IRA Standing Phone Distribution Instructions Form

What is the IRA Standing Phone Distribution Instructions

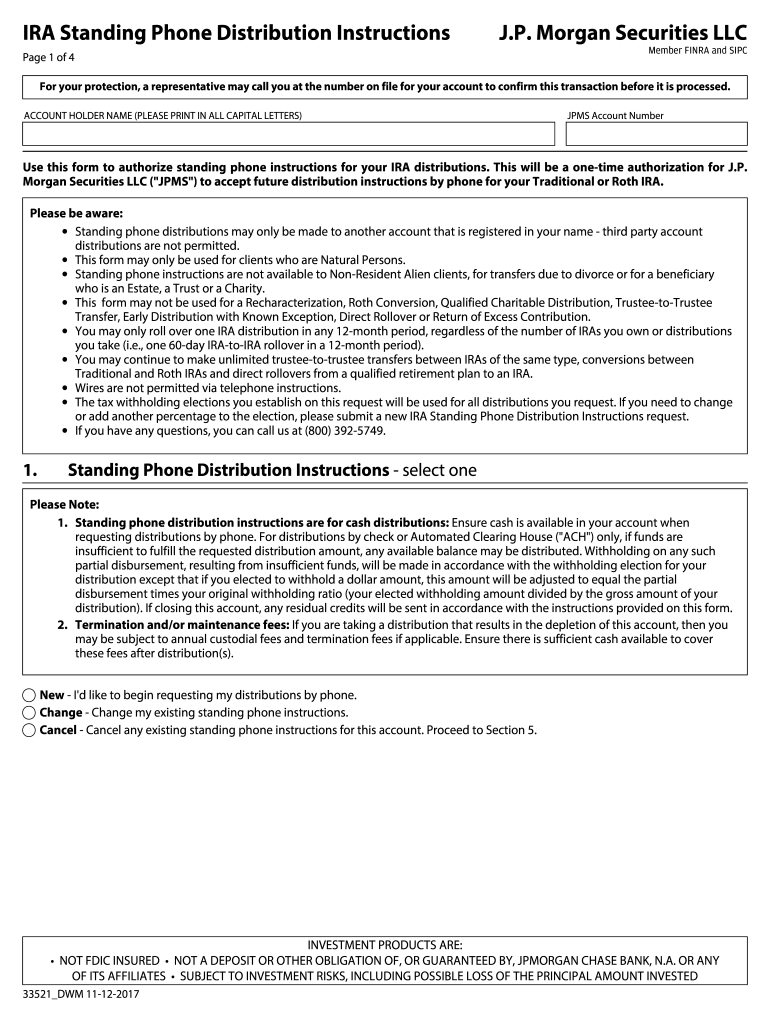

The IRA Standing Phone Distribution Instructions is a document that outlines how an individual can authorize their financial institution to make regular distributions from their Individual Retirement Account (IRA) via phone requests. This form provides a structured approach for account holders to specify the terms and conditions under which distributions should be made, ensuring compliance with IRS regulations while facilitating easier access to funds. By completing this form, account holders can streamline their withdrawal process, making it more efficient and convenient.

How to use the IRA Standing Phone Distribution Instructions

Using the IRA Standing Phone Distribution Instructions involves several steps to ensure that the form is completed accurately and submitted properly. First, gather necessary personal information, including your IRA account number and identification details. Next, fill out the form by specifying the amount and frequency of distributions, along with any other required details. Once completed, submit the form to your financial institution, either electronically or via mail, depending on their submission guidelines. Ensure to keep a copy for your records and confirm with your institution that the instructions have been processed.

Steps to complete the IRA Standing Phone Distribution Instructions

Completing the IRA Standing Phone Distribution Instructions requires careful attention to detail. Follow these steps:

- Obtain the form from your financial institution or their website.

- Fill in your personal information, including your name, address, and IRA account number.

- Specify the distribution amount and frequency (e.g., monthly, quarterly).

- Include any additional instructions or preferences regarding the distribution method.

- Review the form for accuracy and completeness.

- Submit the form according to your financial institution's guidelines.

Legal use of the IRA Standing Phone Distribution Instructions

The IRA Standing Phone Distribution Instructions must comply with various legal requirements to be considered valid. This includes adherence to IRS regulations governing retirement accounts, ensuring that distributions do not exceed annual limits and are made in accordance with the account holder's age and retirement status. Additionally, the form must be signed and dated by the account holder, and it is advisable to use secure electronic methods for submission to maintain compliance with eSignature laws. Legal validity is crucial to avoid potential penalties associated with improper withdrawals.

Key elements of the IRA Standing Phone Distribution Instructions

Several key elements are essential for the IRA Standing Phone Distribution Instructions to be effective:

- Account Holder Information: Personal details such as name, address, and account number.

- Distribution Amount: The specific dollar amount to be withdrawn.

- Frequency of Distributions: How often funds should be distributed (e.g., monthly, annually).

- Authorization Signature: A signature or electronic signature that validates the instructions.

- Contact Information: A phone number for the financial institution to confirm instructions.

Form Submission Methods

Submitting the IRA Standing Phone Distribution Instructions can be done through multiple methods, depending on the policies of your financial institution. Common submission methods include:

- Online Submission: Many institutions allow electronic submission through their secure portal.

- Mail: You can send the completed form via postal service to the designated address provided by your institution.

- In-Person: Some account holders may prefer to deliver the form directly to a branch office for immediate processing.

Quick guide on how to complete ira standing phone distribution instructions

Effortlessly Prepare IRA Standing Phone Distribution Instructions on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage IRA Standing Phone Distribution Instructions on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Modify and Electronically Sign IRA Standing Phone Distribution Instructions with Ease

- Locate IRA Standing Phone Distribution Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign IRA Standing Phone Distribution Instructions and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira standing phone distribution instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IRA Standing Phone Distribution Instructions?

IRA Standing Phone Distribution Instructions are directives that outline how to manage and distribute funds from an Individual Retirement Account over the phone. These instructions ensure that account holders can make informed and efficient decisions regarding their IRA distributions without the hassle of paperwork.

-

How can airSlate SignNow assist with IRA Standing Phone Distribution Instructions?

airSlate SignNow simplifies the process of creating and managing IRA Standing Phone Distribution Instructions by allowing users to eSign documents electronically. This reduces the time and effort required to finalize distribution instructions, enabling clients to handle their IRA matters seamlessly.

-

What are the benefits of using airSlate SignNow for IRA Standing Phone Distribution Instructions?

Using airSlate SignNow for IRA Standing Phone Distribution Instructions offers several benefits, such as increased efficiency, secure document handling, and reduced turnaround times. Users can ensure compliance and accuracy by having a digital trail of all signed instructions.

-

Is there a cost associated with setting up IRA Standing Phone Distribution Instructions?

The cost of setting up IRA Standing Phone Distribution Instructions through airSlate SignNow varies based on the plan selected. However, the platform is generally recognized as a cost-effective solution, providing exceptional value for businesses needing reliable eSigning services.

-

Can IRA Standing Phone Distribution Instructions be integrated with other business tools?

Yes, IRA Standing Phone Distribution Instructions created with airSlate SignNow can be easily integrated with various business tools and applications. This ensures that you can sync your financial information and maintain efficient workflows across your organization.

-

What documents are needed for IRA Standing Phone Distribution Instructions?

To prepare IRA Standing Phone Distribution Instructions, you'll typically need your IRA account information and identification documents. Additionally, having your beneficiary details on hand will help streamline the process of creating effective distribution instructions.

-

How secure is the information submitted for IRA Standing Phone Distribution Instructions?

airSlate SignNow places a high priority on security, utilizing advanced encryption methods to protect information submitted for IRA Standing Phone Distribution Instructions. This ensures that all sensitive data remains confidential and safeguarded against unauthorized access.

Get more for IRA Standing Phone Distribution Instructions

- Mt cafo ar2 reporting form

- Division of corporations fee schedule form

- Hacienda pr modelo 3325 form

- Contact us alaska department of health state of alaska form

- Authorization for release of information form

- 1 pediatric acute care certified registered nurse form

- One health record business assessment form

- Alabama board of nursing abn complaint evaluation tool form

Find out other IRA Standing Phone Distribution Instructions

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free