You May Make Comments Anonymously, or You May Include Your Name and E Mail Address or Phone Number Irs Form

What is the IRS Form You May Make Comments Anonymously, Or You May Include Your Name And E-mail Address Or Phone Number?

The IRS form allowing individuals to make comments anonymously or with personal information is designed to facilitate communication with the IRS. This form enables taxpayers to provide feedback, report issues, or ask questions regarding their tax situations. It serves as a channel for taxpayers to express concerns or seek clarification on various tax-related matters without the need for formal identification, although providing personal information can help expedite responses.

How to Use the IRS Form You May Make Comments Anonymously, Or You May Include Your Name And E-mail Address Or Phone Number

To effectively use this IRS form, begin by clearly stating your comments or questions. If you choose to remain anonymous, ensure that your message is concise and specific to facilitate a timely response. If you opt to include your name and contact information, provide accurate details to enable the IRS to follow up with you. This form can be submitted via the IRS website or through designated channels outlined by the IRS.

Steps to Complete the IRS Form You May Make Comments Anonymously, Or You May Include Your Name And E-mail Address Or Phone Number

Completing the IRS form involves several straightforward steps:

- Access the form through the IRS website or the designated submission portal.

- Read the instructions carefully to understand the requirements.

- Fill in your comments or questions in the provided text box.

- Decide whether to include your name and contact information.

- Review your submission for clarity and accuracy.

- Submit the form as directed, either online or via mail.

Legal Use of the IRS Form You May Make Comments Anonymously, Or You May Include Your Name And E-mail Address Or Phone Number

This IRS form is legally recognized as a means of communication with the IRS. It is important to ensure that the information provided is truthful and relevant to your tax inquiries. Misrepresentation or false statements can lead to penalties. The form is designed to protect taxpayer rights while facilitating open dialogue with the IRS.

IRS Guidelines for Completing the Form

The IRS provides specific guidelines for completing this form to ensure that submissions are processed efficiently. Key guidelines include:

- Be clear and concise in your comments or questions.

- Use appropriate language and avoid ambiguous terms.

- If including personal information, ensure it is accurate and up-to-date.

- Follow the submission instructions carefully to avoid delays.

Filing Deadlines and Important Dates for the IRS Form

While this form does not have a specific filing deadline, it is advisable to submit comments or inquiries as soon as issues arise. Timely communication can help resolve tax matters more efficiently. Keeping track of important tax deadlines, such as filing dates for tax returns, can also be beneficial when using this form for related inquiries.

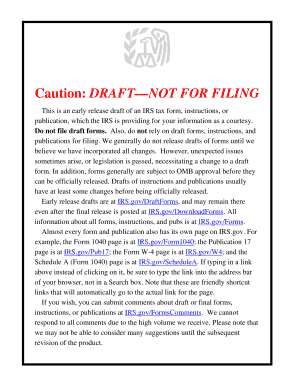

Quick guide on how to complete irs gov draftforms

Effortlessly Prepare irs gov draftforms on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without complications. Handle irs gov draftforms on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign irs gov draftforms with Ease

- Obtain irs gov draftforms and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal value as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign irs gov draftforms and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs irs gov draftforms

-

How can you check your social security number online?

There are two Internet verification options you can use to verify that your employee names and Social Security numbers (SSN) match Social Security's records. You can:Verify up to 10 names and SSNs (per screen) online and receive immediate results. This option is ideal to verify new hires.Upload overnight files of up to 250,000 names and SSNs and usually receive results the next government business day. This option is ideal if you want to verify an entire payroll database or if you hire a large number of workers at a time.While the service is available to all employers and third-party submitters, it can only be used to verify current or former employees and only for wage reporting (Form W-2) purposes.Why Should I Verify Names and SSNs OnlineCorrect names and SSNs on W-2 wage reports are the keys to the successful processing of your annual wage report submission.It's faster and easier to use than submitting your requests paper listings or using Social Security's telephone verification option.Results in more accurate wage reports.Saves processing costs and reduces the number of W-2c's.Allows Social Security to give the proper credit to your employees' earnings record, which will be important information in determining their Social Security benefits in the future.Want to find out someone's social security number? Social security number's aren't as hard to get as you may think. Many sites offer social security numbers to employers for identification verification. SSN's of deceased persons are also available to the public if you know where to look. Here are a few tips on how to find out someone's Social Security number.Step 1Obtain the true full name of the person's social security number that you are looking for. Many people use nicknames or completely different names entirely. A middle initial can also be important when identifying multiple people with the same first and last name.Step 2Search the Social Security Death Index (SSDI) online if you are looking for the social security number of someone who has passed away. This site is easy to search and contains almost every person who has died since the early 60's.Step 3Utilize E-Verify's service through the Web. E-Verify works in partnership with the Social Security Administration to provide social security number verification to qualified employers and agencies. E-Verify is free to use for employers to determine if a worker is eligible for employment in the U.S.If you are living in the US and making ends meet can be a problem at times, then you need to know about the special program of the government which is established just to help those in need. Do you know what Social Security is? What is the meaning of Social Security and the concept? Well, if you are looking for answers for these questions and many more then you have landed on the right page. Everything you need to know about it is below.Requesting a Social Security Card Replacement can be a tedious process that involves visits to a local Social Security Administration office and hours standing in long lines to process a request. You could waste your entire work day at the SSA office in order to complete your application, and your card would only arrive in about 14 days.If your Social Security Card has been lost or stolen, if you need a copy or duplicate of your card, if you need a new card, or even a card name change, you can now mail in your application. You will receive your Social Security Replacement Card within the same time frame as if applied in person, but won't waste your day at the SSA office. But reading through endless instructions and filling out government forms can be a complicated process in which errors and mistakes can easily happen.In order to make your life simpler, we have developed a system that allows you to apply for a Social Security Card through an online application consisting of a simplified and intuitive questionnaire that adapts itself to your specific situation, thus helping you avoid mistakes that could potentially delay or cancel your request.If you do not receive benefits, you can:New! Request a replacement Social Security card if you meet certain requirements;New! Check the status of your application or appeal.Get your Social Security Statement, to review:Estimates of your future retirement, disability, and survivors benefits;Your earnings once a year to verify the amounts that we posted are correct; andThe estimated Social Security and Medicare taxes you’ve paid.Get a benefit verification letter stating that:You never received Social Security benefits, Supplemental Security Income (SSI) or Medicare; orYou received benefits in the past, but do not currently receive them. (The letter will include the date your benefits stopped and how much you received that year.); orYou applied for benefits but haven’t received an answer yet.If you receive benefits or have Medicare, you can:New! Request a replacement Social Security card if you meet certain requirements;New! Report your wages if you work and receive Disability Insurance benefits;Get your benefit verification letter;Check your benefit and payment information and your earnings record;Change your address and phone number;Start or change direct deposit of your benefit payment;Get a replacement Medicare card; andGet a replacement SSA-1099 or SSA-1042S for tax season.At Social Security, protecting your personal information is more important than ever. We continue to evaluate and improve our robust cyber-security program to safeguard your information. The thing is, we can’t do it alone. You can help us secure your information by taking one of these steps:Open your personal my Social Security account. A my Social Security account is your gateway to many of our online services. Create your account today and take away the risk of someone else trying to create one in your name, even if they obtain your Social Security number.If you already have a my Social Security account, but haven’t signed in lately, take a moment to login to easily take advantage of our second method to identify you each time you log in. This is in addition to our first layer of security, a username and password. You can choose either your cell phone number or your email address as your second identification method. Using two ways to identify you when you sign on will help protect your account from unauthorized use and potential identity theft. If you suspect identity theft, report it to our Office of the Inspector General and visit Identity Theft Recovery Steps.If you know your Social Security information has been compromised, and if you don’t want to do business with Social Security online, you can use our Block Electronic Access You can block any automated telephone and electronic access to your Social Security record. No one, including you, will be able to see or change your personal information on the internet or through our automated telephone service. If you block access to your record and then change your mind in the future, you can contact Social Security and ask us to unblock it after you prove your identity. This resource is available to certain victims of identity theft and those who need extra security.We will continue to do our part to protect what’s important to you. And we’ll continue to advise you on how to protect yourself.How could you possibly "forget" your Social Security number?You'd have numerous tax documents with it on it, an employment application and an I-9 immigration form; and you would have had to file either background checks for renting or for work. You also need your SSN to open a bank account in the United States.Sorry...but short of an elderly person experiencing Alzheimer's or dementia the odds of not knowing your Social Security number or where to find it in your own residence or at work are so improbable that this question is almost certainly an attempt at social engineering.Started in 1935, Social Security is a federal program that provides economic help to the section of the public which needs it. People who can benefit from the Social Security program of the government are retired people, poor, disabled and others. During the great depression of the 1930s, the US Government signed the Social Security Act in an effort to provide a safety net for people going through financial crises. Though the great depression has ended a long time ago, the authorities have decided to keep the program running so as to provide the required financial support to people needing it.How Does It Work?In the US, employees as well as employers are required to pay Social Security taxes, and the funds raised through levying these taxes on the general public are provided as benefits to those in need. This way, workers of today pay the money that they will receive as benefits when they retire and so on. The Social Security benefits you receive are based on the amount of Social Security taxes you paid that are somewhat based on your income.What Are Social Security Benefits?The benefits offered by the Social Security Administration can be received in a number of ways, such as retirement benefits that you start receiving after you have signNowed the age of 62. In 2011, approximately 39 million people in the US received average monthly benefits of USD 1229 as retirement benefits. The US Social Security Administration also offers Disability benefits for people who have been disabled for at least five full months and their condition has rendered them unable to work. Furthermore, there is also a program for survivors which provides benefits for the widows and children of Social Security beneficiaries.Apart from these, there are also supplemental benefits that are available for people 65 years of age or older who have very limited financial resources and are disabled. Then there is also medicare which covered about 49 million people in 2011, making more than 550 billion US dollars in benefit payments.Well, now that you know what exactly Social Security is, what it entails and how it works, it is time for you to tell us what you think. Do you believe that the Social Security scheme of the US government is adequate or does it need further changes to be made for effective? Tell us through your comments below. We would love to hear from you.If you do not know your SSN (Social Security Number) and have lost your original card, you will need to visit your local Social Security Administration office - in person. To discuss your Social Security number or to obtain a replacement card, you will need certain documents as proof of U.S. citizenship. These include a U.S. birth certificate or a U.S. passport.An acceptable document must be current (not expired) and show your name, identifying information (date of birth or age) and preferably a recent photograph. For example, as proof of identity, Social Security must see your:U.S. driver's license;State-issued non-driver identification card; orU.S. passport.If you do not have one of these specific documents or you cannot get a replacement for one of them within 10 days, SSA will ask to see other documents, including:Employee identification card;School identification card;Health insurance card (not a Medicare card); orU.S. military identification card.If you come across a site that is displaying anyone’s Social Security number or Medical Records, you need to report them for internet crime because they hacked private information or bought data that was hacked and sold to sites like which exist primarily to perpetrate or promote fraud and identity theft. If you are hunting for Social Security numbers instead of just using your own, you can also be held responsible for attempted fraud or identity theft if you try to use it. There really is no honor among thieves, so don’t set yourself up for that to come haunt you. The political issues that are all over the news for the last 12 months and even beyond is all about illegal hacking and look at the widespread ill effects that is having.There are reputable sites for looking up someone’s background for your own protection or for employment purposes that do not advertise they can give you Social Security numbers, they do not have them. You cannot get your own Social Security number online, even on the SSA website signed into your account, as it is private and blocked save for the last four. It is protected information and not even listed on the web. Of course with Equifax’s last irresponsible hoopla, over 143 million people are up a creek without a paddle and totally screwed for life because you can’t just up and change your identity whenever you want like you change your passwords or screen names.When you go in person to your local office they may be able to assist you to find your number that day, if you have at least two forms of accepted ID, meaning originalorcertified by issuer documentation, your father’s social security number, or other forms of ID. signNowd documents are NOT accepted in any case. You must be able prove your identity beyond any doubt to get that number. If you try to apply for a second Social Security number they will also assume fraud and you’ll have a headache. If you are attempting to get your Social Security card replaced by mail you will have to fill out the correct forms from SSA and send your original or certified by issuer. They will not take copies or signNowd forms. Your identification documents will be returned to you once they have reviewed them.You also will have an extremely hard time changing your Social Security number once issued. The number you are issued belongs to you for eternity, even after you die, that number stays attached to you—they do not re-use a number. It will just about take a legal order and proof for the reason you want to change it. All of your work history is attached to your number and changing it is not allowed only for reasons like witness protection or in certain cases of domestic violence. There are only one or two reasons they will issue a new number and losing your card is not one of them. Head into your local SSA office with acceptable forms of identification and apply for a replacement card—pretty simple and above board.Any old joe without a legitimate business and an Employer Identification Number (EIN) issued by the Internal Revenue Service (IRS) cannot just go to Social Security and get your number without being registered as a legitimate business entity. You cannot type a persons name into a search box and access someone’s records that are not your own. You will have to show proof of your business along with submitting all requested documentation. You will need your own Social Security number just to complete this registration too as well as a stack of paperwork.Sites that advertise that they have everyone’s social security number are scams and will gladly take your money and not give you an SSN. Read their terms of use, they are not responsible for any information you get from their site. They need to be reported for internet fraud. Things like just type in a name and a state and you’ll have access to medical records, work history and earnings statements are simply not speaking the truth. If you hear that or someone tells you that, I’d run fast away from the fraud ans prison.Is this Service Completely Legal?Using our service is legal as soon as you have a valid purpose. You must have a valid purpose like debt recovery, child support, 1099 filling, etc. We may contact you and request supporting documents after you complete the order.How Does it Work?Complete your order in 3 easy steps.Step 1: Enter Subject and Your Information. Step 2: Review and Continue. Step 3: Finalize Your Order.You will receive the Report in 5 business days via e-mail.If we can not find your subject’s social security number, we will refund your money back.What is included in Find Social Security Number Service Report?Subject’s Full Social Security Number, SSN Issue Date, SSN Issue State, Other People used that SSN and More.Digi: You cannot find your SSN online.Other writers have provided you all the information to recover your SSN.Tip: When planning to go into your local SS office, avoid the 1st of the month. Supplementary Security Income (SSI) checks come out on the 1st. Local SS offices are often jammed w/desperate SSI recipients who did not receive their SSI checks.Also, arrive early in the day and bring tablet, smart phone, good book or other personal entertainment. Social Security offices are busy places at the best of times. The staff, however, really try to be helpful. Your business will be simple and they’ll be grateful for that. You won’t be dealing with a faceless bureaucrat.If you come across a site that is displaying anyone’s Social Security number or Medical Records, you need to report them for internet crime because they hacked private information or bought data that was hacked and sold to sites like which exist primarily to perpetrate or promote fraud and identity theft. If you are hunting for Social Security numbers instead of just using your own, you can also be held responsible for attempted fraud or identity theft if you try to use it. There really is no honor among thieves, so don’t set yourself up for that to come haunt you. The political issues that are all over the news for the last 12 months and even beyond is all about illegal hacking and look at the widespread ill effects that is having.There are reputable sites for looking up someone’s background for your own protection or for employment purposes that do not advertise they can give you Social Security numbers, they do not have them. You cannot get your own Social Security number online, even on the SSA website signed into your account, as it is private and blocked save for the last four. It is protected information and not even listed on the web. Of course with Equifax’s last irresponsible hoopla, over 143 million people are up a creek without a paddle and totally screwed for life because you can’t just up and change your identity whenever you want like you change your passwords or screen names.When you go in person to your local office they may be able to assist you to find your number that day, if you have at least two forms of accepted ID, meaning originalorcertified by issuer documentation, your father’s social security number, or other forms of ID. signNowd documents are NOT accepted in any case. You must be able prove your identity beyond any doubt to get that number. If you try to apply for a second Social Security number they will also assume fraud and you’ll have a headache. If you are attempting to get your Social Security card replaced by mail you will have to fill out the correct forms from SSA and send your original or certified by issuer. They will not take copies or signNowd forms. Your identification documents will be returned to you once they have reviewed them.You also will have an extremely hard time changing your Social Security number once issued. The number you are issued belongs to you for eternity, even after you die, that number stays attached to you—they do not re-use a number. It will just about take a legal order and proof for the reason you want to change it. All of your work history is attached to your number and changing it is not allowed only for reasons like witness protection or in certain cases of domestic violence. There are only one or two reasons they will issue a new number and losing your card is not one of them. Head into your local SSA office with acceptable forms of identification and apply for a replacement card—pretty simple and above board.Any old joe without a legitimate business and an Employer Identification Number (EIN) issued by the Internal Revenue Service (IRS) cannot just go to Social Security and get your number without being registered as a legitimate business entity. You cannot type a persons name into a search box and access someone’s records that are not your own. You will have to show proof of your business along with submitting all requested documentation. You will need your own Social Security number just to complete this registration too as well as a stack of paperwork.Sites that advertise that they have everyone’s social security number are scams and will gladly take your money and not give you an SSN. Read their terms of use, they are not responsible for any information you get from their site. They need to be reported for internet fraud. Things like just type in a name and a state and you’ll have access to medical records, work history and earnings statements are simply not speaking the truth. If you hear that or someone tells you that, I’d run fast away from the fraud ans prison.FAQ1 Why is there a charge for the service? The SSA provides free forms.E-forms is a paid service that makes the process of filling out and filing government forms simpler and more convenient.Our service eliminates the process of reading through endless, hard to find complicated instructions, and eliminates the necessity of standing in line at the Social Security office.By using e-forms you avoid common mistakes that could potentially delay or even cancel your application.Think of it as filing your tax return. While you may download IRS forms and fill them out yourself, most Americans rather have the help of an accountant or prefer to use a software application in order to make sure all information is submitted correctly, thus avoiding costly mistakes.2 Application InformationWhere is my new social security card?To receive a new social security card, you must mail your Social Security application package along with the required supporting documents.Your e-package includes the filled-out, ready to be mailed SS5 form, list of acceptable documents for each situation, detailed instructions and a prepaid mailing label addressed from you to your correct local Social Security Office.After mailing your package you will receive your new Social Security card and supporting documents at your mailing address within 10 to 14 business days.Please note that you will first receive the new card, then the supporting documents.Why do I have to mail documents with the SS5 form?The SSA needs to attest that you are in fact the person you say you are. In order to avoid fraud and identity theft, you must submit original documents. This is for your own protection.3 Application ProcessDo I have to fill out Race information?Race is an option, not a required information, and we can not maintain it in our database. You may check the box if you wish so.Can I request a new SS number for someone other than a child?According to SSA regulations, only children under 12 years of age may request a new number by mail. Anyone older than 12 requesting a first SS number must apply in person.4 Application StatusHow long until I receive receive my card?You will receive your new social security card along with the supporting documents at the mailing address listed on your application. It may take up to 10-14 business days for your new card to be delivered. Actual delivery time dependes on you local Social Security office.Please note that you will first receive your new social security card and then you will receive your supporting documents a few days after.5 BillingThe price for the e-package is $38Your order will be treated with priority and your e-package will be ready immediately.Can I get a refund after I sent my order?If your order has been processed and you are not satisfied with the service, you may request a refund:If you request a refund within 3 days of placing you order, your purchase will be refunded, as long as you have not used the pre paid label or received filing instructions by phone or e-mail.No refunds will be granted after 3 days of the purchase date.Refunds are given in the same manner in which user completed the order. Additionally, if the payment method that was used to pay for the transaction is no longer valid, canceled or stops working for any reason, Site will not be responsible if you can not receive reimbursement for reasons of closure, cancellation or any reason to limit the operation of payment method.Please consult our Terms and Conditions for more detailed information about cancellations and refunds.How long does it take for a refund to be posted?A refund posts back into your account within 3-4 business days after the refund is issued.If you have received confirmation of your refund from e-forms and the refund has not appeared on your statement after 3-4 business days, please contact your bank for more information.6 Required DocumentsIn order to prevent fraud and to protect you against Identity Theft, the SSA requires that you send original documents in order to prove that you are who you claim to be. The SSA will only accept original documents or copies certified by the issuing agency.How I can get certified copies?You can request a copy of your Driver’s License online at your local DMV.What types of documents are accepted?Acceptable DocumentsIf you are a US Born Citizen, and have been issued a previous card as an American citizen, you only need to show proof of identity.To prove your identity you need to send a Driver’s License, a State issued non driver’s ID, or a US Passport.If you were not born in the US or are not a US Citizen, you must provide proof of both identity and citizenship.Please check e-forms-us/docs for a complete list of acceptable documents.7 Our servicesWho is E-forms?E-forms is an online application preparation service. We simplify the SS5 application process through an intuitive questionnaire. Based on your answers, we generate a pre-filled SS5 form, ready to print, sign and mail.In addition, we also provide you with the exact address of where to mail your package (it varies by home address).Also, we provide detailed instructions and a complete list of acceptable documents for each different situation.This online process allows you to avoid going to your local SSA office and waiting in line – even if you visit the local office to apply in person, you won’t be issued a card right away. All SS cards are sent by US mail.Steps to the application process:Step 1: Answer the customized questionsStep 2: Sign your filled out SS5 form.Step 3: Attach your supporting documents and mail your packet to the Social Security Administration using the pre paid USPS label.Step 4: Receive your card in the mail in 10-14 business days8 PrivacyWhat happens to my personal information?E-forms uses the most advanced 256 bit encryption technology to protect your information.After you complete the process and the package is sent to you, your Social Security number is deleted from our files. Only the last four digits are stored for identification purposes.We do not store credit card numbers or any of your financial information.

Related searches to irs gov draftforms

Create this form in 5 minutes!

How to create an eSignature for the irs gov draftforms

How to make an electronic signature for your You May Make Comments Anonymously Or You May Include Your Name And E Mail Address Or Phone Number Irs online

How to create an electronic signature for the You May Make Comments Anonymously Or You May Include Your Name And E Mail Address Or Phone Number Irs in Chrome

How to create an electronic signature for putting it on the You May Make Comments Anonymously Or You May Include Your Name And E Mail Address Or Phone Number Irs in Gmail

How to create an electronic signature for the You May Make Comments Anonymously Or You May Include Your Name And E Mail Address Or Phone Number Irs right from your smartphone

How to create an electronic signature for the You May Make Comments Anonymously Or You May Include Your Name And E Mail Address Or Phone Number Irs on iOS

How to create an eSignature for the You May Make Comments Anonymously Or You May Include Your Name And E Mail Address Or Phone Number Irs on Android OS

People also ask irs gov draftforms

-

What are IRS gov draftforms and how can airSlate SignNow help?

IRS gov draftforms are pre-formatted documents provided by the IRS for various purposes. airSlate SignNow streamlines the process by allowing you to easily fill, sign, and send these forms electronically, ensuring compliance and efficiency.

-

Are there any costs associated with using airSlate SignNow for IRS gov draftforms?

airSlate SignNow offers a range of pricing plans to suit different business needs. Whether you require basic features or advanced integrations, you'll find a cost-effective solution to manage your IRS gov draftforms efficiently.

-

What key features does airSlate SignNow offer for managing IRS gov draftforms?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure document storage. These functionalities facilitate the easy management of IRS gov draftforms, enhancing business productivity.

-

Can I integrate airSlate SignNow with other tools when working on IRS gov draftforms?

Yes, airSlate SignNow supports integration with a variety of platforms and applications. This allows you to automate workflows related to IRS gov draftforms and connect with your existing tools seamlessly.

-

How does airSlate SignNow ensure the security of IRS gov draftforms?

Security is a top priority for airSlate SignNow. We implement advanced encryption and compliance measures to protect your IRS gov draftforms, ensuring your sensitive data remains confidential and secure.

-

Is airSlate SignNow user-friendly for those unfamiliar with IRS gov draftforms?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for users at all levels to navigate. Regardless of your familiarity with IRS gov draftforms, you’ll find our platform simple to use.

-

What benefits does airSlate SignNow provide for businesses handling IRS gov draftforms?

Using airSlate SignNow enhances operational efficiency by reducing the time needed to prepare, sign, and submit IRS gov draftforms. This solution also minimizes errors and streamlines communication between parties.

Get more for irs gov draftforms

- Infolab stanford form

- Subject self declaration notice texas health steps health care form

- British ice skating test application form

- Simi institute for careers and education reviews form

- Hdb ach form

- Ldi integrated pharmacy prior authorization form staywell guam inc

- Installation registration department of safety amp professional dsps wi form

- Kauo heng kh 323d form

Find out other irs gov draftforms

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online