This Form is to Serve as Authorization to Indicate on the Municipality's Tax Collection Records that All Current and Future

Understanding the Authorization Form for Tax Collection Records

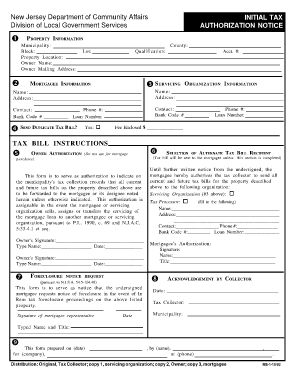

The form titled "This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future Tax Bills On The Property Described Above Nj" is a legal document used to authorize the municipality to update its tax collection records. This form ensures that all current and future tax bills for the specified property are correctly recorded under the designated taxpayer's name. It is essential for property owners to maintain accurate records to avoid potential discrepancies in tax assessments.

Steps to Complete the Authorization Form

Completing the authorization form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property, including the address and any relevant identification numbers. Next, fill out the form with the required details, ensuring that all information is correct and complete. Once the form is filled out, review it for any errors. Finally, sign the form electronically or in person, depending on the submission method chosen.

Legal Use of the Authorization Form

This form serves a critical legal function in the realm of tax collection. By signing the authorization, property owners grant permission for the municipality to record their tax information accurately. This legal acknowledgment helps prevent future disputes regarding tax liabilities. It is important to understand that the form must be filled out in accordance with local laws and regulations to be considered valid.

Obtaining the Authorization Form

The authorization form can typically be obtained from the municipality's official website or local tax office. Many municipalities provide downloadable versions of the form, which can be filled out electronically. If an online option is not available, property owners can visit the local tax office to request a physical copy of the form. It is advisable to check for any specific instructions or requirements that may vary by location.

Key Elements of the Authorization Form

Several key elements must be included in the authorization form to ensure its validity. These elements typically include the property owner's name, property address, a statement of authorization, and the signature of the property owner. Additionally, some forms may require the inclusion of a date and contact information. Ensuring that all these components are present will help facilitate the processing of the form by the municipality.

Examples of Using the Authorization Form

Property owners may use this authorization form in various scenarios, such as when transferring ownership of a property or updating tax records after a name change. For instance, if a property is sold, the new owner can use the form to ensure that all future tax bills are directed to their name. Similarly, if an owner changes their legal name, the form can be used to update the tax records accordingly.

Submission Methods for the Authorization Form

There are generally multiple submission methods available for the authorization form. Property owners can often submit the completed form online through the municipality's website, which is convenient and efficient. Alternatively, the form can be mailed to the local tax office or delivered in person. It is important to verify the preferred submission method for the specific municipality to ensure timely processing.

Quick guide on how to complete this form is to serve as authorization to indicate on the municipalitys tax collection records that all current and future tax

Effortlessly prepare This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future on any device

The management of documents online has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents rapidly and without issues. Manage This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest method to modify and electronically sign This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future efficiently

- Obtain This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method to deliver your form: through email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you select. Modify and electronically sign This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this form is to serve as authorization to indicate on the municipalitys tax collection records that all current and future tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 'This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future Tax Bills On The Property Described Above Nj.'?

This form serves as an official authorization that enables the municipality's tax collection records to reflect that all current and future tax bills related to the specified property are correctly recorded. It ensures that property owners maintain accurate tax records and simplifies the management of their tax obligations.

-

How do I fill out the form for authorization regarding tax bills?

To fill out the form, simply provide the necessary details about your property as described above, along with your information as the property owner. Ensure all entries are precise to avoid any issues with tax records. Once completed, this form serves as authorization to indicate on the municipality's tax collection records.

-

Is there a cost associated with using airSlate SignNow for this authorization form?

airSlate SignNow offers a cost-effective solution that includes a variety of pricing plans tailored to business needs. Using our platform to process 'This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future Tax Bills On The Property Described Above Nj.' can be included in these plans with no hidden fees.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow provides features like easy document sharing, electronic signatures, and secure cloud storage. These features facilitate quick processing of 'This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future Tax Bills On The Property Described Above Nj.' ensuring efficient management of your tax documents.

-

Can I integrate airSlate SignNow with other software solutions?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing your workflow. This allows for improved efficiency when handling authorization forms, including 'This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future Tax Bills On The Property Described Above Nj.'

-

What are the benefits of using airSlate SignNow for tax authorization forms?

Using airSlate SignNow for your tax authorization form streamlines the signing process, saves time, and improves accuracy. This form enables you to manage all current and future tax bills effortlessly while ensuring compliance with municipal requirements.

-

How secure is the information I send through airSlate SignNow?

AirSlate SignNow prioritizes security and compliance, implementing industry-standard encryption and data protection measures. You can trust that the information on 'This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future Tax Bills On The Property Described Above Nj.' is kept secure throughout the process.

Get more for This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future

- Nmc loft kit waiver application form

- 2019 2020 low income verification form parent

- Ung core plan of study university of north georgia form

- Sponsored billing statementindd kellogg community college form

- Report changes or special circumstancesonestopflorida form

- Student internship agreements form

- And other documents to form

- Application for facultystaff tuition waiver form

Find out other This Form Is To Serve As Authorization To Indicate On The Municipality's Tax Collection Records That All Current And Future

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast