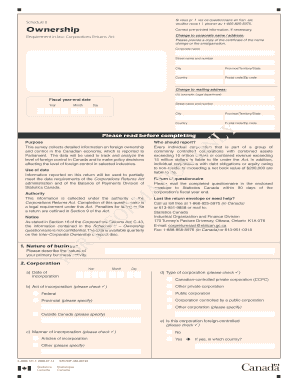

Schedule II Ownership Statistics Canada Form

What is the Schedule II Ownership Statistics Canada

The Schedule II Ownership Statistics Canada form is a document used for reporting ownership information related to specific assets or properties. This form is essential for individuals and businesses that need to provide accurate data about their ownership status for statistical purposes. It helps in the collection of data that informs government policies and economic assessments. Understanding the purpose of this form is crucial for compliance with Canadian regulations, even for U.S. residents who may have cross-border interests.

How to use the Schedule II Ownership Statistics Canada

Using the Schedule II Ownership Statistics Canada form involves several steps to ensure accurate completion. First, gather all necessary information regarding the assets or properties you own. This includes details such as the type of asset, its value, and the duration of ownership. Once you have this information, you can fill out the form. Ensure that all entries are clear and concise to avoid any misunderstandings. After completing the form, review it for accuracy before submission to ensure compliance with reporting requirements.

Steps to complete the Schedule II Ownership Statistics Canada

Completing the Schedule II Ownership Statistics Canada form requires careful attention to detail. Follow these steps:

- Collect all relevant information about your ownership, including asset types and values.

- Obtain the latest version of the Schedule II form from the appropriate source.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check all entries for correctness and completeness.

- Submit the form according to the guidelines provided, either online or by mail.

Legal use of the Schedule II Ownership Statistics Canada

The legal use of the Schedule II Ownership Statistics Canada form is vital for ensuring compliance with Canadian laws regarding asset reporting. This form is recognized as a legitimate document for statistical purposes, and accurate completion is necessary to avoid potential legal issues. Individuals and businesses must be aware of the implications of misreporting or failing to submit the form, as this could lead to penalties or other legal repercussions.

Key elements of the Schedule II Ownership Statistics Canada

Several key elements are essential when filling out the Schedule II Ownership Statistics Canada form. These include:

- Asset Description: Clearly define the type of asset owned.

- Ownership Duration: Indicate how long the asset has been owned.

- Value of the Asset: Provide an accurate valuation of the asset.

- Owner Information: Include the name and contact details of the owner.

Who Issues the Form

The Schedule II Ownership Statistics Canada form is issued by Statistics Canada, the national statistical agency responsible for collecting and analyzing data related to various aspects of Canadian life. This agency plays a crucial role in ensuring that the information collected is accurate and reflective of current ownership trends, which is vital for government planning and policy-making.

Quick guide on how to complete schedule ii ownership statistics canada

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage [SKS] across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

Steps to Alter and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Use the tools at your disposal to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ii ownership statistics canada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Schedule II Ownership Statistics Canada?

Schedule II Ownership Statistics Canada refers to the data regarding the ownership structure of Schedule II banks, which are Canadian banks that are licensed to operate but are not fully integrated into the group of domestic banks. This data is crucial for understanding the market shares, operational dynamics, and regulatory compliance of these financial entities.

-

How can airSlate SignNow help me manage Schedule II Ownership Statistics Canada?

airSlate SignNow offers a streamlined solution for managing important documents related to Schedule II Ownership Statistics Canada. With features like eSigning and document tracking, businesses can efficiently handle their compliance and reporting needs without the hassle of paper paperwork.

-

What pricing options does airSlate SignNow offer for features related to Schedule II Ownership Statistics Canada?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs, including features that assist with the management of Schedule II Ownership Statistics Canada. You can choose from monthly, yearly, or custom plans based on the volume of documents you need to manage.

-

What features does airSlate SignNow offer that benefit businesses in handling Schedule II Ownership Statistics Canada?

Key features of airSlate SignNow include customizable templates, advanced eSignature capabilities, and integration options that enhance the handling of Schedule II Ownership Statistics Canada. These features allow for quick turnaround times on essential documentation while maintaining compliance with regulations.

-

Can airSlate SignNow integrate with other financial software for managing Schedule II Ownership Statistics Canada?

Yes, airSlate SignNow seamlessly integrates with various financial software platforms to facilitate the management of Schedule II Ownership Statistics Canada. This integration allows for automated workflows that enhance efficiency and reduce manual data entry errors.

-

What are the benefits of using airSlate SignNow for Schedule II Ownership Statistics Canada compliance?

Using airSlate SignNow for Schedule II Ownership Statistics Canada compliance can signNowly reduce administrative burdens while ensuring accuracy and timeliness in submissions. Its user-friendly interface and powerful features make it easy to manage complex documentation efficiently.

-

Is airSlate SignNow secure for handling Schedule II Ownership Statistics Canada documents?

Absolutely. airSlate SignNow employs advanced encryption and security protocols to ensure that all documents related to Schedule II Ownership Statistics Canada are protected. This level of security is crucial for maintaining confidentiality and compliance with financial regulations.

Get more for Schedule II Ownership Statistics Canada

- National real estate ch 5 property ownership and the form

- The above space for recorders use only form

- Structuresthe offer is composed of compensation for loss of form

- Memorandum of agreement federal highway administration form

- Right of way by tenant form

- Read this before you sign that pipeline easement lease farm form

- Lease agreement dated november 19 1996 form

- Air rights lease agreement secgovhome form

Find out other Schedule II Ownership Statistics Canada

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document