Form ST 810 111208 OS 114 Schedule CT Schedule for New York Tax Ny

What is the Connecticut OS 114 Form?

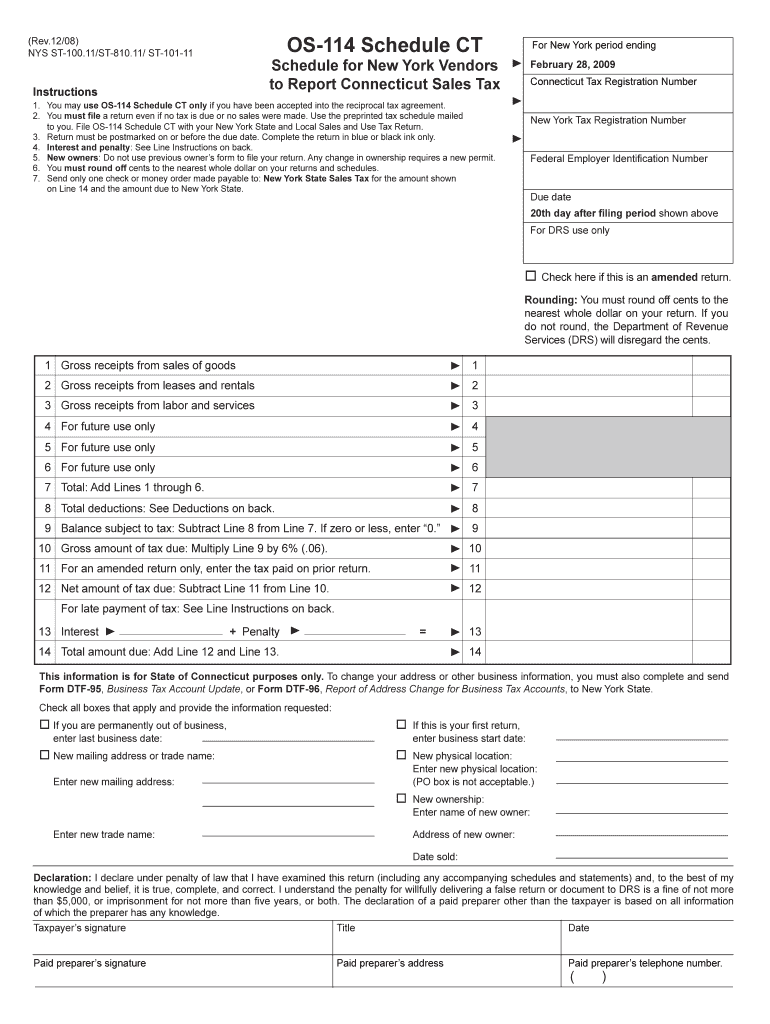

The Connecticut OS 114 form, also known as the ST08 OS 114 Schedule CT, is a tax document used for reporting specific financial information to the state of Connecticut. This form is primarily utilized for tax purposes, particularly by businesses and individuals who need to report sales and use tax. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax laws.

Steps to Complete the Connecticut OS 114 Form

Completing the Connecticut OS 114 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documentation, including sales records and any relevant invoices. Next, carefully fill out each section of the form, providing accurate figures for sales and use tax collected. It is crucial to double-check all entries for errors before submission. Once completed, review the form to ensure all required signatures are included.

How to Obtain the Connecticut OS 114 Form

The Connecticut OS 114 form can be obtained directly from the Connecticut Department of Revenue Services website. Users can download the form in PDF format, which can then be printed for completion. Additionally, physical copies may be available at local government offices or tax assistance centers. Ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the Connecticut OS 114 Form

The legal use of the Connecticut OS 114 form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. Failure to comply with these regulations can result in penalties or fines. It is important to keep a copy of the submitted form for your records, as it may be required for future reference or audits.

Filing Deadlines for the Connecticut OS 114 Form

Filing deadlines for the Connecticut OS 114 form vary depending on the specific tax period being reported. Generally, businesses are required to submit this form on a quarterly basis. It is essential to be aware of these deadlines to avoid late fees and ensure compliance with state tax regulations. Marking these dates on your calendar can help keep your filing on track.

Required Documents for the Connecticut OS 114 Form

When preparing to complete the Connecticut OS 114 form, certain documents are required to ensure accurate reporting. These may include sales receipts, invoices, and any other financial records that detail sales and use tax collected. Having these documents readily available will streamline the completion process and help maintain compliance with state requirements.

Form Submission Methods for the Connecticut OS 114 Form

The Connecticut OS 114 form can be submitted through various methods. Taxpayers have the option to file the form online through the Connecticut Department of Revenue Services portal, which offers a convenient and efficient way to submit electronically. Alternatively, the completed form can be mailed to the appropriate address provided on the form. In-person submissions may also be possible at designated state offices.

Quick guide on how to complete os 114 form

Effortlessly prepare os 114 form on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage connecticut os 114 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign ct os 114 with ease

- Find now 810 11 12 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign os 114 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the os 114 form

How to generate an electronic signature for your Form St 810111208 Os 114 Schedule Ct Schedule For New York Tax Ny online

How to create an eSignature for the Form St 810111208 Os 114 Schedule Ct Schedule For New York Tax Ny in Google Chrome

How to create an electronic signature for putting it on the Form St 810111208 Os 114 Schedule Ct Schedule For New York Tax Ny in Gmail

How to create an electronic signature for the Form St 810111208 Os 114 Schedule Ct Schedule For New York Tax Ny from your mobile device

How to make an electronic signature for the Form St 810111208 Os 114 Schedule Ct Schedule For New York Tax Ny on iOS

How to make an eSignature for the Form St 810111208 Os 114 Schedule Ct Schedule For New York Tax Ny on Android

People also ask ct os 114

-

What is Connecticut OS 114?

Connecticut OS 114 is a standard form used in various business processes across Connecticut. It facilitates the signing and management of important documents in compliance with state regulations. Utilizing airSlate SignNow can streamline this process, making it easier to manage your Connecticut OS 114 forms.

-

How does airSlate SignNow help with Connecticut OS 114 forms?

airSlate SignNow provides an efficient platform for electronically signing and sending Connecticut OS 114 documents. This enables businesses to reduce paperwork and enhance turnaround times. The user-friendly interface simplifies the management of these essential forms.

-

What are the pricing options for using airSlate SignNow for Connecticut OS 114?

airSlate SignNow offers competitive pricing plans tailored for businesses needing to manage Connecticut OS 114 forms. Pricing typically depends on the number of users and features required. There’s also a free trial available to explore its capabilities before committing.

-

Is airSlate SignNow secure for processing Connecticut OS 114 documents?

Yes, airSlate SignNow prioritizes security, ensuring that all Connecticut OS 114 documents are encrypted and stored safely. The platform complies with industry standards to protect sensitive information. Users can sign and send documents with peace of mind.

-

What features does airSlate SignNow offer for streamlining Connecticut OS 114 processing?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for Connecticut OS 114 documents. These tools help businesses improve efficiency and maintain organization when handling important forms.

-

Can airSlate SignNow integrate with other software for managing Connecticut OS 114?

Absolutely! airSlate SignNow integrates seamlessly with various applications to streamline the handling of Connecticut OS 114 forms. This includes CRM systems, cloud storage, and more, enhancing your business workflows and reducing time spent on repetitive tasks.

-

What are the benefits of using airSlate SignNow for Connecticut OS 114?

Using airSlate SignNow for Connecticut OS 114 offers numerous benefits, including increased productivity and reduced turnaround times. The electronic signature feature eliminates the need for physical paperwork, making processes faster and more efficient. Ultimately, it helps businesses save time and resources.

Get more for now 810 11 12

- Fjzhidc d iz lzz dl xvc v hidgn written by teresa r form

- Residential billing change we energies form

- Cie form

- Vaf9 100348801 form

- Booking form hotel

- Proof of physical exam leagueathletics com form

- Job shadow application st vincent health stvincent form

- Mini cex patient centered observation form clinician version depts washington

Find out other os 114

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template