Form 941c1 on Line

What is the Form 941c1 On Line

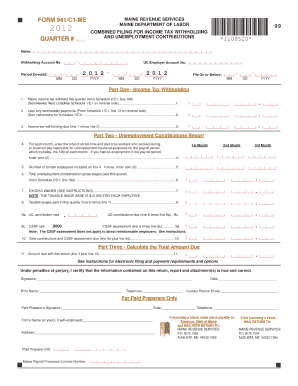

The Form 941c1 On Line is a specific tax form used by employers in the United States to report adjustments to previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. This form allows employers to correct errors related to income tax withholding, Social Security, and Medicare taxes. By submitting the Form 941c1 On Line, businesses can ensure that their tax records are accurate and up to date, which is essential for compliance with IRS regulations.

How to use the Form 941c1 On Line

Using the Form 941c1 On Line involves a straightforward process. First, access the form through a reliable electronic platform that supports e-signatures. Next, fill out the required fields, ensuring that all corrections to the original Form 941 are accurately represented. After completing the form, review it for any errors before submitting it electronically. Utilizing an e-signature solution can help streamline this process, making it easier to sign and submit the form securely.

Steps to complete the Form 941c1 On Line

Completing the Form 941c1 On Line requires several key steps:

- Gather necessary information, including details from the original Form 941.

- Access the Form 941c1 through an e-signature platform.

- Enter the corrections needed for the tax reporting period.

- Review the completed form for accuracy.

- Sign the form electronically using a secure e-signature feature.

- Submit the form electronically to the IRS.

Legal use of the Form 941c1 On Line

The legal use of the Form 941c1 On Line is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted in compliance with the Electronic Signatures in Global and National Commerce Act (ESIGN). This act allows electronic signatures to be treated as legally valid, provided that the signer is properly authenticated and that the process adheres to all relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941c1 On Line align with the deadlines for submitting the original Form 941. Employers must file Form 941 on a quarterly basis, with specific deadlines for each quarter. It is crucial to be aware of these dates to avoid penalties for late submissions. Typically, the deadlines are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31

Key elements of the Form 941c1 On Line

Key elements of the Form 941c1 On Line include the identification of the employer, the tax period for which corrections are being made, and the specific adjustments being reported. Employers must provide accurate figures for any changes in withholding amounts, as well as any adjustments to Social Security and Medicare taxes. Ensuring that all information is correct is essential for maintaining compliance with IRS regulations.

Quick guide on how to complete form 941c1 on line

Complete Form 941c1 On Line effortlessly on any device

Web-based document organization has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can access the appropriate template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 941c1 On Line on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest method to modify and eSign Form 941c1 On Line with ease

- Obtain Form 941c1 On Line and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key portions of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 941c1 On Line and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941c1 on line

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941c1 and why do I need it?

Form 941c1 is a correction form used to amend your quarterly payroll tax returns. Completing Form 941c1 On Line allows businesses to ensure their tax submissions are accurate and compliant, helping avoid potential penalties or issues with the IRS.

-

How can airSlate SignNow help with filling out Form 941c1 On Line?

airSlate SignNow provides a streamlined platform for completing Form 941c1 On Line. With customizable templates and eSigning capabilities, you can efficiently fill out and submit your form, making the process much easier and quicker.

-

Is airSlate SignNow affordable for small businesses that need Form 941c1 On Line?

Yes, airSlate SignNow offers competitive pricing tailored for small businesses, ensuring that submitting Form 941c1 On Line is a cost-effective solution. Our flexible plans mean that you can choose the options that fit your budget while accessing all necessary features.

-

What features does airSlate SignNow offer for managing Form 941c1 On Line?

airSlate SignNow includes features like cloud storage, eSignature capabilities, and real-time collaboration, all designed to simplify the management of Form 941c1 On Line. These tools make it easy to revise documents and gather signatures quickly, increasing your productivity.

-

Can I integrate airSlate SignNow with my existing software for Form 941c1 On Line?

Absolutely! airSlate SignNow offers seamless integrations with various popular business tools, allowing you to manage Form 941c1 On Line effectively. Connecting with your existing software enhances data consistency and ensures a smooth workflow.

-

How secure is airSlate SignNow for handling Form 941c1 On Line?

Security is a top priority at airSlate SignNow. When you complete Form 941c1 On Line, your documents are protected with state-of-the-art encryption and secure storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for Form 941c1 On Line compared to traditional methods?

Using airSlate SignNow for Form 941c1 On Line provides numerous benefits over traditional paper methods. You can complete your forms digitally, save time on deliveries, reduce the risk of errors, and enhance overall efficiency with easy access and collaboration features.

Get more for Form 941c1 On Line

Find out other Form 941c1 On Line

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document