Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers

Understanding the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5

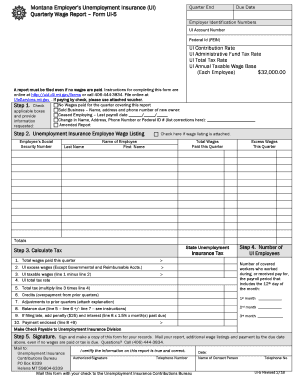

The Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 is essential for employers to report wages paid to employees. This form helps the state determine the unemployment insurance contributions owed by businesses. Each quarter, employers must accurately complete this form to ensure compliance with state regulations.

Key components of the form include the employer's identification numbers, such as the UI account number and Federal Employer Identification Number (FEIN). Additionally, the form requires details about the UI contribution rate, which varies based on the employer’s experience rating and the overall unemployment rate in Montana.

Steps to Complete the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5

Completing the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 involves several important steps:

- Gather necessary information, including the UI account number, FEIN, and employee wage details.

- Calculate the total wages paid to all employees during the quarter.

- Determine the applicable UI contribution rate based on your business's classification and experience rating.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the completed form by the due date, either online or via mail.

Filing Deadlines for the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5

Employers must adhere to specific filing deadlines for the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5. The due dates typically align with the end of each quarter:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Timely submission is crucial to avoid penalties and ensure compliance with state regulations.

Legal Use of the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5

The Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 must be completed in accordance with state laws governing unemployment insurance. Employers are legally required to submit accurate wage reports to maintain their eligibility for unemployment insurance benefits. Failure to comply with these regulations may result in penalties, including fines or increased contribution rates.

It is important to keep records of submitted forms and any correspondence with the Montana Department of Labor and Industry to ensure compliance and address any potential disputes.

Required Documents for Completing the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5

To complete the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5, employers should prepare the following documents:

- Employer Identification Number (EIN) or Federal Employer Identification Number (FEIN)

- UI account number

- Wage records for all employees for the reporting quarter

- Details of any employee separations or changes in employment status

Having these documents ready will facilitate a smoother completion process and ensure all necessary information is reported accurately.

State-Specific Rules for the Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5

Employers in Montana must be aware of state-specific rules that govern the completion and submission of the UI Quarterly Wage Report Form UI5. These rules include:

- Accurate reporting of all wages, including bonuses and overtime.

- Compliance with Montana's unemployment insurance laws, including contribution rates and eligibility criteria.

- Maintaining accurate and up-to-date employee records.

Understanding these regulations helps employers avoid compliance issues and potential penalties.

Quick guide on how to complete montana employers unemployment insurance ui quarterly wage report form ui5 quarter end due date employer identification numbers

Complete Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers effortlessly

- Find Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from your preferred device. Edit and electronically sign Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the montana employers unemployment insurance ui quarterly wage report form ui5 quarter end due date employer identification numbers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What quarters does unemployment look at when calculating benefits?

Unemployment benefits typically look at the last four completed quarters of a person's work history. This means the quarters during which you have earned sufficient wages are considered to determine your eligibility and benefit amount. It's essential to maintain a steady work history during these quarters for optimal benefits.

-

How does airSlate SignNow help with unemployment documentation?

AirSlate SignNow provides a streamlined platform to eSign and send important unemployment documentation securely. This ensures that your forms are submitted promptly and tracked accurately, improving your chances of a quick response from unemployment agencies. By using our service, you can focus on your job search while we handle your paperwork efficiently.

-

Are there any costs associated with using airSlate SignNow for unemployment forms?

Yes, airSlate SignNow offers a range of pricing plans to meet different business needs, including options for individuals. While prices vary, the service is designed to be cost-effective, ensuring that you find a plan that suits your budget while allowing you to handle unemployment forms seamlessly.

-

What features does airSlate SignNow provide to enhance document management for unemployment claims?

AirSlate SignNow includes features such as real-time tracking, customizable templates, and secure eSignature capabilities. These features not only make the process of submitting unemployment claims easier but also allow for flexibility and ease of use, ensuring that you can manage your documents efficiently.

-

Can airSlate SignNow integrate with other tools to assist with unemployment claims?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage your unemployment documentation in conjunction with other tools you may be using, creating a more efficient workflow.

-

How can I ensure my unemployment forms are properly completed using airSlate SignNow?

By utilizing airSlate SignNow’s intuitive interface and customizable templates, you can easily ensure that your unemployment forms are filled out correctly. Additionally, features like guided prompts and validations help prevent common errors, giving you confidence that your forms meet the requirements of unemployment agencies.

-

Is airSlate SignNow secure for handling sensitive unemployment documents?

Absolutely, airSlate SignNow is built with security in mind, utilizing encryption and compliance with various industry standards. This ensures that your sensitive unemployment documents are protected at all times, providing peace of mind as you navigate the unemployment process.

Get more for Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers

- Patrol cleveland form

- The national registry form

- North broadway united methodist church childrens ministry information sheet

- Akron veterinary internal medicine ampamp oncology330 666 form

- Senior project mentor evaluation form avon lake city schools

- Tax certification statement for management company pennsylvania form

- Abcte application addendum application for a temporary teaching permit form

- Schuylkill county public defender form

Find out other Montana Employers Unemployment Insurance UI Quarterly Wage Report Form UI5 Quarter End Due Date Employer Identification Numbers

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now