NEVADA DEPARTMENT of TAXATION NAC 372 730 FORM and

What is the Nevada Department of Taxation NAC 372 730 Form?

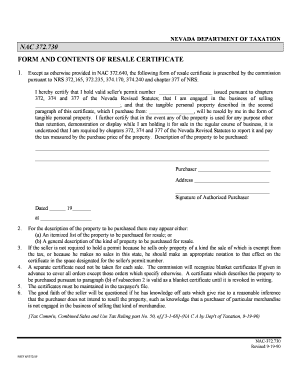

The Nevada Department of Taxation NAC 372 730 form, commonly referred to as the resale certificate, is a crucial document for businesses engaged in the sale of tangible personal property in Nevada. This form allows retailers to purchase goods without paying sales tax, provided that these goods are intended for resale. By submitting this certificate, businesses affirm that they are registered with the Nevada Department of Taxation and are compliant with state tax regulations. The resale certificate is essential for maintaining accurate tax records and ensuring that sales tax is only collected on final consumer sales.

Steps to Complete the Nevada Department of Taxation NAC 372 730 Form

Completing the Nevada resale certificate involves several straightforward steps:

- Obtain the form: You can access the Nevada resale certificate form from the Nevada Department of Taxation's official website or other authorized sources.

- Fill in your business information: This includes your business name, address, and sales tax permit number.

- Provide details of the seller: Include the name and address of the seller from whom you are purchasing items for resale.

- Describe the property: Clearly specify the type of goods you intend to purchase for resale.

- Sign and date the form: Ensure that the form is signed by an authorized representative of your business, along with the date of signing.

Once completed, the form should be presented to the seller at the time of purchase to validate the tax-exempt status of the transaction.

Legal Use of the Nevada Department of Taxation NAC 372 730 Form

The resale certificate is legally binding and serves as a declaration that the purchaser intends to resell the items acquired without paying sales tax. This form must be used in compliance with Nevada tax laws, which require that the purchaser is registered and in good standing with the Nevada Department of Taxation. Misuse of the resale certificate, such as using it for personal purchases or items not intended for resale, can lead to penalties, including fines and back taxes owed.

Key Elements of the Nevada Department of Taxation NAC 372 730 Form

Understanding the key elements of the Nevada resale certificate is essential for proper usage:

- Business Information: The form requires detailed information about the purchasing business, including the sales tax permit number.

- Seller Information: The name and address of the seller must be clearly indicated.

- Description of Goods: A clear description of the items being purchased for resale is necessary.

- Signature: An authorized signature is required to validate the form.

These elements ensure that the form is completed accurately and meets the legal requirements set forth by the state.

How to Obtain the Nevada Department of Taxation NAC 372 730 Form

The Nevada resale certificate can be obtained from several sources. The most reliable method is to visit the official website of the Nevada Department of Taxation, where the form is available for download. Additionally, businesses may request a physical copy from tax offices or authorized tax professionals. It is essential to ensure that you are using the most current version of the form to comply with state regulations.

Form Submission Methods

Once the Nevada resale certificate is completed, it can be submitted in various ways. The most common method is to present the form directly to the seller at the time of purchase. Some businesses may also choose to keep a copy for their records. It is important to note that the resale certificate does not need to be submitted to the state; it is primarily for use between the buyer and seller during transactions.

Quick guide on how to complete nevada department of taxation nac 372 730 form and

Complete NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to modify and electronically sign NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND with ease

- Locate NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nevada department of taxation nac 372 730 form and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Nevada form resale certificate?

A Nevada form resale certificate is a document that allows businesses in Nevada to purchase goods without paying sales tax. This form certifies that the buyer intends to resell the goods, thus qualifying for tax exemption. Using a Nevada form resale certificate can help businesses save money on their purchases and streamline their accounting processes.

-

How do I obtain a Nevada form resale certificate?

To obtain a Nevada form resale certificate, you typically need to register your business with the Nevada Department of Taxation. Once registered, you can fill out the form provided by the department. It’s important to ensure that you are using the latest version of the Nevada form resale certificate to avoid any compliance issues.

-

Can the Nevada form resale certificate be used for online purchases?

Yes, the Nevada form resale certificate can be used for online purchases. When making purchases from suppliers online, you can submit your resale certificate to ensure that sales tax is not applied. Make sure to verify that the seller accepts this form to facilitate a smooth transaction.

-

What benefits does using a Nevada form resale certificate provide to businesses?

Using a Nevada form resale certificate allows businesses to save on sales tax, which can signNowly lower overall costs. Additionally, it simplifies the purchasing process and helps maintain accurate accounting records. By utilizing this certificate, businesses can focus more on growth rather than tax concerns.

-

Are there any fees associated with using the Nevada form resale certificate?

There are generally no fees specific to using the Nevada form resale certificate itself. However, businesses may incur costs related to obtaining or renewing their business license. It’s best to review any potential administrative fees associated with your business registration and compliance.

-

How does airSlate SignNow help in managing the Nevada form resale certificate process?

airSlate SignNow provides an efficient platform for businesses to manage documents, including the Nevada form resale certificate. With eSignature capabilities, businesses can easily send, sign, and store their resale certificates securely. This simplifies the process and ensures compliance with state regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for managing Nevada form resale certificates?

Yes, airSlate SignNow offers integrations with various accounting software, allowing seamless management of the Nevada form resale certificate. This helps streamline operations by automatically syncing data and documents. Such integrations enhance productivity and ensure that you can easily access your resale certificates when needed.

Get more for NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND

Find out other NEVADA DEPARTMENT OF TAXATION NAC 372 730 FORM AND

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template