Hawaii Schedule X Form

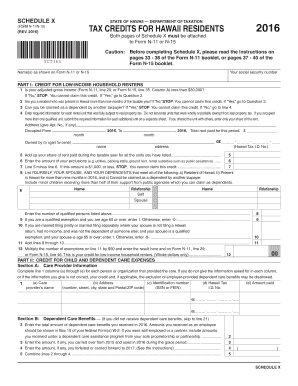

What is the Hawaii Schedule X

The Hawaii Schedule X is a supplementary form used by taxpayers in Hawaii to report specific types of income and deductions that are not included on the standard tax return. This form is particularly relevant for individuals and businesses that need to provide additional details regarding their financial activities within the state. It is essential for ensuring compliance with state tax regulations and for accurately calculating tax liabilities.

How to use the Hawaii Schedule X

Using the Hawaii Schedule X involves several steps to ensure that all required information is accurately reported. Taxpayers should first gather all relevant financial documents, including income statements and deduction records. Next, complete the form by filling in the necessary sections, which may include income from various sources, adjustments, and credits. It is important to review the form for accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the Hawaii Schedule X

Completing the Hawaii Schedule X requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Report all applicable income sources in the designated sections.

- List any deductions or credits you qualify for, ensuring you have supporting documentation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Hawaii Schedule X

The Hawaii Schedule X is legally binding when filled out and submitted according to state regulations. To ensure its legal validity, taxpayers must adhere to the guidelines established by the Hawaii Department of Taxation. This includes providing accurate information and maintaining compliance with all relevant tax laws. Additionally, electronic submissions must meet the requirements set forth by eSignature regulations to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Schedule X typically align with the state's tax return deadlines. Taxpayers should be aware of the following important dates:

- Tax return filing deadline: Usually April 20 for most taxpayers.

- Extensions: If an extension is filed, the deadline may be extended to October 20.

- Payment deadlines: Any taxes owed must be paid by the original filing deadline to avoid penalties.

Who Issues the Form

The Hawaii Schedule X is issued by the Hawaii Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance for completing the form, as well as updates on any changes to tax regulations that may affect its use.

Quick guide on how to complete hawaii schedule x

Effortlessly prepare Hawaii Schedule X on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-conscious alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Hawaii Schedule X on any platform using airSlate SignNow's Android or iOS applications and enhance any document workflow today.

How to edit and eSign Hawaii Schedule X with ease

- Locate Hawaii Schedule X and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or darken sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Hawaii Schedule X and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii schedule x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hawaii Schedule X and how can airSlate SignNow assist with it?

Hawaii Schedule X refers to a specific scheduling format used for certain business operations in Hawaii. With airSlate SignNow, you can easily create, send, and eSign documents related to your Hawaii Schedule X, streamlining your workflow and ensuring compliance. Our platform is designed to cater to your specific needs, making document management more efficient.

-

How does airSlate SignNow's pricing structure work for Hawaii Schedule X users?

Our pricing for using airSlate SignNow in relation to Hawaii Schedule X is designed to be adaptable to various business sizes and needs. We offer a range of plans that cater to different usage levels, ensuring you get the most cost-effective solution for eSigning and managing your documents. Visit our pricing page for more detailed information tailored to Hawaii Schedule X users.

-

What features does airSlate SignNow offer for managing Hawaii Schedule X documentation?

airSlate SignNow provides numerous features to help you manage Hawaii Schedule X documentation efficiently. These include secure eSigning, document templates, and real-time tracking of signed documents. Additionally, our platform allows for collaborative workflows, making it easier for multiple parties to manage their schedules seamlessly.

-

Are there any benefits of using airSlate SignNow for Hawaii Schedule X?

Using airSlate SignNow for Hawaii Schedule X offers several benefits, including increased efficiency and reduced turnaround time for document signing. Our user-friendly interface simplifies the eSigning process, allowing you to focus on your business operations. Furthermore, electronic signatures are legally binding, which adds an extra layer of security to your transactions.

-

Can airSlate SignNow integrate with other tools for Hawaii Schedule X management?

Yes, airSlate SignNow seamlessly integrates with various platforms to enhance your Hawaii Schedule X management. You can connect with popular tools such as CRMs, cloud storage services, and productivity applications, ensuring a smooth flow of information across your business ecosystem. This integration makes it easier to keep your documents organized and accessible.

-

Is airSlate SignNow secure for handling sensitive Hawaii Schedule X documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including those related to Hawaii Schedule X. We implement advanced encryption technologies and comply with industry standards to protect your information. With our secure platform, you can confidently manage sensitive documents without worrying about data bsignNowes.

-

What kind of customer support does airSlate SignNow offer for Hawaii Schedule X users?

airSlate SignNow provides comprehensive customer support for users dealing with Hawaii Schedule X. Our support team is available through multiple channels, including live chat, email, and phone, ensuring that your queries are addressed promptly. We also offer a robust knowledge base and tutorials to help you maximize the platform's benefits.

Get more for Hawaii Schedule X

- Pdf requisition for mobile support equipment demande de matriel form

- The personal information collected on this form is collected under the authority of the freedom of information and protection

- 330 303 nf eng form

- The personal information on this form is collected for the purpose of providing funds through autism funding under age 6

- Application to license a vehicle department of transport form

- For youth allowance and abstudy purposes unless they meet one form

- Private company form mod pc services australia

- Atlantic intermediate skilled program form

Find out other Hawaii Schedule X

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF