Amended it 203 Form

What is the Amended It 203 Form

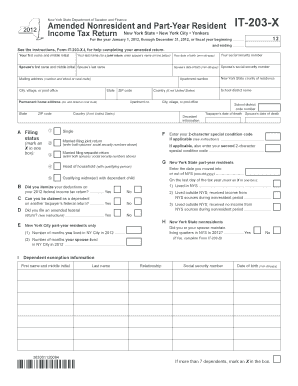

The Amended IT-203 Form is a tax document used by non-residents of New York State to amend their previous tax returns. This form allows individuals to correct errors, claim additional deductions, or report changes in income that were not included in the original filing. It is essential for ensuring compliance with state tax regulations and for accurately reflecting an individual's tax obligations.

How to use the Amended It 203 Form

To effectively use the Amended IT-203 Form, start by gathering all relevant documentation, including your original tax return and any supporting documents for the changes you are making. Complete the form by filling in your personal information, the tax year you are amending, and the specific changes being made. Ensure that you provide clear explanations for each amendment to facilitate the review process by the New York State Department of Taxation and Finance.

Steps to complete the Amended It 203 Form

Completing the Amended IT-203 Form involves several key steps:

- Obtain the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the original return.

- List the changes you are making, including any additional income or deductions.

- Attach any necessary documentation to support your amendments.

- Review the completed form for accuracy before submission.

Legal use of the Amended It 203 Form

The legal use of the Amended IT-203 Form is governed by New York State tax laws. It is crucial to ensure that all information provided is accurate and truthful, as submitting false information can lead to penalties or legal repercussions. The form must be filed within a specific timeframe, typically within three years of the original filing date, to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Amended IT-203 Form are critical to avoid penalties. Generally, the amended form must be submitted within three years from the original due date of the return. It is advisable to check the New York State Department of Taxation and Finance website for specific dates related to the current tax year, as these can change annually.

Required Documents

When submitting the Amended IT-203 Form, you must include certain required documents to support your amendments. These may include:

- A copy of your original IT-203 form.

- Any W-2 or 1099 forms that reflect changes in income.

- Documentation for additional deductions or credits claimed.

- Any correspondence with the New York State Department of Taxation and Finance regarding your original return.

Quick guide on how to complete amended it 203 form

Complete Amended It 203 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Amended It 203 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Amended It 203 Form with ease

- Find Amended It 203 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Amended It 203 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amended it 203 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Amended It 203 Form used for?

The Amended It 203 Form is designed for New York State taxpayers who need to modify a previously submitted tax return. It allows individuals to make necessary corrections to their income, deductions, or credits. By using the Amended It 203 Form, taxpayers can ensure their tax records are accurate, which can assist in gaining any additional refunds or addressing discrepancies.

-

How can airSlate SignNow assist with the Amended It 203 Form?

airSlate SignNow simplifies the process of filling out and eSigning the Amended It 203 Form. Our platform offers user-friendly templates and tools that streamline document preparation, making it easier to ensure accurate submissions. With airSlate SignNow, you can collaborate with tax professionals or family members to complete your form effectively.

-

Is there a cost associated with using airSlate SignNow for the Amended It 203 Form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various needs, including individual and business users preparing the Amended It 203 Form. Our solutions are cost-effective and provide excellent value through features like secure eSigning, document tracking, and storage. Visit our pricing page for detailed information on different subscription options.

-

Are there specific features in airSlate SignNow that support the Amended It 203 Form process?

Absolutely, airSlate SignNow includes key features designed to assist users with the Amended It 203 Form, such as eSignature capabilities, customizable templates, and cloud storage. Additionally, our platform enables users to send reminders for unsigned documents and securely store completed forms for easy access in the future. This all-in-one solution enhances your tax preparation experience.

-

Can I integrate airSlate SignNow with other software to manage my Amended It 203 Form more efficiently?

Yes, airSlate SignNow offers seamless integrations with various productivity tools and platforms to help you manage your Amended It 203 Form efficiently. Popular integrations include Google Drive, Salesforce, and Microsoft Office applications, allowing you to streamline your workflow and access important documents conveniently. This connectivity simplifies the process of document management and collaboration.

-

What are the benefits of using airSlate SignNow for the Amended It 203 Form over traditional methods?

Using airSlate SignNow for the Amended It 203 Form provides numerous benefits compared to traditional paper methods. It enhances efficiency, reduces the risk of errors during the editing process, and ensures faster submission due to the eSigning feature. Furthermore, it minimizes the hassle of physical paperwork and allows for secure digital storage of your important tax documents.

-

How secure is airSlate SignNow when submitting my Amended It 203 Form?

airSlate SignNow prioritizes the security of your documents, including the Amended It 203 Form. We implement robust encryption techniques, secure cloud storage, and compliance with industry standards to protect your data. You can trust airSlate SignNow to safeguard your sensitive information while providing a reliable platform for eSignature and document management.

Get more for Amended It 203 Form

- Clinical nutrition internship program advisor statement of form

- Augusta health fitness child facility agreement form

- Calkins md form

- Icw group risk mangemenet accident investigation form icw group risk mangemenet accident investigation form

- Request records from form

- Patient registration form epic primary care

- Shadow afokafo orthometry form

- Event facility or entity name form

Find out other Amended It 203 Form

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe