Form 1040N, Nebraska Individual Income Tax Return Taxhow

What is the Form 1040N, Nebraska Individual Income Tax Return?

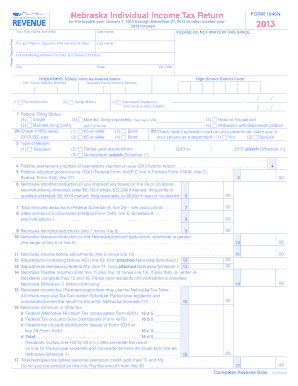

The Form 1040N is the official Nebraska Individual Income Tax Return used by residents of Nebraska to report their income and calculate their state tax liability. This form is essential for individuals earning income in Nebraska, as it ensures compliance with state tax laws. The information provided on the form includes personal details, income sources, deductions, and credits applicable to the taxpayer. Understanding the purpose and requirements of Form 1040N is crucial for accurate tax filing and avoiding potential penalties.

How to Use the Form 1040N, Nebraska Individual Income Tax Return

Using the Form 1040N involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary documents, such as W-2s, 1099s, and other income statements. Next, individuals should carefully fill out the form, ensuring that all personal information and income details are accurate. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference. Utilizing digital tools can streamline the process, making it easier to fill out and sign the form securely.

Steps to Complete the Form 1040N, Nebraska Individual Income Tax Return

Completing the Form 1040N requires a systematic approach to ensure all information is accurately reported. The steps include:

- Gather all relevant financial documents, including income statements and deduction records.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and interest.

- Claim applicable deductions and credits to reduce taxable income.

- Calculate the total tax liability based on the provided information.

- Review the completed form for accuracy before submission.

Legal Use of the Form 1040N, Nebraska Individual Income Tax Return

The Form 1040N is legally binding when completed and submitted according to Nebraska tax laws. It is essential for taxpayers to ensure that all information is truthful and accurate, as providing false information can lead to penalties or legal consequences. Electronic signatures on the form are recognized under U.S. law, provided they comply with regulations such as ESIGN and UETA. Utilizing a reliable eSignature solution can help ensure that the form is executed legally and securely.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the Form 1040N to avoid late penalties. The typical filing deadline for individual income tax returns in Nebraska is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable for individuals to stay informed about any changes to deadlines, especially in light of potential extensions or special provisions during extraordinary circumstances.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1040N. The form can be filed electronically through authorized e-filing services, which often provide a streamlined process for completion and submission. Alternatively, individuals may choose to print the form and mail it to the appropriate Nebraska Department of Revenue address. In-person submissions may also be accepted at designated tax offices, allowing for direct assistance if needed. Each method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete form 1040n nebraska individual income tax return taxhow

Complete Form 1040N, Nebraska Individual Income Tax Return Taxhow seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form 1040N, Nebraska Individual Income Tax Return Taxhow across any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 1040N, Nebraska Individual Income Tax Return Taxhow with ease

- Locate Form 1040N, Nebraska Individual Income Tax Return Taxhow and click Get Form to begin.

- Use the tools at your disposal to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Form 1040N, Nebraska Individual Income Tax Return Taxhow to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040n nebraska individual income tax return taxhow

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040N, Nebraska Individual Income Tax Return Taxhow?

The Form 1040N, Nebraska Individual Income Tax Return Taxhow is a state-specific tax return form for Nebraska residents. It allows individuals to report their income and calculate their state tax obligations. Understanding this form can simplify your tax filing process.

-

How does airSlate SignNow assist with the Form 1040N, Nebraska Individual Income Tax Return Taxhow?

AirSlate SignNow provides a streamlined way to send, eSign, and manage your Form 1040N, Nebraska Individual Income Tax Return Taxhow. Our platform simplifies document handling, making it easier for you to complete and submit your tax returns securely and efficiently.

-

What are the pricing options for using airSlate SignNow for Form 1040N, Nebraska Individual Income Tax Return Taxhow?

AirSlate SignNow offers competitive pricing plans tailored to fit different user needs, including solo users and businesses. By subscribing, you gain access to features that are essential for managing your Form 1040N, Nebraska Individual Income Tax Return Taxhow confidently and affordably.

-

Are there features specific to eSigning the Form 1040N, Nebraska Individual Income Tax Return Taxhow?

Yes, airSlate SignNow includes features like secure electronic signatures and customizable workflows specifically for the Form 1040N, Nebraska Individual Income Tax Return Taxhow. These features enhance the efficiency of your tax filing process while ensuring compliance with state regulations.

-

Can I integrate airSlate SignNow with my accounting software for the Form 1040N, Nebraska Individual Income Tax Return Taxhow?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software, helping you streamline the management of your Form 1040N, Nebraska Individual Income Tax Return Taxhow. This integration enables better organization of your documents and data, ensuring a smoother tax preparation experience.

-

What benefits does airSlate SignNow provide when filing the Form 1040N, Nebraska Individual Income Tax Return Taxhow?

Using airSlate SignNow for the Form 1040N, Nebraska Individual Income Tax Return Taxhow provides numerous benefits, including reduced paperwork and fewer errors. Our solution allows for easy tracking of document status and receiving notifications, ensuring that you never miss a filing deadline.

-

How secure is the information shared through airSlate SignNow when filing the Form 1040N, Nebraska Individual Income Tax Return Taxhow?

AirSlate SignNow employs bank-level encryption and security protocols to protect your information when filing the Form 1040N, Nebraska Individual Income Tax Return Taxhow. Our commitment to security ensures that your data remains confidential and secure throughout the entire process.

Get more for Form 1040N, Nebraska Individual Income Tax Return Taxhow

Find out other Form 1040N, Nebraska Individual Income Tax Return Taxhow

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document