What Are St 220 Forms

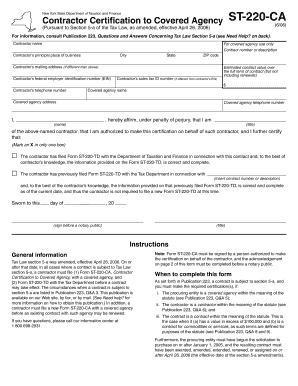

What is the ST-220 Form?

The ST-220 form is a sales tax exemption certificate used in the United States, primarily by businesses to purchase goods or services without paying sales tax. This form is essential for qualifying organizations, such as non-profits or government entities, that are exempt from sales tax under specific regulations. The ST-220 allows these organizations to provide proof of their tax-exempt status when making purchases, ensuring compliance with state tax laws.

How to use the ST-220 Form

To use the ST-220 form, the purchaser must fill out the required information, including their organization’s name, address, and tax-exempt status. The seller must retain a copy of the completed form for their records. This process helps both parties ensure that the transaction adheres to tax regulations. It is important to use the ST-220 form correctly to avoid any potential tax liabilities.

Steps to complete the ST-220 Form

Completing the ST-220 form involves several straightforward steps:

- Obtain the ST-220 form from your state’s tax authority or website.

- Fill in your organization’s name, address, and tax identification number.

- Indicate the type of exemption your organization qualifies for.

- Sign and date the form to validate it.

- Provide the completed form to the seller at the time of purchase.

Legal use of the ST-220 Form

The legal use of the ST-220 form is critical for maintaining compliance with state tax laws. Organizations must ensure they qualify for tax exemption and accurately complete the form. Misuse of the form, such as using it when not eligible, can lead to penalties, including back taxes and fines. It is advisable for organizations to keep records of all transactions involving the ST-220 form for auditing purposes.

Key elements of the ST-220 Form

Key elements of the ST-220 form include:

- Organization Information: Name, address, and tax identification number.

- Exemption Type: A clear indication of the exemption category under which the organization qualifies.

- Signature: The form must be signed by an authorized representative of the organization.

- Date: The date of signing is essential for record-keeping.

Who Issues the ST-220 Form

The ST-220 form is issued by the state tax authority in the respective state where the organization operates. Each state may have its own version of the form, so it is important to ensure that you are using the correct version applicable to your state. Organizations should verify the issuing authority to ensure compliance with local tax regulations.

Quick guide on how to complete what are st 220 forms

Complete What Are St 220 Forms effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents rapidly without delays. Manage What Are St 220 Forms on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign What Are St 220 Forms without effort

- Obtain What Are St 220 Forms and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and eSign What Are St 220 Forms and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what are st 220 forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What Are St 220 Forms?

What Are St 220 Forms? They are specific forms used for various tax-related purposes, particularly in New York State. Understanding these forms is crucial for businesses to ensure compliance with tax regulations and to make informed financial decisions.

-

How do airSlate SignNow features help with St 220 Forms?

airSlate SignNow provides features like document templates and eSignature capabilities that simplify the process of managing St 220 Forms. With our platform, you can easily create, edit, and securely sign these forms, making it efficient for businesses to handle their tax documentation.

-

Are there any costs associated with using airSlate SignNow for St 220 Forms?

Yes, using airSlate SignNow for St 220 Forms does involve a subscription fee, but it remains a cost-effective solution. Our pricing plans are designed to accommodate various business needs, providing excellent value for the features and benefits offered.

-

What are the benefits of using airSlate SignNow for managing St 220 Forms?

Using airSlate SignNow for managing St 220 Forms streamlines your document workflow, improves accuracy, and saves time. It allows businesses to quickly gather signatures and ensures that critical forms are completed in a timely manner, ultimately enhancing productivity.

-

Can airSlate SignNow integrate with other software for handling St 220 Forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage St 220 Forms within your existing workflows. This integration capability enhances efficiency by reducing manual data entry and ensuring that your documents are always in sync.

-

Is airSlate SignNow user-friendly for those unfamiliar with St 220 Forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, even for those unfamiliar with St 220 Forms. Our intuitive interface and guided workflows help users navigate the process effortlessly, ensuring that both novices and experienced users can manage their documents with ease.

-

What security measures are in place when using airSlate SignNow with St 220 Forms?

airSlate SignNow prioritizes security for all documents, including St 220 Forms. We implement industry-standard encryption, secure storage, and advanced authentication methods to protect your sensitive information throughout the sign-off process.

Get more for What Are St 220 Forms

- Aircraft lease agreement findlegalformscom

- Manifestation 101 how to manifest anything your heart desires form

- Transmittal information form georgia corporation georgia secretary of

- In the superior court of hall county state of georgia form

- Divorce without minor children packet dawson county clerk of court form

- Sample forest products sale agreement georgia forestry commission form

- Petition for years support instructions i specific instructions 1 form

- Georgia how to fill petition to probate will in solemn form fill out and

Find out other What Are St 220 Forms

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now