Charles Schwab Forms

What are Charles Schwab Forms?

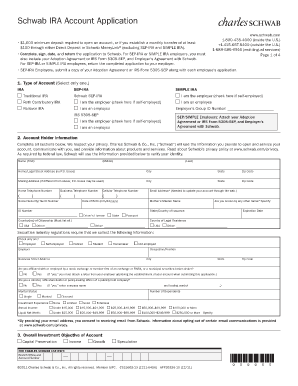

Charles Schwab forms are essential documents used for various financial transactions and account management with Charles Schwab, a leading investment and brokerage firm in the United States. These forms encompass a range of applications, including account openings, tax documentation, and investment requests. They are designed to facilitate smooth communication between clients and the firm, ensuring compliance with financial regulations.

Steps to Complete the Charles Schwab Forms

Completing Charles Schwab forms requires careful attention to detail to ensure accuracy and compliance. Here are the general steps to follow:

- Gather necessary information, such as personal identification, financial details, and account numbers.

- Access the specific form you need from the Charles Schwab forms library.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on the instructions provided.

How to Obtain the Charles Schwab Forms

Charles Schwab forms can be easily obtained through the official Charles Schwab website. Clients can navigate to the forms library, where they will find a comprehensive list of available forms. Additionally, forms can often be requested directly from customer service representatives if assistance is needed.

Legal Use of the Charles Schwab Forms

The legal use of Charles Schwab forms is governed by various regulations, including the Electronic Signatures in Global and National Commerce (ESIGN) Act. When completed and submitted correctly, these forms are considered legally binding. It is crucial to ensure that all signatures are authentic and that the forms comply with relevant legal standards to avoid any potential disputes.

Key Elements of the Charles Schwab Forms

Each Charles Schwab form contains several key elements that are vital for its validity:

- Personal Information: This includes the client's name, address, and Social Security number.

- Account Details: Specific information regarding the type of account being opened or managed.

- Signature Section: A designated area for the client to sign, confirming the accuracy of the information provided.

- Date: The date on which the form is completed, which is essential for compliance and record-keeping.

Form Submission Methods

Charles Schwab forms can be submitted through various methods, depending on the client's preference and the specific form requirements:

- Online Submission: Many forms can be completed and submitted electronically through the Charles Schwab website.

- Mail: Clients may choose to print the completed forms and send them via postal mail to the designated address.

- In-Person: Some forms may be submitted in person at a local Charles Schwab branch, allowing for immediate processing.

Quick guide on how to complete charles schwab forms

Prepare Charles Schwab Forms effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your files swiftly without delays. Manage Charles Schwab Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Charles Schwab Forms with ease

- Find Charles Schwab Forms and then click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal power as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Modify and eSign Charles Schwab Forms and ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charles schwab forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Charles Schwab forms and how can airSlate SignNow help?

Charles Schwab forms are essential documents required by clients to manage their investment accounts and services. With airSlate SignNow, you can easily eSign and send these Charles Schwab forms electronically, ensuring a faster and more efficient process that eliminates the need for paper.

-

Are there any costs associated with using airSlate SignNow for Charles Schwab forms?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet the needs of different users. Depending on the plan you choose, you can benefit from unlimited eSigning and easy management of Charles Schwab forms without any hidden fees, making it a cost-effective solution.

-

What features does airSlate SignNow provide for managing Charles Schwab forms?

airSlate SignNow provides a comprehensive set of features for managing Charles Schwab forms, including intuitive drag-and-drop fields, automated workflows, and secure cloud storage. You can also track document status in real-time, ensuring all forms are signed and filed promptly.

-

How does airSlate SignNow ensure the security of Charles Schwab forms?

Security is a top priority for airSlate SignNow when handling Charles Schwab forms. The platform utilizes advanced encryption and secure data storage practices to protect your sensitive information, ensuring that all your financial documents are kept safe and compliant.

-

Can I integrate airSlate SignNow with other services while using Charles Schwab forms?

Absolutely! airSlate SignNow offers seamless integrations with various platforms and applications, allowing you to connect your workflow effectively. This means you can easily manage Charles Schwab forms alongside your existing tools, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for Charles Schwab forms?

Using airSlate SignNow for Charles Schwab forms streamlines your document management process, reducing time spent on paperwork and eliminating delays. The benefits include quick turnaround times, enhanced accuracy, and the ability to access and manage your forms from anywhere.

-

Is airSlate SignNow suitable for both individuals and businesses for handling Charles Schwab forms?

Yes, airSlate SignNow is designed to cater to both individual users and businesses. Whether you’re dealing with a few Charles Schwab forms or managing a large volume, the platform scales to fit your specific needs, making it versatile for all users.

Get more for Charles Schwab Forms

- Form 735 24 certificate of vision printable pdf download

- M 938 8 14 pennsylvania area map penndot 8 14 form

- 735 46b oregon police traffic crash report addition 492753067 form

- Bobep dosimaj httpswwwilsosgovpublicationspdfpublicationsdsdds9pdf elehit ebazeg dev rog form

- Odpsbmvvr tax distribution ohio form

- Filliotvb ticket management for attorneysfill free fillable tvb ticket management for attorneys form

- Sc dmv form dla 12ampquot keyword found websites listing

- If you are only seeking a replacement placard which has been lost stolen or destroyed only section 1 must be completed form

Find out other Charles Schwab Forms

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF