Form AD 1 8 the New York State Department of Taxation and Tax Ny

What is the Form AD-1 8 The New York State Department Of Taxation And Tax NY

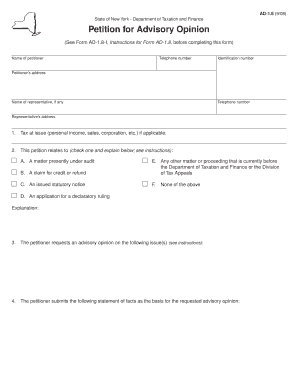

The Form AD-1 8 is a document issued by the New York State Department of Taxation and Finance. It is primarily used for tax-related purposes, allowing individuals and businesses to report specific information required by the state. This form plays a crucial role in ensuring compliance with New York tax regulations and is essential for accurate tax reporting.

How to use the Form AD-1 8 The New York State Department Of Taxation And Tax NY

Using the Form AD-1 8 involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained from the New York State Department of Taxation and Finance website. Next, gather all necessary information, including your tax identification number, income details, and any relevant deductions. Fill out the form carefully, ensuring all sections are completed accurately to avoid delays in processing.

Steps to complete the Form AD-1 8 The New York State Department Of Taxation And Tax NY

Completing the Form AD-1 8 involves a series of steps:

- Download the form from the official state website.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide details about your income, deductions, and any credits you are claiming.

- Review the completed form for accuracy before submission.

Legal use of the Form AD-1 8 The New York State Department Of Taxation And Tax NY

The Form AD-1 8 is legally binding when completed and submitted according to the guidelines set forth by the New York State Department of Taxation and Finance. It is essential to ensure that all information provided is truthful and accurate, as discrepancies may lead to penalties or legal repercussions. Proper electronic signatures can enhance the legal standing of the document when submitted digitally.

Key elements of the Form AD-1 8 The New York State Department Of Taxation And Tax NY

Key elements of the Form AD-1 8 include:

- Taxpayer identification details.

- Income reporting sections.

- Deductions and credits applicable to the taxpayer.

- Signature and date fields for verification.

Form Submission Methods (Online / Mail / In-Person)

The Form AD-1 8 can be submitted through various methods. Taxpayers have the option to file online via the New York State Department of Taxation and Finance's e-filing system, which is often the fastest method. Alternatively, the form can be mailed to the appropriate address provided in the instructions or submitted in person at designated tax offices. Each method has specific guidelines that must be followed to ensure successful submission.

Quick guide on how to complete form ad 1 8 the new york state department of taxation and tax ny

Effortlessly Complete Form AD 1 8 The New York State Department Of Taxation And Tax Ny on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed paperwork, as you can access the appropriate form and securely preserve it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents rapidly without any hold-ups. Manage Form AD 1 8 The New York State Department Of Taxation And Tax Ny on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Form AD 1 8 The New York State Department Of Taxation And Tax Ny with Ease

- Find Form AD 1 8 The New York State Department Of Taxation And Tax Ny and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Select important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Don't worry about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign Form AD 1 8 The New York State Department Of Taxation And Tax Ny to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ad 1 8 the new york state department of taxation and tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

Form AD 1 8 The New York State Department Of Taxation And Tax Ny is a document required for specific tax filings in New York State. It is essential for individuals and businesses looking to ensure compliance with state tax regulations. Understanding this form is crucial for meeting legal obligations.

-

How can airSlate SignNow help with Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

airSlate SignNow simplifies the process of filling out and signing Form AD 1 8 The New York State Department Of Taxation And Tax Ny. Our platform allows users to electronically sign, store, and send the form efficiently, ensuring a streamlined workflow. This can save users time and reduce errors in submissions.

-

Is there a cost associated with using airSlate SignNow for Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

Yes, there is a subscription fee for using airSlate SignNow's services, which can vary depending on the plan you choose. However, the platform is designed to be cost-effective, providing excellent value for businesses that need to manage forms like Form AD 1 8 The New York State Department Of Taxation And Tax Ny. You can explore different pricing tiers to find the one that best fits your needs.

-

What features does airSlate SignNow offer for handling Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

airSlate SignNow offers a variety of features for efficiently managing Form AD 1 8 The New York State Department Of Taxation And Tax Ny, including customizable templates, real-time tracking, and automated notifications. These features enhance user experience, making it easier to complete and submit the form accurately and on time.

-

Can I integrate airSlate SignNow with other software for Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

Absolutely! airSlate SignNow offers numerous integrations with popular third-party applications. This allows you to seamlessly incorporate the management of Form AD 1 8 The New York State Department Of Taxation And Tax Ny into your existing systems, improving overall efficiency and productivity.

-

What are the benefits of using airSlate SignNow for Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

Using airSlate SignNow for Form AD 1 8 The New York State Department Of Taxation And Tax Ny offers several benefits, including increased speed, reduced chances of error, and enhanced security. By digitizing your document processes, you can also ensure compliance and facilitate easier access to necessary records when needed.

-

Is airSlate SignNow secure for submitting Form AD 1 8 The New York State Department Of Taxation And Tax Ny?

Yes, airSlate SignNow prioritizes security and uses encryption and other protective measures to ensure that your documents, including Form AD 1 8 The New York State Department Of Taxation And Tax Ny, are securely handled. Our platform adheres to industry standards to provide a safe environment for all users.

Get more for Form AD 1 8 The New York State Department Of Taxation And Tax Ny

- Pa state inspection practice test form

- Mv210 form

- Charliecardcharlieticket consolidation request form

- Best eeo practices task force report form

- Alternate transportation form jamesville dewitt school district

- Defense advanced research projects agency darpa form

- Amedd cs pam 350 10 ncosupportcom 6965010 form

- Ticket program agreement tpa change form reminders

Find out other Form AD 1 8 The New York State Department Of Taxation And Tax Ny

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free