BPT in Alabama Department of Revenue Alabama Gov Form

What is the BPT IN Alabama Department Of Revenue Alabama gov

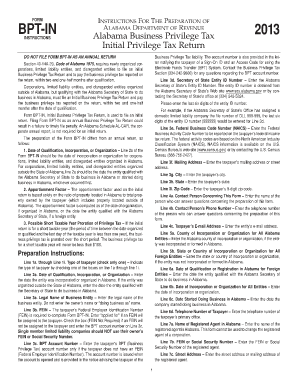

The BPT IN Alabama Department Of Revenue Alabama gov form is a business privilege tax return required for businesses operating in Alabama. This form is essential for reporting the gross receipts of a business and calculating the tax owed to the state. The information provided on this form helps the Alabama Department of Revenue assess the tax liability of businesses, ensuring compliance with state tax laws. It is crucial for both new and established businesses to understand the requirements associated with this form to avoid penalties and ensure proper tax reporting.

How to use the BPT IN Alabama Department Of Revenue Alabama gov

Using the BPT IN Alabama Department Of Revenue Alabama gov form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and records of gross receipts. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect the business's financial activity for the reporting period. After completing the form, review it for any errors before submission. Businesses can submit the form electronically through the Alabama Department of Revenue's online portal or by mailing a printed copy to the appropriate address.

Steps to complete the BPT IN Alabama Department Of Revenue Alabama gov

Completing the BPT IN Alabama Department Of Revenue Alabama gov form involves a systematic approach:

- Gather financial documents, including income statements and receipts.

- Access the form through the Alabama Department of Revenue website.

- Fill in the business information, including name, address, and tax identification number.

- Report gross receipts accurately for the specified tax period.

- Calculate the tax owed based on the reported gross receipts.

- Review the form for accuracy and completeness.

- Submit the form electronically or via mail, ensuring it is sent to the correct address.

Legal use of the BPT IN Alabama Department Of Revenue Alabama gov

The BPT IN Alabama Department Of Revenue Alabama gov form is legally binding when completed and submitted according to state regulations. It serves as a formal declaration of a business's gross receipts and tax liability. Compliance with the filing requirements is essential to avoid legal repercussions, including fines and penalties. Businesses must ensure that the information provided is truthful and accurate, as any discrepancies could lead to audits or further legal action by the Alabama Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the BPT IN Alabama Department Of Revenue Alabama gov form are crucial for compliance. Typically, businesses must file the form annually, with the deadline falling on the 15th day of the third month following the end of the tax year. For example, if a business operates on a calendar year, the filing deadline would be March 15. It is important for businesses to mark these dates on their calendars to avoid late fees and ensure timely compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the BPT IN Alabama Department Of Revenue Alabama gov form on time can result in significant penalties. Businesses may face fines that accumulate based on the duration of the delay. Additionally, non-compliance can lead to interest charges on any unpaid taxes, further increasing the financial burden. It is essential for businesses to understand these potential penalties and prioritize timely filing to maintain compliance with Alabama tax regulations.

Quick guide on how to complete bpt in alabama department of revenue alabama gov

Prepare BPT IN Alabama Department Of Revenue Alabama gov easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage BPT IN Alabama Department Of Revenue Alabama gov on any device using the airSlate SignNow Android or iOS apps and streamline your document-related processes today.

How to edit and eSign BPT IN Alabama Department Of Revenue Alabama gov effortlessly

- Find BPT IN Alabama Department Of Revenue Alabama gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign BPT IN Alabama Department Of Revenue Alabama gov and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bpt in alabama department of revenue alabama gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BPT in Alabama and how does it relate to the Department of Revenue?

The BPT, or Business Privilege Tax, in Alabama is a tax levied on businesses for the privilege of conducting business in the state. This tax is managed by the Alabama Department of Revenue, and understanding its implications is essential for compliance and financial planning.

-

How can airSlate SignNow help with BPT filings in Alabama?

airSlate SignNow facilitates the signing and submission of necessary documents for BPT filings in Alabama Department of Revenue. By using our platform, businesses can streamline the process, ensuring compliance and saving valuable time during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored for various business sizes. Regardless of your specific needs related to the BPT in Alabama Department of Revenue, our solutions are designed to be cost-effective and user-friendly.

-

Is airSlate SignNow compliant with Alabama Department of Revenue regulations?

Yes, airSlate SignNow is designed to adhere to all relevant regulations, including those set forth by the Alabama Department of Revenue. This compliance ensures that your documents are legally binding and securely managed, especially when dealing with BPT matters.

-

Can I integrate airSlate SignNow with other tools for managing BPT in Alabama?

Absolutely! airSlate SignNow seamlessly integrates with various productivity tools that businesses commonly use. This flexibility helps users manage their BPT in Alabama Department of Revenue more efficiently by streamlining workflows and document management.

-

What features does airSlate SignNow offer to assist businesses with BPT in Alabama?

airSlate SignNow provides features such as secure eSigning, document templates, and real-time tracking, which are all critical when managing BPT in Alabama. These tools simplify the process and help ensure that your filings meet all necessary compliance requirements.

-

What benefits can businesses expect from using airSlate SignNow for BPT in Alabama?

By utilizing airSlate SignNow, businesses can enhance their efficiency and reduce the risk of errors in BPT filings. Our platform not only speeds up the documentation process but also ensures compliance with Alabama Department of Revenue requirements, leading to better overall cash flow management.

Get more for BPT IN Alabama Department Of Revenue Alabama gov

Find out other BPT IN Alabama Department Of Revenue Alabama gov

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed