Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

What is the Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

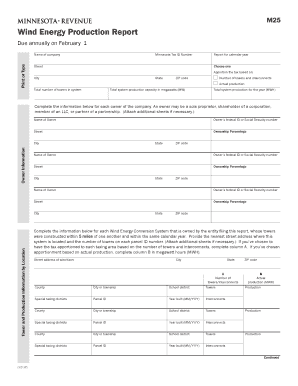

The Form M25, Wind Energy Production Report, is a crucial document required by the Minnesota Department of Revenue for entities involved in wind energy production. This form serves to report the amount of energy produced, ensuring compliance with state regulations. The data collected through the M25 is vital for assessing the impact of wind energy on the state’s energy portfolio and for determining tax liabilities associated with energy production.

Steps to complete the Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

Completing the Form M25 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the wind energy production for the reporting period. This includes the total kilowatt-hours generated and any relevant operational details. Next, accurately fill out each section of the form, ensuring that all figures are correct and supported by documentation. After completing the form, review it thoroughly for any errors before submission. Finally, submit the form by the designated deadline to avoid penalties.

How to obtain the Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

The Form M25 can be obtained directly from the Minnesota Department of Revenue's official website. It is typically available as a downloadable PDF file, which can be printed for completion. Additionally, some local government offices may provide physical copies of the form. Ensure you have the most current version of the form to avoid any issues during submission.

Legal use of the Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

The legal use of the Form M25 is governed by state regulations regarding wind energy production. It is essential that the information provided is accurate and truthful, as any discrepancies could lead to legal repercussions. The form must be signed and dated by an authorized representative of the entity submitting it, ensuring that it meets the legal standards for documentation in Minnesota.

Key elements of the Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

Key elements of the Form M25 include sections for reporting the total energy produced, the operational status of the wind farm, and any applicable tax credits or exemptions. Additionally, the form requires identification information for the entity submitting it, including the business name, address, and contact details. Accurate reporting of these elements is critical for compliance and for the calculation of any taxes owed based on energy production.

Filing Deadlines / Important Dates

Filing deadlines for the Form M25 are typically set annually, with specific dates established by the Minnesota Department of Revenue. It is important for entities to be aware of these deadlines to ensure timely submission and avoid penalties. Generally, the form must be filed by a date specified in the annual reporting guidelines, which can vary based on legislative changes or updates from the Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Form M25 can be submitted through various methods, including online submission via the Minnesota Department of Revenue's e-filing system, mailing a completed paper form, or delivering it in person to a designated office. Each submission method has its own requirements and processing times, so it is advisable to choose the method that best fits the entity's operational needs and compliance strategy.

Quick guide on how to complete form m25 wind energy production report minnesota department revenue state mn

Complete Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn effortlessly on any device

Digital document management has gained traction with companies and individuals. It offers an ideal eco-conscious substitute to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn on any device with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn with ease

- Obtain Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redacted sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to preserve your adjustments.

- Select your method of delivering your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m25 wind energy production report minnesota department revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn?

Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn, is a document required by the state to report the wind energy production of facilities. It helps in assessing the contribution of wind energy resources to the state's energy goals. Accurate completion ensures compliance with state regulations and promotes sustainable energy practices.

-

How can airSlate SignNow assist in completing Form M25?

airSlate SignNow offers a user-friendly platform for businesses to easily fill out and eSign Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn. With templates and customizable workflows, preparing this report becomes quick and efficient. The platform helps ensure accuracy, which is essential for regulatory compliance.

-

Are there costs associated with using airSlate SignNow for Form M25?

Yes, there are various pricing plans available for using airSlate SignNow, allowing businesses to choose a plan that fits their budget and needs. Each plan includes features that streamline the preparation and submission of documents such as Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn. You can easily compare the plans to determine the best option for your organization.

-

What features does airSlate SignNow provide for Form M25 submissions?

airSlate SignNow includes features like document templates, bulk send options, and real-time collaboration, which can simplify the submission of Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn. It also offers tracking capabilities, allowing users to monitor the status of their submissions. These features enhance efficiency and ensure timely filing.

-

Is airSlate SignNow compliant with state regulations for Form M25?

Yes, airSlate SignNow is designed to meet compliance requirements for documents like Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn. The platform incorporates security measures and legally binding eSignature options, ensuring that your submissions comply with state and federal regulations. This provides peace of mind for businesses focusing on compliance.

-

Can airSlate SignNow integrate with other software for filing Form M25?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions that businesses might already be using. This means you can connect tools for accounting, project management, or CRM systems to streamline the filing of Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn, enhancing your overall operational workflow.

-

What are the benefits of using airSlate SignNow for Form M25?

Using airSlate SignNow for Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn, brings numerous benefits, including time savings, improved accuracy, and ease of use. The platform not only simplifies the documentation process but also ensures you remain compliant with state requirements. By opting for eSigning, you also contribute to a more eco-friendly business approach.

Get more for Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

- Royal mail redirection form

- Laptop checklist template form

- Fill in the blanks with suitable tenses with answers pdf form

- Finite and non finite verbs worksheets for grade 7 with answers pdf form

- Demande de mutation minesec en ligne form

- Career interest inventory pictorial version form

- Hillingdon maternity self referral form

- Cctv installation contract agreement sample form

Find out other Form M25, Wind Energy Production Report Minnesota Department Revenue State Mn

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter