CBJ Hardship Exemption Application City and Borough of Juneau Juneau Form

What is the CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

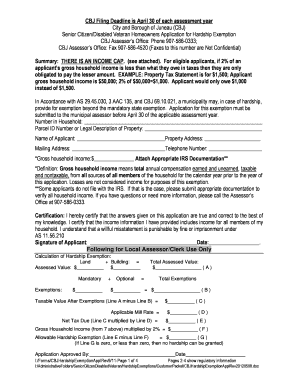

The CBJ Hardship Exemption Application is a specific form used by residents of Juneau, Alaska, to request a property tax exemption based on financial hardship. This application allows eligible individuals to seek relief from property taxes, providing them with essential financial support during difficult times. The exemption is designed to assist those who may be struggling due to various circumstances, such as unemployment, medical expenses, or other significant financial burdens.

Steps to complete the CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

Completing the CBJ Hardship Exemption Application involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income, expenses, and any relevant financial statements. Next, fill out the application form carefully, providing all requested information. It is crucial to review the form for any errors or omissions before submission. Once completed, submit the application to the appropriate city office, either online or by mail, depending on the available options.

Eligibility Criteria for the CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

To qualify for the CBJ Hardship Exemption, applicants must meet specific eligibility criteria. Generally, this includes being a resident of Juneau, demonstrating financial hardship, and having a property that qualifies under the exemption guidelines. Factors such as income level, household size, and existing financial obligations are considered during the evaluation process. It is important for applicants to provide accurate and complete information to facilitate a fair assessment of their situation.

Required Documents for the CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

When applying for the CBJ Hardship Exemption, certain documents are required to support the application. These may include proof of income, such as pay stubs or tax returns, documentation of expenses like medical bills or mortgage statements, and any other relevant financial records. Having these documents ready will help streamline the application process and ensure that the city can make an informed decision regarding the exemption request.

Form Submission Methods for the CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

The CBJ Hardship Exemption Application can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online via the city’s official website, ensuring a quick and efficient process. Alternatively, the completed application can be mailed to the designated city office or delivered in person. It is essential to follow the submission guidelines provided by the city to ensure timely processing of the application.

Legal use of the CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

The legal use of the CBJ Hardship Exemption Application is governed by local laws and regulations pertaining to property tax exemptions. Submitting a valid application is crucial for obtaining the exemption legally. The city reviews each application to determine eligibility based on established criteria. Ensuring compliance with all legal requirements not only protects the applicant's interests but also upholds the integrity of the exemption process.

Quick guide on how to complete cbj hardship exemption application city and borough of juneau juneau

Complete CBJ Hardship Exemption Application City And Borough Of Juneau Juneau effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage CBJ Hardship Exemption Application City And Borough Of Juneau Juneau on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to alter and eSign CBJ Hardship Exemption Application City And Borough Of Juneau Juneau with ease

- Locate CBJ Hardship Exemption Application City And Borough Of Juneau Juneau and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require the printing of new copies. airSlate SignNow addresses your document management requirements in just a few clicks from a device of your preference. Modify and eSign CBJ Hardship Exemption Application City And Borough Of Juneau Juneau and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cbj hardship exemption application city and borough of juneau juneau

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CBJ Hardship Exemption Application for the City and Borough of Juneau?

The CBJ Hardship Exemption Application for the City and Borough of Juneau is designed to assist residents who may qualify for property tax exemptions due to financial hardships. This application allows eligible residents to receive relief that can signNowly reduce their property tax burden, making it easier for those in need to manage their finances.

-

How do I apply for the CBJ Hardship Exemption Application in Juneau?

To apply for the CBJ Hardship Exemption Application in Juneau, you must fill out the necessary forms and provide documentation of your financial status. Submissions can be done online or by mail, ensuring a convenient process for all applicants. Once submitted, your application will be reviewed, and you will be notified about the outcome.

-

What documents are required for the CBJ Hardship Exemption Application?

When applying for the CBJ Hardship Exemption Application, you’ll typically need to provide proof of income, tax returns, and any relevant financial statements. These documents help verify your eligibility and financial hardship status. It’s essential to have all required paperwork ready to expedite the application process.

-

Is there a fee for submitting the CBJ Hardship Exemption Application?

There is no fee associated with submitting the CBJ Hardship Exemption Application for the City and Borough of Juneau. This is part of the effort to make financial relief accessible to those who may be struggling. Ensure to submit your application on time to benefit from the exemptions available.

-

How long does it take to process the CBJ Hardship Exemption Application?

The processing time for the CBJ Hardship Exemption Application can vary based on the volume of applications received. Generally, applicants can expect to receive a response within 4 to 6 weeks after submitting their forms. For any inquiries, you can contact the city’s tax office directly for updates on your application status.

-

What benefits does the CBJ Hardship Exemption Application provide?

The CBJ Hardship Exemption Application can provide signNow tax relief by reducing your property taxes based on your financial circumstances. This can help alleviate some of the financial pressures faced by residents during challenging times. By applying, you can secure the support you need to maintain homeownership.

-

Can I check the status of my CBJ Hardship Exemption Application online?

Yes, you can typically check the status of your CBJ Hardship Exemption Application online through the City and Borough of Juneau’s official website. Look for the designated section on property tax exemptions, where you can enter your details to view your application status. This feature allows you to stay informed without needing to call.

Get more for CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

- The client the contractor contract for painting services form

- Control number mo 14 09 form

- Business entity owner form

- Judgment of the full order of protection adult this missouri courts form

- Statement of income and expenses for use in dissolution of marriage form

- Cs 96 acknowledgment agreeing to termination of child supp form

- Execution application and order 16th circuit court of jackson form

- Control number mo ed1014 form

Find out other CBJ Hardship Exemption Application City And Borough Of Juneau Juneau

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure