PA 41 Payment Voucher PA 41 PA V Form

What is the PA 41 Payment Voucher PA 41 PA V

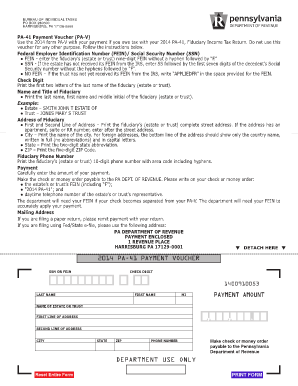

The PA 41 Payment Voucher, also known as PA 41 or PA V, is a form used in Pennsylvania for reporting and paying certain taxes. This voucher is specifically designed for partnerships that need to remit their tax liabilities to the state. It serves as a notification to the Pennsylvania Department of Revenue regarding the payment being made and includes essential details about the partnership and the tax amount due.

How to use the PA 41 Payment Voucher PA 41 PA V

To effectively use the PA 41 Payment Voucher, a partnership must first complete the form accurately. This involves entering the partnership's name, address, and identification number. Additionally, the tax amount being paid must be clearly indicated. Once completed, the voucher can be submitted along with the payment to ensure that the tax is credited appropriately. It is important to retain a copy of the voucher for your records.

Steps to complete the PA 41 Payment Voucher PA 41 PA V

Completing the PA 41 Payment Voucher involves several key steps:

- Gather necessary information about the partnership, including name, address, and identification number.

- Determine the tax amount due for the reporting period.

- Fill out the voucher form, ensuring all information is accurate and legible.

- Review the completed form for any errors or omissions.

- Submit the voucher along with the payment to the appropriate Pennsylvania Department of Revenue address.

Legal use of the PA 41 Payment Voucher PA 41 PA V

The PA 41 Payment Voucher is legally recognized as a valid method for partnerships to report and pay their tax liabilities in Pennsylvania. To ensure its legal standing, the form must be completed in accordance with state regulations, and payments must be made by the due date specified by the Pennsylvania Department of Revenue. Proper use of this voucher helps avoid penalties and ensures compliance with state tax laws.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines associated with the PA 41 Payment Voucher. Generally, payments are due on the 15th day of the fourth month following the end of the partnership's tax year. It is crucial to stay informed about these deadlines to avoid late fees and maintain compliance with state regulations.

Who Issues the Form

The PA 41 Payment Voucher is issued by the Pennsylvania Department of Revenue. This state agency is responsible for administering tax laws and ensuring that partnerships fulfill their tax obligations. The department provides the necessary forms and guidelines for partnerships to comply with state tax requirements.

Quick guide on how to complete pa 41 payment voucher pa 41 pa v

Complete PA 41 Payment Voucher PA 41 PA V effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage PA 41 Payment Voucher PA 41 PA V on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign PA 41 Payment Voucher PA 41 PA V effortlessly

- Obtain PA 41 Payment Voucher PA 41 PA V and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Select pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to record your changes.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign PA 41 Payment Voucher PA 41 PA V to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 41 payment voucher pa 41 pa v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 41 Payment Voucher PA 41 PA V?

The PA 41 Payment Voucher PA 41 PA V is a tax form used by businesses in Pennsylvania to report and remit payment for certain state tax obligations. This form simplifies the payment process and ensures compliance with state regulations. Understanding the PA 41 Payment Voucher PA 41 PA V is crucial for accurate financial reporting.

-

How can airSlate SignNow assist with filing the PA 41 Payment Voucher PA 41 PA V?

airSlate SignNow provides an easy-to-use platform that allows you to digitally fill out and eSign the PA 41 Payment Voucher PA 41 PA V. This streamlines the filing process, ensuring that your submissions are timely and error-free. Utilizing airSlate SignNow can signNowly improve your efficiency when handling the PA 41 Payment Voucher PA 41 PA V.

-

What are the costs associated with using airSlate SignNow for the PA 41 Payment Voucher PA 41 PA V?

airSlate SignNow offers various pricing plans to fit different business needs, making it a cost-effective solution for managing documents like the PA 41 Payment Voucher PA 41 PA V. By choosing a suitable plan, you can take advantage of features that enhance your document management process without breaking your budget.

-

What features does airSlate SignNow include for PA 41 Payment Voucher PA 41 PA V users?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure eSigning for handling the PA 41 Payment Voucher PA 41 PA V. These features not only simplify the process but also ensure that you maintain compliance and security. Leveraging these tools can enhance your overall experience with the PA 41 Payment Voucher PA 41 PA V.

-

Is there a mobile app available for managing the PA 41 Payment Voucher PA 41 PA V?

Yes, airSlate SignNow offers a mobile app that allows you to manage your documents, including the PA 41 Payment Voucher PA 41 PA V, from anywhere. This flexibility ensures that you can complete and eSign your tax forms on the go, enhancing productivity. Stay connected and in control with the airSlate SignNow mobile app.

-

Can I integrate airSlate SignNow with other software for the PA 41 Payment Voucher PA 41 PA V?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to connect your workflows for the PA 41 Payment Voucher PA 41 PA V. This integration capability simplifies the overall process, enabling you to enhance efficiency and maintain organized records across different platforms.

-

What are the benefits of using airSlate SignNow for the PA 41 Payment Voucher PA 41 PA V?

Using airSlate SignNow for the PA 41 Payment Voucher PA 41 PA V offers numerous benefits, including quicker turnaround times, reduced paperwork, and enhanced security. The platform automates much of the process, allowing you to focus on more critical business tasks. Moreover, error reduction and easy tracking of submissions make airSlate SignNow an ideal choice.

Get more for PA 41 Payment Voucher PA 41 PA V

Find out other PA 41 Payment Voucher PA 41 PA V

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile

- How To Electronic signature Kansas lease agreement

- Electronic signature Michigan Landlord tenant lease agreement Now

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement