941af Me Form

What is the 941af Me

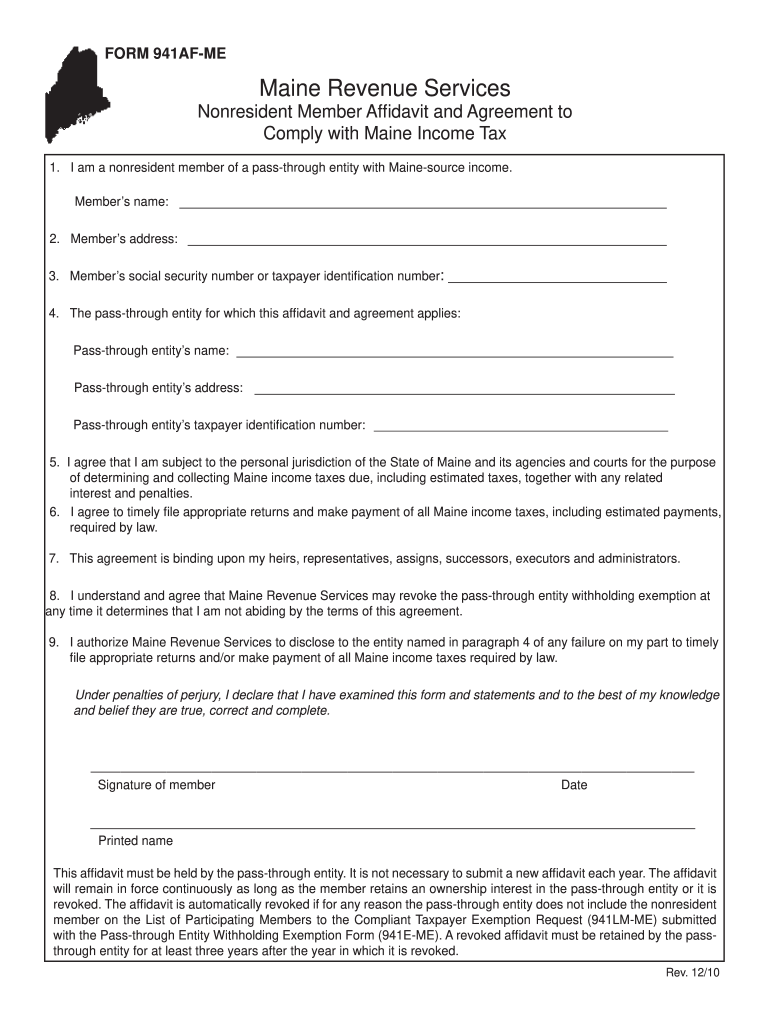

The 941af Me form is a specific tax document used in the United States for reporting certain tax information related to employment. This form is particularly relevant for employers who need to report wages, tips, and other compensation paid to employees, as well as the associated federal income tax withheld. Understanding the purpose of the 941af Me form is essential for compliance with federal tax regulations.

How to use the 941af Me

Using the 941af Me form involves several steps to ensure accurate reporting. First, gather all necessary information regarding employee wages and tax withholdings. Next, fill out the form with precise details, including the total number of employees and the amounts withheld for federal income tax, Social Security, and Medicare. After completing the form, review it for accuracy before submission. Utilizing electronic tools can simplify this process, making it easier to fill out and submit the form securely.

Steps to complete the 941af Me

Completing the 941af Me form requires following a structured approach:

- Collect all relevant payroll records for the reporting period.

- Enter the total wages and tips paid to employees during the quarter.

- Calculate and input the federal income tax withheld from employee wages.

- Include amounts for Social Security and Medicare taxes.

- Review the completed form for any discrepancies or errors.

- Submit the form electronically or via mail, ensuring it is sent by the deadline.

Legal use of the 941af Me

The legal use of the 941af Me form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted on time. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Ensuring that the form is filled out according to IRS guidelines is crucial for avoiding penalties and ensuring compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 941af Me form are critical for compliance. Generally, the form must be filed quarterly, with specific due dates for each quarter. These dates typically fall on the last day of the month following the end of the quarter. For example, the deadline for the first quarter (January to March) is usually April 30. Staying aware of these deadlines helps avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The 941af Me form can be submitted through various methods, providing flexibility for employers. Options include:

- Online: Many employers choose to file electronically through the IRS e-file system, which streamlines the process and provides immediate confirmation of submission.

- Mail: The form can be printed and mailed to the appropriate IRS address based on the employer's location.

- In-Person: While less common, some employers may opt to deliver the form in person to their local IRS office.

Quick guide on how to complete 941af me

Prepare 941af Me effortlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your files promptly without delays. Manage 941af Me on any device with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign 941af Me without exertion

- Obtain 941af Me and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choosing. Alter and eSign 941af Me and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 941af me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 941af me and how can it benefit my business?

The form 941af me is a specific document that businesses can use for filing payroll-related information with the IRS. Using airSlate SignNow to manage this form streamlines the process, making it easier and quicker to submit essential data. This ensures compliance while saving time and reducing error rates.

-

How does airSlate SignNow help in filling out the form 941af me?

airSlate SignNow provides a user-friendly platform for filling out the form 941af me digitally. Its intuitive interface allows you to enter information accurately, and the eSignature feature enables you to sign and send the document securely. This minimizes the hassle of paperwork and enhances overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the form 941af me?

Yes, airSlate SignNow offers different pricing plans tailored to various business needs. The cost fluctuates based on the features you select, including how many users will access the form 941af me. Investing in this solution often results in savings through improved workflow and reduced administrative burdens.

-

Can I integrate airSlate SignNow with my current software for managing the form 941af me?

Absolutely! airSlate SignNow can seamlessly integrate with various software platforms, including CRM and accounting systems. This integration allows you to manage the form 941af me from your existing tools, making it even easier to keep your documents organized and accessible.

-

What features does airSlate SignNow offer for managing the form 941af me?

airSlate SignNow provides essential features such as template creation, e-signature capabilities, and real-time document tracking for the form 941af me. These tools enhance document management and ensure that you can quickly access and update your forms without hassle. Overall, it simplifies the entire signing process.

-

How secure is the information submitted in the form 941af me using airSlate SignNow?

The security of your information is a top priority for airSlate SignNow. All data submitted with the form 941af me is encrypted and stored securely, complying with industry standards. This ensures that sensitive payroll information remains confidential and protected from unauthorized access.

-

Can teams collaborate on the form 941af me using airSlate SignNow?

Yes, airSlate SignNow supports team collaboration for managing the form 941af me. Multiple users can access, edit, and review the document simultaneously, which facilitates better communication and ensures everyone is on the same page. This feature is particularly beneficial for businesses with team-oriented processes.

Get more for 941af Me

- Pshp intensive outpatient day treatment form intensive outpatient day treatment form

- Doctors hospital of augusta form

- Patient forms packet georgia pain management

- Also please provide the receptionist a picture id and your insurance card form

- Gastroenterology specialists of dekalb llc form

- Patient financial responsibility form jennifer wagner ma

- Pshp ga facilityagency change form facilityagency change form

- Copy of your photo id must accompany this request please form

Find out other 941af Me

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template