elements of the Oklahoma Form OW 15 include specific fields that must be filled out to provide comprehensive information. These may include:

- Personal or business name

- Contact information

- Details relevant to the purpose of the form

- Signature and date fields

Each element plays a crucial role in the processing and acceptance of the form by the relevant authorities.

Form Submission Methods

The Oklahoma Form OW 15 can be submitted through various methods, including:

- Online submission via a designated portal

- Mailing the completed form to the appropriate office

- In-person submission at designated locations

Choosing the correct submission method is important to ensure timely processing of the form.

Quick guide on how to complete oklahoma form ow 15

Complete Oklahoma Form Ow 15 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without any delays. Manage Oklahoma Form Ow 15 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Oklahoma Form Ow 15 seamlessly

- Find Oklahoma Form Ow 15 and click on Get Form to initiate.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow takes care of your document management needs with just a few clicks from any device of your choice. Modify and eSign Oklahoma Form Ow 15 to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form ow 15

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ow 15 and how is it used?

Form ow 15 is a document used for various administrative purposes, such as collecting information or obtaining consent. With airSlate SignNow, you can easily create, send, and eSign your form ow 15, streamlining the process and ensuring compliance without the hassle of paperwork.

-

How can I integrate form ow 15 into my existing workflows?

Integrating form ow 15 into your workflows is seamless with airSlate SignNow. You can connect the form to various apps and platforms you already use, automating the data collection process and enhancing efficiency within your organization.

-

Is there a free trial for using form ow 15 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to test the features available for form ow 15. This way, you can explore how eSigning and document management can improve your processes without any commitment.

-

What are the pricing options for using form ow 15 on airSlate SignNow?

The pricing for using form ow 15 on airSlate SignNow varies based on the plan you choose. Different tiers offer various features, including advanced integrations and user capacities, ensuring you find a suitable option that meets your business needs.

-

What features enhance form ow 15’s functionality on airSlate SignNow?

AirSlate SignNow provides features like reusable templates, advanced analytics, and real-time notifications for your form ow 15. These tools can enhance productivity and ensure that your document processes are tracked and managed effectively.

-

Can I customize my form ow 15 using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your form ow 15 easily. You can add fields, adjust layouts, and incorporate your branding to create a tailored document that meets your specifications.

-

How does eSigning with form ow 15 improve my business operations?

eSigning with form ow 15 using airSlate SignNow signNowly reduces the turnaround time for document approvals. This ensures that business operations run smoothly and helps you maintain a competitive edge by accelerating workflows.

Get more for Oklahoma Form Ow 15

- Georgia form 500 rev 603 fill in circle if you formsend

- State tax registration application acupaysolutionscom form

- Form l 80 rev 2016 tracer request for tax year forms 2016

- T rpt100 honolulu 2014 form

- Form t rpt100 2020

- 2012 ia 1040es 2016 form

- Inheritance tax checklist iowa department of revenue iowagov form

- Exemption certificate sales 2017 form

Find out other Oklahoma Form Ow 15

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure