Restaurant Tax Report City of St Louis, MO Form

What is the Restaurant Tax Report City Of St Louis, MO

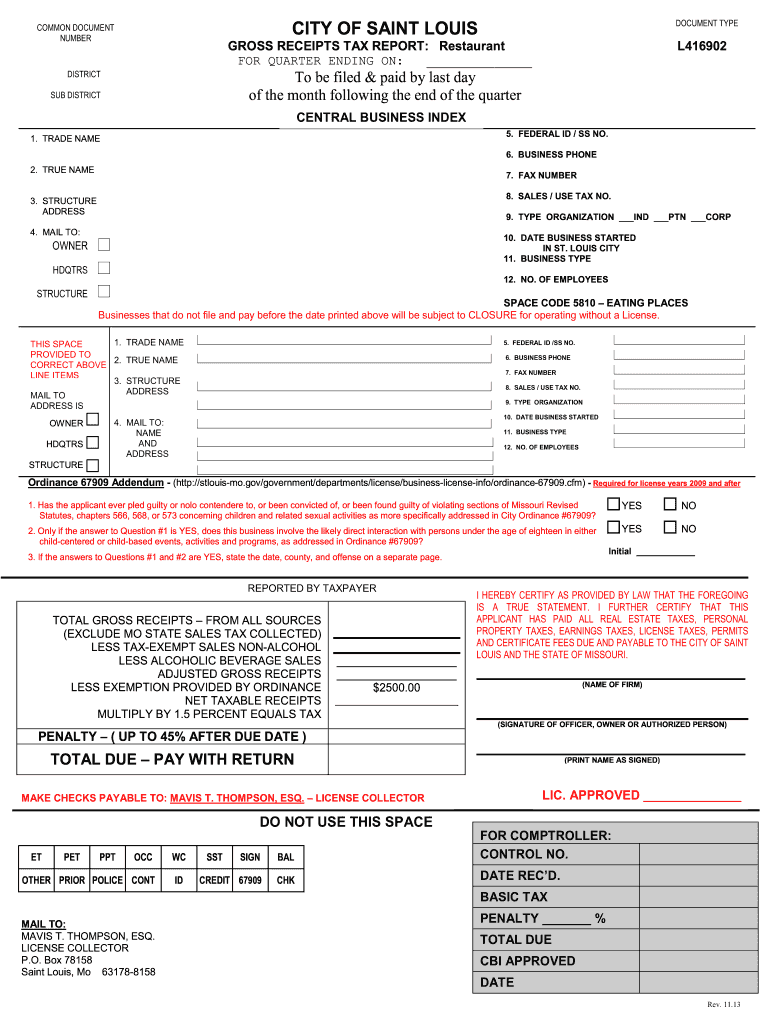

The Restaurant Tax Report for the City of St. Louis, MO, is a specific tax form required for businesses operating within the city that serve food and beverages. This report is designed to collect taxes on the sales of food and drinks, which are essential for funding local services and infrastructure. The form requires businesses to provide detailed information about their sales, tax collected, and any exemptions that may apply. It is crucial for compliance with local tax regulations and helps ensure that restaurants contribute their fair share to the community.

How to use the Restaurant Tax Report City Of St Louis, MO

Using the Restaurant Tax Report involves several steps to ensure accurate completion and submission. First, gather all necessary sales data for the reporting period, including total sales, tax collected, and any applicable deductions. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your business's financial activities. Once completed, the report can be submitted online or via mail, depending on your preference and the city's guidelines. It is important to keep a copy for your records and to ensure compliance with local tax laws.

Steps to complete the Restaurant Tax Report City Of St Louis, MO

Completing the Restaurant Tax Report involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect all sales data for the reporting period, including daily sales and tax collected.

- Access the Restaurant Tax Report form from the City of St. Louis website or designated source.

- Fill in the required fields, including business information and sales figures.

- Double-check all entries for accuracy, ensuring that totals match your records.

- Submit the completed form online or via mail, adhering to the specified deadlines.

- Retain a copy of the submitted report for your records.

Legal use of the Restaurant Tax Report City Of St Louis, MO

The legal use of the Restaurant Tax Report is essential for businesses to comply with local tax laws. This report serves as an official document that outlines the tax obligations of restaurants operating in St. Louis. Failure to accurately complete and submit this report can result in penalties, including fines or legal action. Additionally, the information provided in the report is subject to audits by city officials, making it vital for businesses to maintain accurate records and ensure compliance with all reporting requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Restaurant Tax Report is crucial for compliance. Typically, reports are due on a quarterly basis, with specific deadlines set by the City of St. Louis. It is important for businesses to mark these dates on their calendars to avoid late submissions, which can incur penalties. Keeping track of these deadlines ensures that restaurants remain in good standing with local tax authorities and can avoid unnecessary complications.

Required Documents

To complete the Restaurant Tax Report, certain documents are required to ensure accurate reporting. Businesses should prepare:

- Sales records for the reporting period, including daily sales summaries.

- Documentation of any tax exemptions or deductions claimed.

- Previous tax reports for reference and consistency.

- Any correspondence from the City of St. Louis regarding tax obligations.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with local regulations.

Quick guide on how to complete restaurant tax report city of st louis mo

Prepare Restaurant Tax Report City Of St Louis, MO effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Restaurant Tax Report City Of St Louis, MO on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest method to alter and eSign Restaurant Tax Report City Of St Louis, MO with minimal effort

- Find Restaurant Tax Report City Of St Louis, MO and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, wearying form searches, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Restaurant Tax Report City Of St Louis, MO and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the restaurant tax report city of st louis mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Restaurant Tax Report City Of St Louis, MO, and why is it important?

The Restaurant Tax Report City Of St Louis, MO is a mandatory document that restaurants must file to report tax collections and ensure compliance with local regulations. It is essential for maintaining good standing with the city authorities and avoiding potential fines.

-

How can airSlate SignNow help with the Restaurant Tax Report City Of St Louis, MO?

airSlate SignNow streamlines the process of preparing and submitting the Restaurant Tax Report City Of St Louis, MO with its easy-to-use electronic signature and document management capabilities. This helps ensure accuracy and saves you time when filing your tax reports.

-

What features does airSlate SignNow offer for managing the Restaurant Tax Report City Of St Louis, MO?

With airSlate SignNow, you can easily create, send, and track your Restaurant Tax Report City Of St Louis, MO. The platform offers customizable templates, automated reminders, and secure storage to ensure your documents are always accessible and correctly managed.

-

Is airSlate SignNow a cost-effective solution for the Restaurant Tax Report City Of St Louis, MO?

Yes, airSlate SignNow is designed to be a cost-effective solution, offering competitive pricing plans. By reducing paperwork and streamlining the filing process for the Restaurant Tax Report City Of St Louis, MO, businesses can save valuable time and resources.

-

Can I integrate airSlate SignNow with my existing accounting software for the Restaurant Tax Report City Of St Louis, MO?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to sync data and streamline the preparation of the Restaurant Tax Report City Of St Louis, MO. This integration helps eliminate manual data entry and reduces the risk of errors.

-

What support does airSlate SignNow provide for filing the Restaurant Tax Report City Of St Louis, MO?

airSlate SignNow offers comprehensive customer support, including tutorials and guides, to assist you in filing the Restaurant Tax Report City Of St Louis, MO. Our dedicated support team is also available to help resolve any questions or issues during the eSigning process.

-

Is it secure to use airSlate SignNow for my Restaurant Tax Report City Of St Louis, MO?

Yes, airSlate SignNow prioritizes security and compliance, employing advanced encryption and security protocols to protect your data. You can confidently use our platform for your Restaurant Tax Report City Of St Louis, MO, knowing that your sensitive information is safe.

Get more for Restaurant Tax Report City Of St Louis, MO

- Employee electric vehicle charging application state of form

- Oregon deq waste tire carrier permit renewal application deq state or form

- Oregon business change in status form

- Facility and on street permit application city of salem cityofsalem form

- Employee electric vehicle charging application print oregon form

- Foreign limited liability company oregon secretary of state form

- Individual history form oregongov

- Electrical license application mail application with form

Find out other Restaurant Tax Report City Of St Louis, MO

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online