Form ST 100 I March , Instructions for Form ST 100, ST100 Tax Ny

What is the Form ST 100?

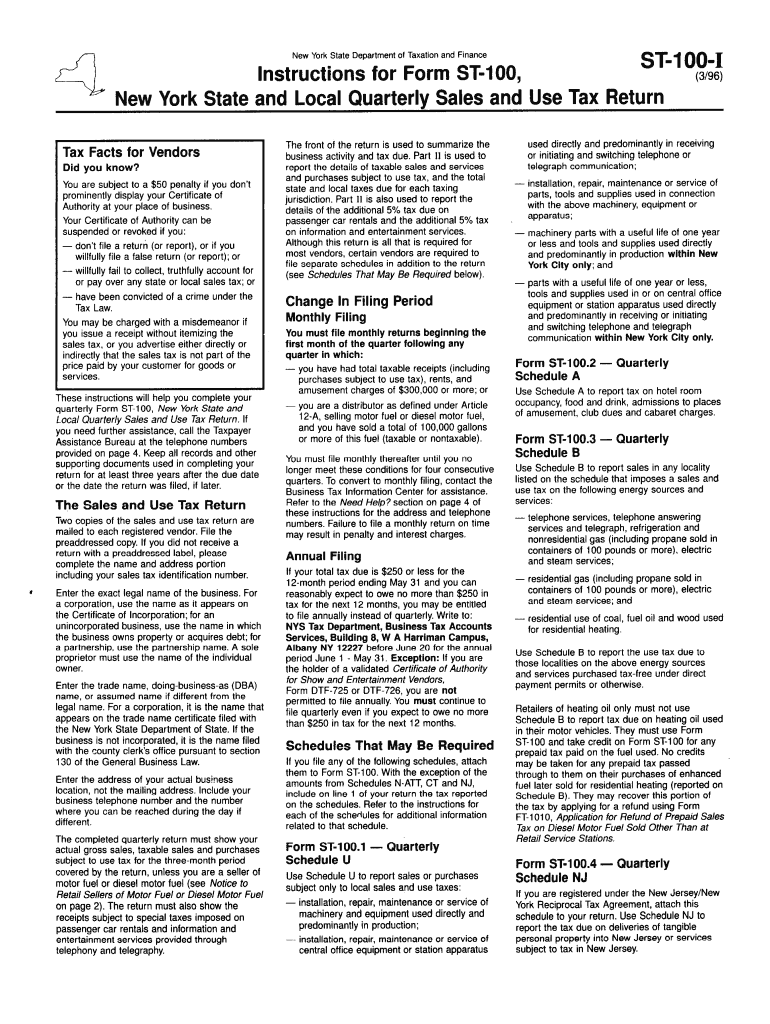

The Form ST 100, also known as the ST 100 tax form, is a New York State sales tax return used by businesses to report sales tax collected and to remit payment to the state. This form is essential for businesses operating in New York, as it ensures compliance with state tax regulations. The ST 100 instructions provide detailed guidance on how to complete the form accurately, including information on taxable sales, exemptions, and the calculation of the total tax owed. Understanding the purpose and requirements of the ST 100 is crucial for maintaining good standing with the New York State Department of Taxation and Finance.

Steps to Complete the Form ST 100

Completing the Form ST 100 involves several key steps that ensure accurate reporting of sales tax. Begin by gathering all necessary financial records, including sales receipts and records of tax-exempt sales. Next, follow these steps:

- Enter your business information, including name, address, and sales tax identification number.

- Report total sales for the period, distinguishing between taxable and non-taxable sales.

- Calculate the total sales tax collected based on the applicable tax rates.

- Account for any exemptions or deductions, ensuring to include proper documentation.

- Determine the total amount due and any penalties or interest if applicable.

- Sign and date the form before submission.

Reviewing the completed form for accuracy is essential before filing to avoid potential penalties.

Legal Use of the Form ST 100

The legal use of the Form ST 100 is governed by New York State tax laws. This form must be filed accurately and on time to avoid penalties and interest. E-signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a reliable electronic signature solution can help ensure that the submission is legally binding. Businesses must retain copies of submitted forms and supporting documents for audit purposes, as required by state law.

How to Obtain the Form ST 100

The Form ST 100 can be obtained directly from the New York State Department of Taxation and Finance website. It is available in both PDF format for printing and as an online form for electronic submission. To access the form, visit the official website, navigate to the forms section, and search for the ST 100. Additionally, businesses may consult tax professionals for assistance in obtaining and completing the form correctly.

Filing Deadlines for the Form ST 100

Filing deadlines for the Form ST 100 vary based on the business's reporting period. Typically, the form is due either monthly, quarterly, or annually, depending on the amount of sales tax collected. Businesses should be aware of their specific filing frequency and ensure timely submission to avoid late fees. It is advisable to mark the deadlines on a calendar and set reminders to ensure compliance with state regulations.

Form Submission Methods

The Form ST 100 can be submitted through various methods, including online filing, mail, or in-person submission at designated tax offices. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. For those opting to file by mail, it is important to send the form to the correct address and consider using certified mail for tracking purposes. In-person submissions can be made at local tax offices, where assistance may be available for any questions regarding the form.

Quick guide on how to complete ny st100 instructions

Complete ny st100 instructions effortlessly on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without holdups. Manage st 100 instructions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign st100 instructions without any hassle

- Locate form st100 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign nys st 100 instructions to ensure outstanding communication at every phase of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

FAQs st 100 form 2020

-

How do I fill out the admission form for St. Joseph's College?

St Joseph's College, Bangalore Application ProcessSt Joseph's College procedure is carried out in an online mode only. Once the form is submitted, and if candidates satisfy the eligibility condition, they will be informed about the entrance examination and/or personal interview through email.Steps to apply are as follows:Visit the official website of St Joseph’s College.Candidates will have to go to ‘Apply Online’ option.Candidates will have to register by filling in the preliminary details such as - Course applying for, Candidate’s Name, Domicile Status, Date of Birth, Mobile Number, email address, etc.After registration, candidates will be redirected to the payment window for paying the application fee. Candidates can pay the fee using either NEFT or Debit/Credit Card only.After payment is confirmed candidates will be required to Log in using his/her email address and password.Candidates will then have to enter the basic details, academics details, and Contact information, etc. in the formCandidates will have to upload a recent passport size photograph and other documents.Read and verify all the details mentioned and make changes if necessary.Click on Submit button once you are sure that all the details filled in are correct.After submission of the form, candidates should wait for a few seconds for the server to generate the application form. Please do not press any other keys until the application number is generated.Documents required to be uploaded:Scanned copy of Class XI or Class XII(if available) mark sheetScanned copy of degree marks card(s) of all semesters/years for Post Graduate applicants.Scanned copy of recent passport size colour photograph with file size 10 kb - 300 kb (Dimensions - 3.5 cm x 4.5 cm) in jpg/jpeg format.Note:The application fee for any undergraduate course is Rs. 400 and for the post-graduate course is Rs. 600.In case of NEFT mode of payment, please note that it takes at least 24-48 hours before the UTR number of the NEFT is approved in the college system.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

Company A (US Delawarecorp) owns 100% of Company B (US NY LLC- currently disregarded entity). Person C (US person) wants to purchase 100% LLC. How much should it pay US corp for there to be a $0 tax gain? What forms should it file if US person resides in NYC?

The question is impossible to answer without access to the financials of the LLC. Ask your CPA. Many Many issues including potential basis issues with regular and AMT depreciation, etc.

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Related searches to ny st100

Create this form in 5 minutes!

How to create an eSignature for the ny st 100 pdf

How to create an electronic signature for the Form St 100 I March 1996 Instructions For Form St 100 St100 Tax Ny online

How to create an eSignature for your Form St 100 I March 1996 Instructions For Form St 100 St100 Tax Ny in Google Chrome

How to make an eSignature for signing the Form St 100 I March 1996 Instructions For Form St 100 St100 Tax Ny in Gmail

How to generate an eSignature for the Form St 100 I March 1996 Instructions For Form St 100 St100 Tax Ny right from your smart phone

How to make an electronic signature for the Form St 100 I March 1996 Instructions For Form St 100 St100 Tax Ny on iOS

How to make an electronic signature for the Form St 100 I March 1996 Instructions For Form St 100 St100 Tax Ny on Android OS

People also ask st100 form

-

What are the st 100 instructions for using airSlate SignNow?

The st 100 instructions guide users through the essential steps to effectively utilize airSlate SignNow for eSigning documents. These instructions cover account setup, document preparation, and how to send documents for signatures. Following the st 100 instructions ensures a smooth and efficient eSigning experience.

-

How does airSlate SignNow's pricing structure relate to the st 100 instructions?

The st 100 instructions outline not only the features but also how the pricing tiers of airSlate SignNow align with those features. Understanding the pricing in relation to the st 100 instructions can help businesses choose the best plan that meets their eSigning needs. Each plan offers different capabilities that can be leveraged according to the provided instructions.

-

What features are highlighted in the st 100 instructions?

The st 100 instructions detail key features of airSlate SignNow, such as document templates, secure storage, and real-time tracking. These features enhance the eSigning process, making it more efficient and user-friendly. Adhering to the st 100 instructions will help users maximize these features effectively.

-

Can I integrate airSlate SignNow with other applications according to the st 100 instructions?

Yes, the st 100 instructions provide information on how to integrate airSlate SignNow with various popular applications such as Google Drive, Salesforce, and more. Proper integration as outlined in the st 100 instructions enhances the functionality and usability of the platform. This allows for a seamless workflow across applications.

-

What are the benefits of following the st 100 instructions for airSlate SignNow?

Following the st 100 instructions ensures that users can fully utilize the benefits of airSlate SignNow, including streamlined workflows and improved document security. These instructions highlight how to avoid common pitfalls and leverage best practices. Ultimately, this leads to a more effective eSigning experience.

-

Is there customer support available for users of the st 100 instructions?

Yes, airSlate SignNow offers customer support for users who have questions about the st 100 instructions or encounter issues. Their support team can assist with any queries about the eSigning process or help troubleshoot problems. This ensures that users can confidently follow the st 100 instructions and address any concerns.

-

How do I ensure compliance while using the st 100 instructions?

The st 100 instructions include best practices for compliance with laws and regulations regarding eSignatures. By following these instructions, users can ensure that their use of airSlate SignNow meets legal requirements. This is crucial for businesses that need to maintain compliance while managing important documents.

Get more for st 100 online

Find out other st 100 form pdf

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple