Basic Taxpayer Information ORG6 PERSONAL INFORMATION

What is the Basic Taxpayer Information ORG6 PERSONAL INFORMATION

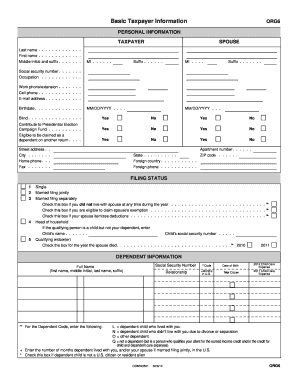

The Basic Taxpayer Information ORG6 PERSONAL INFORMATION is a crucial document that collects essential details about an individual taxpayer. This form typically includes personal identifiers such as name, Social Security number, address, and other relevant data necessary for tax purposes. Understanding this form is vital for compliance with tax regulations and ensures that taxpayers can accurately report their income and claim deductions or credits.

How to use the Basic Taxpayer Information ORG6 PERSONAL INFORMATION

Using the Basic Taxpayer Information ORG6 PERSONAL INFORMATION involves filling out the form accurately to reflect your current personal and financial status. It is essential to provide truthful and complete information to avoid complications during tax filing. Once completed, this form can be submitted electronically or via traditional mail, depending on the requirements of the tax authority or the specific purpose for which it is being used.

Steps to complete the Basic Taxpayer Information ORG6 PERSONAL INFORMATION

Completing the Basic Taxpayer Information ORG6 PERSONAL INFORMATION involves several straightforward steps:

- Gather all necessary personal information, including your full name, Social Security number, and current address.

- Fill out the form carefully, ensuring that all fields are completed accurately.

- Review the information for any errors or omissions.

- Sign and date the form if required, confirming that the information is correct.

- Submit the form according to the specified guidelines, either electronically or by mail.

Legal use of the Basic Taxpayer Information ORG6 PERSONAL INFORMATION

The Basic Taxpayer Information ORG6 PERSONAL INFORMATION is legally recognized as a valid document when completed correctly. It is essential to adhere to the regulations set forth by the Internal Revenue Service (IRS) and any applicable state tax authorities. Proper execution of this form ensures that it can be used for tax filing, audits, and other legal purposes without complications.

Key elements of the Basic Taxpayer Information ORG6 PERSONAL INFORMATION

Key elements of the Basic Taxpayer Information ORG6 PERSONAL INFORMATION include:

- Name: The full legal name of the taxpayer.

- Social Security Number: A unique identifier for tax purposes.

- Address: The current residential address of the taxpayer.

- Filing Status: Information regarding whether the taxpayer is single, married, or head of household.

- Income Information: Details about income sources which may be required for specific tax forms.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Basic Taxpayer Information ORG6 PERSONAL INFORMATION. Taxpayers are encouraged to refer to the IRS website or official publications for the most current instructions. Adhering to these guidelines ensures compliance and helps in avoiding potential penalties or issues during the tax filing process.

Quick guide on how to complete basic taxpayer information org6 personal information

Complete Basic Taxpayer Information ORG6 PERSONAL INFORMATION effortlessly on any gadget

Digital document handling has gained traction among organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Basic Taxpayer Information ORG6 PERSONAL INFORMATION on any gadget using airSlate SignNow Android or iOS apps and streamline any document-related process today.

The easiest method to modify and eSign Basic Taxpayer Information ORG6 PERSONAL INFORMATION with ease

- Obtain Basic Taxpayer Information ORG6 PERSONAL INFORMATION and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and has the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Basic Taxpayer Information ORG6 PERSONAL INFORMATION and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the basic taxpayer information org6 personal information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Basic Taxpayer Information ORG6 PERSONAL INFORMATION?

Basic Taxpayer Information ORG6 PERSONAL INFORMATION refers to essential details required for tax-related documentation. Understanding this information helps ensure compliance with tax laws while using electronic document signing services like airSlate SignNow.

-

How does airSlate SignNow handle Basic Taxpayer Information ORG6 PERSONAL INFORMATION?

AirSlate SignNow securely manages Basic Taxpayer Information ORG6 PERSONAL INFORMATION through its encrypted platform. We prioritize data protection, allowing users to eSign documents without compromising sensitive personal information.

-

What are the pricing options for airSlate SignNow related to Basic Taxpayer Information ORG6 PERSONAL INFORMATION?

Our pricing plans are designed to be cost-effective, accommodating businesses of all sizes. By leveraging features focused on Basic Taxpayer Information ORG6 PERSONAL INFORMATION, users can choose a plan that meets their operational needs.

-

What features does airSlate SignNow offer to manage Basic Taxpayer Information ORG6 PERSONAL INFORMATION?

AirSlate SignNow provides a range of features tailored for handling Basic Taxpayer Information ORG6 PERSONAL INFORMATION. These include customizable templates, secure document storage, and an intuitive eSigning process to enhance user experience.

-

How can I ensure compliance when using Basic Taxpayer Information ORG6 PERSONAL INFORMATION in airSlate SignNow?

To ensure compliance while managing Basic Taxpayer Information ORG6 PERSONAL INFORMATION in airSlate SignNow, follow best practices for document security. Utilize the platform’s compliance features, including audit trails and user authentication, to maintain document integrity.

-

Can I integrate airSlate SignNow with other software for Basic Taxpayer Information ORG6 PERSONAL INFORMATION management?

Yes, airSlate SignNow offers seamless integrations with various third-party applications. This allows you to streamline the handling of Basic Taxpayer Information ORG6 PERSONAL INFORMATION by connecting it with your existing workflows and tools.

-

What benefits does airSlate SignNow provide for managing Basic Taxpayer Information ORG6 PERSONAL INFORMATION?

Using airSlate SignNow for Basic Taxpayer Information ORG6 PERSONAL INFORMATION enhances efficiency and reduces paperwork. The solution facilitates quick document approval processes and helps you maintain compliance with tax documentation requirements seamlessly.

Get more for Basic Taxpayer Information ORG6 PERSONAL INFORMATION

- Control number ak p029 pkg form

- Control number ak p034 pkg form

- Control number ak p035 pkg form

- Control number ak p037 pkg form

- Control number ak p038 pkg form

- Alaska marriage forms and agreementsus legal forms

- Application for certificate of fitness alaska form

- Masonry formsamazoncompower ampamp hand tools

Find out other Basic Taxpayer Information ORG6 PERSONAL INFORMATION

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy