Personal Income Statement Form

What is the Personal Income Statement

The personal income statement is a financial document that summarizes an individual's income and expenses over a specific period, typically one year. This statement is essential for understanding one's financial health and is often used in various scenarios, such as applying for loans, renting property, or preparing for tax season. The personal income statement provides a clear overview of earnings from all sources, including wages, investments, and any additional income, alongside a detailed account of expenditures, which may include living costs, debts, and discretionary spending.

How to Use the Personal Income Statement

Using the personal income statement effectively involves several steps. First, gather all relevant financial documents, such as pay stubs, bank statements, and receipts for expenses. Next, categorize your income and expenses to create a comprehensive view of your financial situation. This categorization can help identify areas where you might save money or need to adjust spending. Once completed, the personal income statement can serve multiple purposes, including budgeting, applying for financial assistance, or providing proof of income for various applications.

Steps to Complete the Personal Income Statement

Completing the personal income statement requires careful attention to detail. Here are the steps to follow:

- Collect all income sources: Include wages, bonuses, rental income, and any other earnings.

- Document all expenses: List fixed expenses such as rent or mortgage, utilities, and variable expenses like groceries and entertainment.

- Calculate total income: Sum all sources of income to determine your gross income.

- Calculate total expenses: Add up all expenses to find your total outflow.

- Determine net income: Subtract total expenses from total income to find your net income, which indicates your financial standing.

Key Elements of the Personal Income Statement

The personal income statement consists of several key elements that provide a comprehensive financial overview. These include:

- Income Sources: A detailed list of all income streams, including salaries, dividends, and other earnings.

- Expense Categories: A breakdown of fixed and variable expenses, which helps in understanding spending habits.

- Net Income: The difference between total income and total expenses, indicating overall financial health.

- Time Frame: The specific period the statement covers, typically one year, which is crucial for annual financial assessments.

Legal Use of the Personal Income Statement

The personal income statement holds legal significance in various contexts, particularly in financial transactions and applications. It serves as a reliable document for lenders when assessing creditworthiness for loans or mortgages. Additionally, it may be required for government assistance programs or tax filings, ensuring compliance with financial regulations. Properly completed, the personal income statement can provide a transparent view of an individual's financial situation, which is essential in legal and financial discussions.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for the timely submission of your personal income statement. For individuals in the United States, the deadline for filing taxes is typically April fifteenth of each year. However, if you require an extension, you may file for one, pushing the deadline to October fifteenth. It is important to keep track of these dates to avoid penalties and ensure compliance with tax regulations. Additionally, if using the personal income statement for other purposes, such as loan applications, check specific deadlines set by financial institutions.

Quick guide on how to complete personal income statement 486925447

Prepare Personal Income Statement effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the functionalities you need to create, modify, and eSign your documents quickly and without delays. Manage Personal Income Statement on any device with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign Personal Income Statement without hassle

- Locate Personal Income Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize necessary sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that function.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Personal Income Statement and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal income statement 486925447

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

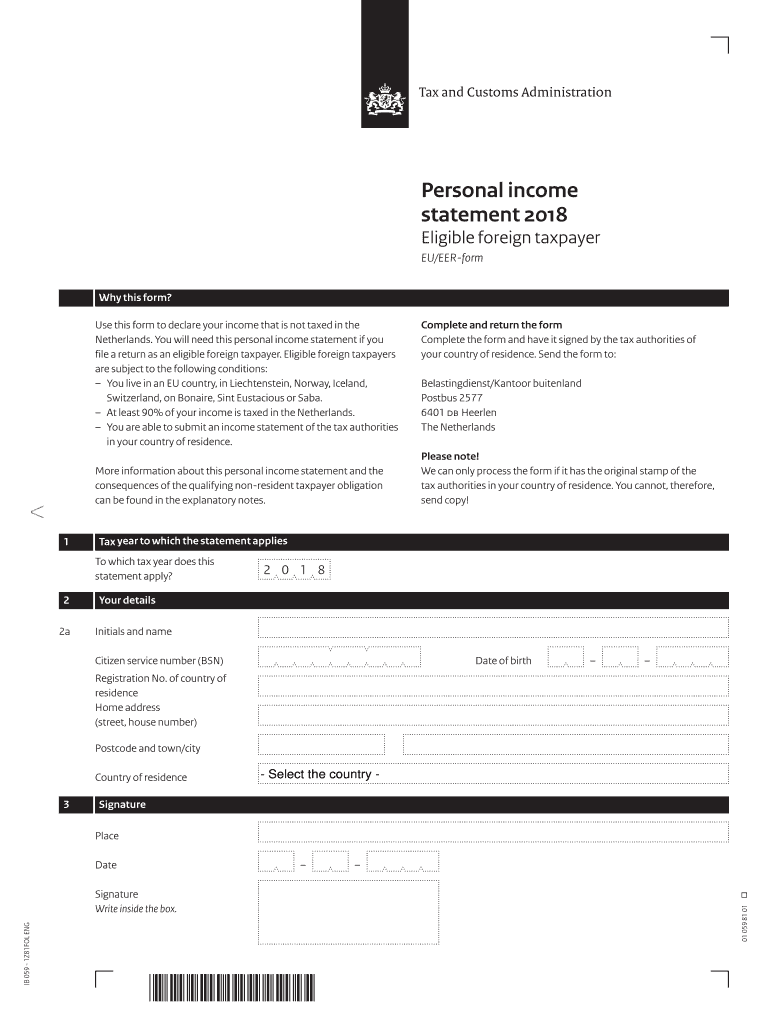

What is a personal income statement 2018?

A personal income statement 2018 is a financial document that summarizes an individual's income, expenses, and overall financial performance for that year. This statement is crucial for understanding your financial situation and making informed decisions regarding personal finance. It can be important for tax purposes, loan applications, and personal budgeting.

-

How can I create a personal income statement 2018 using airSlate SignNow?

Creating a personal income statement 2018 with airSlate SignNow is straightforward. You can use our templates to input your income and expenses, then easily generate a downloadable document. Our platform allows you to customize the statement to suit your specific financial situation.

-

What are the benefits of using airSlate SignNow for my personal income statement 2018?

Using airSlate SignNow for your personal income statement 2018 offers various benefits, including ease of use, cost-effectiveness, and secure e-signature capabilities. You can quickly gather necessary signatures on your document without having to print or fax. This enhances workflow efficiency and ensures your details remain confidential.

-

Is airSlate SignNow cost-effective for generating a personal income statement 2018?

Yes, airSlate SignNow provides a cost-effective solution for generating your personal income statement 2018. Our pricing plans are designed to accommodate different budgets, making it affordable for individuals and small businesses. You can enjoy features like unlimited document sending and e-signing without breaking the bank.

-

Does airSlate SignNow offer integrations for creating my personal income statement 2018?

Absolutely! airSlate SignNow integrates with various applications to streamline the creation of your personal income statement 2018. Whether you need to pull data from accounting software or share your document via email, our integration options enhance your experience and save you time.

-

Can I edit my personal income statement 2018 after creating it with airSlate SignNow?

Yes, you can easily edit your personal income statement 2018 after it's been generated in airSlate SignNow. Our platform allows you to make necessary adjustments to the document, ensuring that all your financial details are accurate and up to date before sharing or filing.

-

How secure is my personal income statement 2018 when using airSlate SignNow?

Your personal income statement 2018 is secure with airSlate SignNow. We prioritize your data security and employ industry-standard encryption protocols. Your information remains confidential, and you can trust that your financial documents are protected from unauthorized access.

Get more for Personal Income Statement

Find out other Personal Income Statement

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast