SBA Form 994F Small Business Administration Sba

What is the SBA Form 994F Small Business Administration Sba

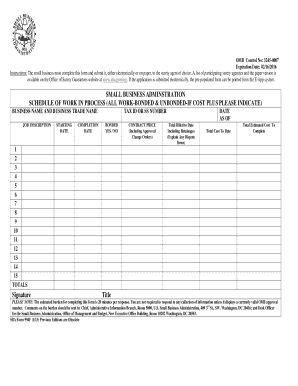

The SBA Form 994F is a document utilized by the Small Business Administration (SBA) to gather essential information from small businesses seeking financial assistance. This form is part of the SBA's efforts to ensure that applicants meet the necessary criteria for loan eligibility and compliance with federal regulations. It typically includes sections that require detailed information about the business's financial status, ownership structure, and operational history. Understanding this form is crucial for small business owners looking to navigate the funding landscape effectively.

How to use the SBA Form 994F Small Business Administration Sba

Using the SBA Form 994F involves several key steps to ensure accurate completion and submission. First, gather all required documentation, including financial statements, tax returns, and business plans. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is advisable to review the form multiple times before submission to avoid errors that could delay processing. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements of the SBA program you are applying for.

Steps to complete the SBA Form 994F Small Business Administration Sba

Completing the SBA Form 994F requires a systematic approach to ensure all necessary information is provided. Follow these steps:

- Review the form thoroughly to understand each section.

- Collect relevant documents, such as financial statements and identification.

- Fill in the business information, including name, address, and ownership details.

- Provide financial data, including revenue, expenses, and debts.

- Double-check all entries for accuracy and completeness.

- Submit the form as per the guidelines provided by the SBA.

Legal use of the SBA Form 994F Small Business Administration Sba

The legal use of the SBA Form 994F is governed by federal regulations that ensure the integrity of the information provided. To be considered legally binding, the form must be filled out truthfully and accurately. Misrepresentation or false information can lead to severe penalties, including loan denial or legal action. The form also requires a signature, affirming that the information is correct and that the applicant agrees to the terms set forth by the SBA.

Key elements of the SBA Form 994F Small Business Administration Sba

Several key elements are essential to the SBA Form 994F, which include:

- Business Identification: Name, address, and contact information.

- Ownership Structure: Details about the owners and their respective stakes.

- Financial Information: Revenue, expenses, and existing debts.

- Purpose of Funding: A clear explanation of how the funds will be used.

- Signature Section: Required signatures to validate the information provided.

Eligibility Criteria

To qualify for assistance through the SBA Form 994F, businesses must meet specific eligibility criteria outlined by the SBA. These criteria typically include being a for-profit business, meeting size standards defined by the SBA, and demonstrating a need for financial assistance. Additionally, the business must be located in the United States and operate primarily within the country. Understanding these criteria is vital for applicants to ensure they meet the necessary requirements before submitting the form.

Quick guide on how to complete sba form 994f small business administration sba

Effortlessly Prepare SBA Form 994F Small Business Administration Sba on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without hassle. Manage SBA Form 994F Small Business Administration Sba on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Alter and eSign SBA Form 994F Small Business Administration Sba with Ease

- Obtain SBA Form 994F Small Business Administration Sba and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the information carefully and then click on the Done button to apply your modifications.

- Select how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, laborious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign SBA Form 994F Small Business Administration Sba to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form 994f small business administration sba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBA Form 994F, and why is it important for small businesses?

The SBA Form 994F is a critical document required by the Small Business Administration (SBA) for certain loan programs. It provides essential information about your business, helping the SBA assess your eligibility for financing. Understanding this form can streamline your loan application process, making it easier for small businesses to secure funding.

-

How can airSlate SignNow help with completing the SBA Form 994F?

airSlate SignNow offers a user-friendly platform for filling out and eSigning the SBA Form 994F. Our solution allows you to complete the document quickly and securely online, ensuring you meet all SBA requirements. With our intuitive interface, small businesses can focus more on their operations and less on paperwork.

-

Is there a cost associated with using airSlate SignNow for the SBA Form 994F?

Yes, airSlate SignNow provides various pricing plans suitable for all business sizes. Our plans are designed to be cost-effective, ensuring that small businesses can easily access the tools necessary to complete the SBA Form 994F. You can choose a plan that fits your budget and workflow needs.

-

What features does airSlate SignNow offer for the SBA Form 994F?

Our platform includes features such as customizable templates, secure eSigning, and document storage specifically tailored for the SBA Form 994F. Additionally, you can track the document status in real-time and collaborate with your team effortlessly. These features enhance the efficiency of completing and submitting your SBA forms.

-

Are there any integrations available for airSlate SignNow to assist with the SBA Form 994F?

Yes, airSlate SignNow seamlessly integrates with various applications including cloud storage platforms and CRM systems. These integrations simplify access to your documents, allowing for quick retrieval while filling out the SBA Form 994F. This streamlined process enhances productivity for small businesses.

-

How secure is airSlate SignNow when handling the SBA Form 994F?

AirSlate SignNow takes security seriously, ensuring that all your documents, including the SBA Form 994F, are protected with advanced encryption protocols. We comply with industry standards to keep your information safe and confidential. This security allows small businesses to complete forms confidently.

-

Can multiple users collaborate on the SBA Form 994F using airSlate SignNow?

Absolutely! With airSlate SignNow, multiple users can collaborate on the SBA Form 994F in real-time. This feature is especially beneficial for small businesses, allowing teams to work together, provide input, and ensure accuracy before submitting the form to the SBA. Collaboration has never been easier or more efficient.

Get more for SBA Form 994F Small Business Administration Sba

- Form ex550 affidavit of service govuk

- Perth112212 by susan k bailey marketing ampamp design issuu form

- Form 15 ontario court servicesservices aux tribunaux

- Ontario seal form 8a application divorce formules fill

- Form 36 affidavit for divorce fill online printable

- Client declaration form

- Notice of injury and claim form wisconsin department of justice doj state wi

- Practitioners professional liability insurance application practitioners professional liability insurance application form

Find out other SBA Form 994F Small Business Administration Sba

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed