The Income Tax Act, 1962 Form No 10ba Legal Pundits

What is the Income Tax Act, 1962 Form No 10BA Legal Pundits

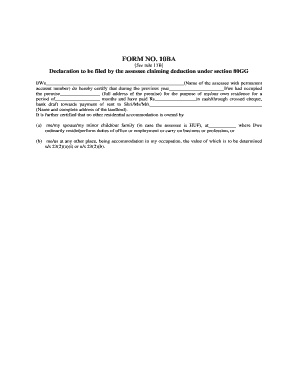

The Income Tax Act, 1962 Form No 10BA is a specific document used in the context of income tax compliance in India. This form is primarily utilized by taxpayers to claim deductions related to specified investments and expenditures. It is essential for individuals and entities seeking to optimize their tax obligations while adhering to legal frameworks. The form requires detailed information about the taxpayer, the nature of the investments, and the deductions being claimed, ensuring transparency and compliance with tax regulations.

How to use the Income Tax Act, 1962 Form No 10BA Legal Pundits

Using the Income Tax Act, 1962 Form No 10BA involves several steps to ensure accurate completion and submission. Taxpayers must gather all relevant financial documents and details regarding their investments. Once the necessary information is compiled, the form can be filled out, ensuring that all sections are completed accurately. After filling out the form, it should be reviewed for any errors before submission. Utilizing a digital solution like signNow can streamline the process, allowing users to fill out, sign, and submit the form securely online.

Steps to complete the Income Tax Act, 1962 Form No 10BA Legal Pundits

Completing the Income Tax Act, 1962 Form No 10BA involves a systematic approach:

- Gather all required financial documents, including proof of investments and expenditures.

- Access the form through a reliable source, ensuring it is the most current version.

- Fill in personal details such as name, address, and PAN (Permanent Account Number).

- Provide information regarding the investments and deductions being claimed.

- Review the completed form for accuracy and completeness.

- Sign the form electronically using a secure eSignature solution.

- Submit the form as per the guidelines provided by the tax authorities.

Legal use of the Income Tax Act, 1962 Form No 10BA Legal Pundits

The legal use of the Income Tax Act, 1962 Form No 10BA is crucial for ensuring compliance with tax laws. This form must be filled out accurately to avoid penalties or legal issues. When submitted correctly, it serves as a legitimate document for claiming tax deductions. Utilizing an eSignature solution like signNow enhances the legal validity of the form by providing a secure and traceable signing process, ensuring that all legal requirements are met.

Key elements of the Income Tax Act, 1962 Form No 10BA Legal Pundits

Key elements of the Income Tax Act, 1962 Form No 10BA include:

- Taxpayer identification details, including name and PAN.

- Details of investments eligible for deductions.

- Amount of deductions claimed.

- Declaration of authenticity and accuracy of the information provided.

- Signature of the taxpayer or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Act, 1962 Form No 10BA are critical for compliance. Taxpayers should be aware of the annual deadlines set by the tax authorities to ensure timely submission. Missing these deadlines can lead to penalties or loss of deductions. It is advisable to mark these dates on a calendar and prepare the form well in advance to avoid last-minute issues.

Quick guide on how to complete the income tax act 1962 form no 10ba legal pundits

Easily Prepare The Income Tax Act, 1962 Form No 10ba Legal Pundits on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without hassles. Manage The Income Tax Act, 1962 Form No 10ba Legal Pundits on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The simplest method to edit and electronically sign The Income Tax Act, 1962 Form No 10ba Legal Pundits effortlessly

- Locate The Income Tax Act, 1962 Form No 10ba Legal Pundits and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Select how you wish to send your form—via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign The Income Tax Act, 1962 Form No 10ba Legal Pundits to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the income tax act 1962 form no 10ba legal pundits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Income Tax Act, 1962 Form No 10ba Legal Pundits and why is it important?

The Income Tax Act, 1962 Form No 10ba Legal Pundits is a crucial document for individuals and businesses claiming certain tax benefits. This form serves to provide specific details to the tax authorities, ensuring compliance and eligibility for deductions. Understanding this form is essential for maximizing tax advantages under the Act.

-

How can airSlate SignNow assist with The Income Tax Act, 1962 Form No 10ba Legal Pundits?

airSlate SignNow simplifies the process of handling The Income Tax Act, 1962 Form No 10ba Legal Pundits by allowing you to send and sign documents electronically. Our platform ensures that all necessary documents are securely signed and stored, making it easier to manage your tax submissions efficiently. Our user-friendly interface is designed for everyone, regardless of tech skills.

-

What are the main features of airSlate SignNow for managing tax forms?

AirSlate SignNow offers features tailored to efficiently manage tax forms, including electronic signatures, document templates, and real-time tracking of document status. These features help you streamline your submission process for The Income Tax Act, 1962 Form No 10ba Legal Pundits, ensuring everything is completed accurately and promptly. Plus, with cloud storage, your documents are always accessible.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax forms?

Yes, airSlate SignNow offers a cost-effective solution for small businesses managing The Income Tax Act, 1962 Form No 10ba Legal Pundits. Our pricing plans are designed to be budget-friendly, allowing businesses to save time and money while ensuring compliance with tax regulations. By utilizing our platform, small businesses can reduce the costs associated with paper forms and manual processing.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely, airSlate SignNow supports integrations with various accounting and tax management software to enhance your workflow. This means you can easily incorporate The Income Tax Act, 1962 Form No 10ba Legal Pundits into your existing systems, ensuring seamless document management. Streamlined integrations help reduce errors and save valuable time when filing your taxes.

-

What benefits does using airSlate SignNow provide when filing tax forms?

Using airSlate SignNow offers numerous benefits when filing tax forms, especially The Income Tax Act, 1962 Form No 10ba Legal Pundits. The platform ensures rapid turnaround times for document signatures, enhances compliance with legal standards, and provides a secure environment for sensitive information. These advantages signNowly streamline the tax filing process.

-

How does airSlate SignNow ensure the security of tax documents?

AirSlate SignNow prioritizes the security of your tax documents, including The Income Tax Act, 1962 Form No 10ba Legal Pundits, by implementing top-notch encryption standards. Our platform ensures that all signed documents are stored securely and only accessible by authorized users. You can have confidence that your sensitive tax information remains confidential and protected.

Get more for The Income Tax Act, 1962 Form No 10ba Legal Pundits

- 921 michigan department of licensing and regulatory form

- Wwwsignnowcomfill and sign pdf form99743form csclcd 800 ampampampquotapplication to register a limited

- Csclcd 762 rev 0921 michigan department of licensing form

- Wwwpdffillercom538517124 note in order tofillable online note in order to fill and save this form

- Get the free instructions to form scc544 articles of

- How to fill out form g 1450

- Us passports travelgov form

- Wwwharrishealthorgsitecollectiondocumentseligibilityhow to get your harris health financial assistance form

Find out other The Income Tax Act, 1962 Form No 10ba Legal Pundits

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile