Equitable Eft Form

What is the equitable eft?

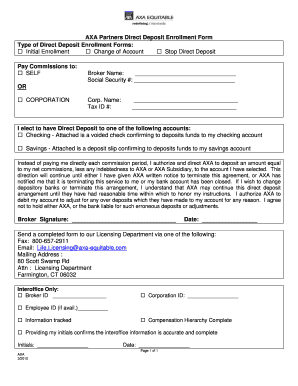

The equitable eft is a financial form used primarily for electronic funds transfers, facilitating the direct deposit or withdrawal of funds between accounts. This form is essential for individuals and businesses looking to manage transactions efficiently and securely in a digital environment. By utilizing the equitable eft, users can streamline their payment processes, ensuring timely and accurate transfers without the need for paper checks or physical visits to banks.

How to use the equitable eft

Using the equitable eft involves several straightforward steps. First, ensure that you have the correct form, which can typically be obtained from your financial institution or downloaded online. Next, fill out the necessary fields, including your bank account information, the amount to be transferred, and any relevant identifiers. Once completed, submit the form electronically through your bank’s secure portal or via a trusted eSignature platform. This method ensures that your transaction is processed quickly and securely.

Steps to complete the equitable eft

Completing the equitable eft requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the equitable eft form from your bank or download it from a reliable source.

- Fill in your personal information, including your name, address, and contact details.

- Provide your bank account number and routing number to ensure accurate processing.

- Specify the amount to be transferred and the frequency of the transfer, if applicable.

- Review all entered information for accuracy to avoid delays.

- Sign the form electronically using a secure eSignature tool to validate your submission.

- Submit the completed form through your bank’s designated online platform.

Legal use of the equitable eft

The equitable eft is legally valid when specific requirements are met. It must comply with federal regulations, including the Electronic Signatures in Global and National Commerce (ESIGN) Act, which ensures that electronic signatures are recognized as legally binding. Additionally, adherence to the Uniform Electronic Transactions Act (UETA) is crucial, as it establishes the legal framework for electronic transactions in the United States. Using a reputable eSignature service can help ensure compliance with these laws and protect the integrity of your transactions.

Key elements of the equitable eft

Several key elements define the equitable eft and ensure its effectiveness:

- Accurate Information: All fields must be filled out correctly to prevent errors in fund transfers.

- Authorization: The form must be signed electronically to authorize the transaction.

- Secure Submission: Use a secure platform to submit the form to protect sensitive information.

- Compliance: Ensure that the form adheres to relevant electronic transaction laws.

Examples of using the equitable eft

The equitable eft can be utilized in various scenarios, including:

- Direct deposit of payroll for employees, ensuring timely payment without physical checks.

- Automated bill payments, allowing businesses and individuals to manage recurring expenses efficiently.

- One-time transfers between personal accounts or to vendors for services rendered.

Quick guide on how to complete equitable eft

Effortlessly Prepare Equitable Eft on Any Device

Digital document management has become increasingly popular with both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Equitable Eft on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to adjust and electronically sign Equitable Eft effortlessly

- Find Equitable Eft and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Equitable Eft and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the equitable eft

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is equitable EFT in the context of airSlate SignNow?

Equitable EFT refers to the electronic funds transfer solution provided by airSlate SignNow, enabling users to send and receive payments securely and efficiently. This feature ensures that transactions are processed smoothly, enhancing the overall workflow for businesses. By integrating equitable EFT, organizations can streamline payment processes alongside document signing.

-

How does equitable EFT benefit small businesses?

Equitable EFT offers small businesses a cost-effective way to manage payments and streamline their operations. With its seamless integration into the airSlate SignNow platform, small business owners can handle transactions without incurring high fees or using complicated processes. This simplicity helps enhance productivity and focus on core business activities.

-

What features does airSlate SignNow offer with equitable EFT?

AirSlate SignNow provides several features with its equitable EFT solution, including secure payment processing, automated invoice generation, and real-time transaction tracking. These features are designed to simplify payment workflows and reduce manual errors. Users can also customize their payment options to meet their specific business needs.

-

Are there any integration options for equitable EFT with other software?

Yes, airSlate SignNow offers robust integration options for equitable EFT with various software platforms like CRM systems, accounting software, and ERP systems. This interconnectedness allows businesses to manage documents and payments in a synchronized manner, enhancing overall efficiency. Users can connect their existing tools easily for a more cohesive workflow.

-

What are the pricing options for using equitable EFT with airSlate SignNow?

AirSlate SignNow provides flexible pricing plans for equitable EFT, making it accessible to organizations of all sizes. These plans include various features and transaction limits, allowing businesses to choose an option that best fits their needs. Interested users can explore pricing tiers on the airSlate SignNow website for detailed information.

-

Is equitable EFT secure for managing sensitive payment information?

Yes, equitable EFT through airSlate SignNow is designed with security in mind, employing advanced encryption protocols to protect sensitive payment information. This commitment to security helps businesses minimize risks associated with fraud and data bsignNowes. Users can rest assured knowing their transactions are handled with the highest level of protection.

-

Can equitable EFT help improve cash flow for businesses?

Absolutely, equitable EFT can signNowly improve cash flow by enabling faster payment processing and reducing the time between invoicing and receiving payments. With airSlate SignNow’s automated features, businesses can receive payments more promptly, enhancing their financial stability. This timely payment processing allows organizations to manage their cash flow more effectively.

Get more for Equitable Eft

Find out other Equitable Eft

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter