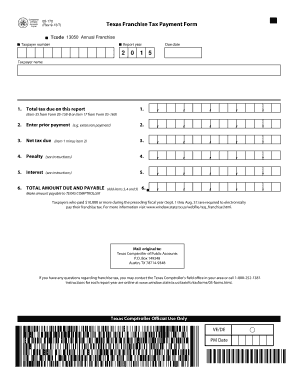

05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment Form

What is the 05 170 Annual Texas Franchise Tax Payment?

The 05 170 Annual Texas Franchise Tax Payment is a form used by businesses operating in Texas to report and pay their franchise tax obligations. This tax is assessed on entities conducting business in the state, including corporations, limited liability companies (LLCs), and partnerships. The form is essential for ensuring compliance with state tax laws and maintaining good standing with the Texas Comptroller of Public Accounts.

Steps to Complete the 05 170 Annual Texas Franchise Tax Payment

Completing the 05 170 form involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect financial data, including revenue figures and details about your business structure.

- Access the Form: Obtain the 05 170 form from the Texas Comptroller's website or through authorized software.

- Fill Out the Form: Carefully enter your business information, revenue details, and calculate the tax owed based on the guidelines provided.

- Review for Accuracy: Double-check all entries for correctness to avoid penalties or delays.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the 05 170 Annual Texas Franchise Tax Payment

The 05 170 form is legally binding when completed and submitted according to Texas law. It serves as an official record of a business's tax obligations and payments. To ensure legal compliance, businesses must adhere to the guidelines set forth by the Texas Comptroller and maintain accurate records of their submissions. Failure to comply can result in penalties, including interest on unpaid taxes and potential legal action.

Filing Deadlines / Important Dates

Filing deadlines for the 05 170 form are crucial for businesses to avoid penalties. Typically, the form is due on May 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for businesses to mark their calendars and prepare their documents in advance to ensure timely submission.

Key Elements of the 05 170 Annual Texas Franchise Tax Payment

Understanding the key elements of the 05 170 form is essential for accurate completion. The form includes sections for:

- Business Identification: Name, address, and tax identification number of the business.

- Revenue Reporting: Total revenue figures from the previous year.

- Tax Calculation: Detailed calculations to determine the franchise tax owed.

- Signature and Certification: Required signatures to validate the submission.

Form Submission Methods

Businesses can submit the 05 170 form through various methods, ensuring flexibility and convenience. Options include:

- Online Submission: Using the Texas Comptroller's e-filing system for quick and efficient processing.

- Mail: Sending a printed copy of the completed form to the appropriate address provided by the Texas Comptroller.

- In-Person: Delivering the form directly to a local Comptroller office for immediate processing.

Quick guide on how to complete 05 170 annual texas franchise tax payment 05 170 annual texas franchise tax payment

Effortlessly Prepare 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment with Ease

- Locate 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over missing or misallocated files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment while ensuring outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 170 annual texas franchise tax payment 05 170 annual texas franchise tax payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 05 170, and how is it used?

The form 05 170 is a specific document used for various administrative purposes, often requiring electronic signatures. With airSlate SignNow, you can easily manage and send this form securely, ensuring compliance and efficiency in your business processes.

-

How can airSlate SignNow help me with form 05 170?

airSlate SignNow provides a straightforward platform for sending, signing, and managing your form 05 170. You'll benefit from features like secure storage, tracking, and templates that simplify the completion and submission of your documents.

-

What are the pricing options for using airSlate SignNow with form 05 170?

airSlate SignNow offers flexible pricing plans based on your usage needs, ensuring you get the best value for managing your form 05 170. Choose from various tiers that provide different levels of features, suitable for both small businesses and large enterprises.

-

Can I integrate airSlate SignNow when working with form 05 170?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and platforms, making it easy to use alongside your existing systems while handling form 05 170. This ensures a smooth workflow, allowing you to automate document management efficiently.

-

What are the benefits of using airSlate SignNow for form 05 170?

Using airSlate SignNow for form 05 170 enhances your efficiency and productivity by streamlining the document signing process. You gain instant access to signed documents, eliminate paper clutter, and improve turnaround times, making your operations more effective.

-

Is airSlate SignNow secure for managing form 05 170?

Absolutely, airSlate SignNow prioritizes security for all documents, including form 05 170. With advanced encryption and compliance with industry standards, you can trust that your sensitive information is well protected while conducting business.

-

Can I track the progress of my form 05 170 using airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your form 05 170. You can see when your document has been sent, viewed, and signed, ensuring you stay informed throughout the signing process.

Get more for 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment

- Declaration of trust under the massachusetts uniform custodial trust act

- 642 903 form and effect of receipt and acceptance by

- A registered in the name of the transferor an adult other than the transferor or a trust company followed in substance b form

- Notice of lien for medial services by hospital form

- Statutory and common law repairmens liens in illinois form

- The law of torts a treatise on the principles of form

- Bill of sale form colorado warranty deed form templates

- If so with regard to each form

Find out other 05 170 Annual Texas Franchise Tax Payment 05 170 Annual Texas Franchise Tax Payment

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document