Il 1120 X Form

What is the Il 1120 X Form

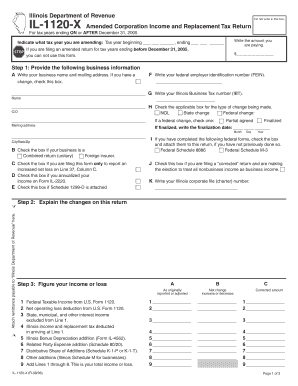

The Il 1120 X Form is a tax amendment form used by corporations in the United States to correct errors on previously filed corporate tax returns. This form allows businesses to make adjustments to their income, deductions, or credits. It is essential for ensuring that the tax records accurately reflect the corporation's financial situation, which can impact future tax liabilities and compliance with IRS regulations.

How to use the Il 1120 X Form

Using the Il 1120 X Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to the original return, including any supporting schedules or statements. Next, clearly indicate the changes being made on the form, providing detailed explanations for each adjustment. Finally, submit the completed form to the appropriate IRS address, ensuring that it is filed within the designated timeframe to avoid penalties.

Steps to complete the Il 1120 X Form

Completing the Il 1120 X Form requires careful attention to detail. Begin by filling out the identification section, including the corporation's name and Employer Identification Number (EIN). Next, specify the tax year for which the amendment is being filed. In the subsequent sections, list the original amounts and the corrected figures, along with explanations for each change. Ensure that all calculations are accurate and that the form is signed by an authorized officer of the corporation before submission.

Legal use of the Il 1120 X Form

The legal use of the Il 1120 X Form is governed by IRS guidelines, which stipulate that it can only be used to amend previously filed corporate tax returns. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies may lead to audits or penalties. The form must be filed within the statute of limitations for tax returns, which is generally three years from the original filing date, to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Il 1120 X Form are critical for compliance. Typically, the form must be submitted within three years of the original return's due date. For corporations operating on a calendar year basis, this means that any amendments for a tax return due on April fifteenth must be filed by April fifteenth of the third year following the tax year. Keeping track of these dates helps prevent penalties and ensures that corrections are made in a timely manner.

Required Documents

When filing the Il 1120 X Form, certain documents are required to support the amendments being made. These may include copies of the original tax return, any relevant schedules, and documentation that justifies the changes, such as receipts or financial statements. Having these documents readily available will facilitate a smoother filing process and help substantiate the corrections made on the form.

Who Issues the Form

The Il 1120 X Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Corporations must ensure they are using the most current version of the form, as the IRS periodically updates tax forms and instructions to reflect changes in tax laws and regulations. Always check the IRS website for the latest forms and guidelines.

Quick guide on how to complete il 1120 x form

Complete Il 1120 X Form effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Il 1120 X Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Il 1120 X Form with ease

- Find Il 1120 X Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Il 1120 X Form and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1120 x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Il 1120 X Form?

The Il 1120 X Form is a tax amendment form used by corporations to correct errors in previously filed Illinois corporate income tax returns. This form allows businesses to adjust reported income, deductions, or credits. Understanding how to accurately complete the Il 1120 X Form is essential for compliance and can help avoid penalties.

-

How can airSlate SignNow assist with the Il 1120 X Form?

airSlate SignNow offers a streamlined electronic signature solution that simplifies the process of signing and sending the Il 1120 X Form. By using our platform, you can quickly gather the necessary approvals from stakeholders and submit your form efficiently. This saves time and minimizes the hassle associated with traditional paperwork.

-

What features does airSlate SignNow provide for managing the Il 1120 X Form?

With airSlate SignNow, you can easily create, edit, and securely send the Il 1120 X Form. Features such as templates, document tracking, and reminders ensure that your filing process is smooth and organized. Additionally, our platform is designed to enhance document security and compliance.

-

Is there a cost associated with using airSlate SignNow for the Il 1120 X Form?

Yes, airSlate SignNow operates on a subscription model, offering various pricing plans to suit different business needs. Each plan includes features that facilitate the completion and management of the Il 1120 X Form. You can choose a plan that best fits your frequency of use and budget.

-

Can I integrate airSlate SignNow with other accounting software for the Il 1120 X Form?

Absolutely! airSlate SignNow offers robust integrations with popular accounting and tax preparation software. This allows you to easily import and manage your data when preparing the Il 1120 X Form, streamlining your workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for tax forms like the Il 1120 X Form?

Using airSlate SignNow for the Il 1120 X Form offers multiple benefits, including improved speed and efficiency in obtaining signatures. The secure, cloud-based solution also provides easy access to documents from anywhere, which can enhance collaboration among team members while maintaining compliance.

-

How does airSlate SignNow ensure the security of my Il 1120 X Form data?

airSlate SignNow prioritizes your data security by utilizing encryption and secure cloud storage. This means that your Il 1120 X Form and any sensitive information remain protected during transmission and storage. You can confidently manage your tax documents without worrying about unauthorized access.

Get more for Il 1120 X Form

- Military leave form pdf

- Ta w31298 9 statement of qualifications new york state thruway thruway ny form

- Pioneer park pavilion rental fairbanks form

- Get the doe ohr 200 005 form

- Ohio dic 3016 form

- Rp1 form download

- New zealand grant application form

- Imaging request form pdf centre for health centreforhealth org

Find out other Il 1120 X Form

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free