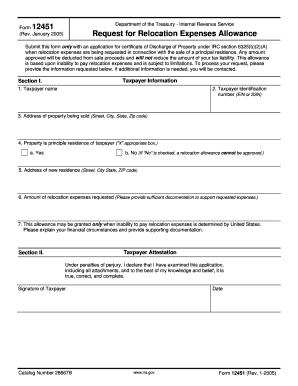

Irs Form 12451

What is the IRS Form 12451

The IRS Form 12451, also known as the "Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns," is a crucial document for businesses seeking additional time to file their tax returns. This form is primarily used by corporations and partnerships to request an extension, allowing them to avoid penalties for late filing. Understanding the purpose and implications of this form is essential for compliance with IRS regulations.

How to Use the IRS Form 12451

Using the IRS Form 12451 involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or through tax preparation software. Next, fill out the required fields, including your business information and the type of return for which you are requesting an extension. After completing the form, you can submit it electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to Complete the IRS Form 12451

Completing the IRS Form 12451 requires careful attention to detail. Follow these steps:

- Gather necessary information, such as your business name, address, and Employer Identification Number (EIN).

- Indicate the type of return for which you are requesting an extension.

- Provide the tax year for which the extension is being requested.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form by the due date of the original return to ensure compliance.

Legal Use of the IRS Form 12451

The legal use of the IRS Form 12451 is governed by specific IRS guidelines. When properly completed and submitted, this form grants businesses an automatic extension of time to file their tax returns. It is important to note that while the form provides additional time for filing, it does not extend the deadline for paying any taxes owed. Businesses must ensure that they meet all legal requirements to avoid penalties associated with late filing.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the IRS Form 12451 is critical for businesses. The form must be submitted by the original due date of the tax return to qualify for an extension. Typically, this is the fifteenth day of the fourth month following the end of the tax year for corporations. For partnerships, the deadline is the fifteenth day of the third month following the end of the tax year. Failing to meet these deadlines can result in penalties.

Form Submission Methods

The IRS Form 12451 can be submitted through various methods, providing flexibility for businesses. You can file the form electronically using IRS e-file services, which is often the quickest option. Alternatively, the form can be mailed to the appropriate IRS address, as specified in the instructions accompanying the form. It is essential to choose a submission method that aligns with your business's needs and ensures timely delivery.

Quick guide on how to complete irs form 12451

Complete Irs Form 12451 seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle Irs Form 12451 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign Irs Form 12451 effortlessly

- Locate Irs Form 12451 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, laborious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs Form 12451 to guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 12451

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 12451?

IRS Form 12451 is a document used for amending tax-related submissions or for reporting specific information to the IRS. Understanding how to correctly complete and submit IRS Form 12451 is crucial for accurate tax reporting. Utilizing tools like airSlate SignNow can simplify the process of managing and eSigning this important form.

-

How can airSlate SignNow help with IRS Form 12451?

airSlate SignNow offers a user-friendly platform that allows you to easily upload, sign, and send IRS Form 12451. Our solution ensures secure document management and provides the ability to track the status of your submissions efficiently. This can help streamline your workflow and reduce potential errors associated with IRS Form 12451.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Our packages provide cost-effective solutions for sending and eSigning documents, including IRS Form 12451. You can explore our pricing page for detailed information on plans that best suit your requirements.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow is compliant with IRS regulations and industry standards for electronic signatures and document management. Our platform ensures that your use of IRS Form 12451 meets all necessary legal requirements. This compliance helps you remain confident in your document handling process.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. Whether you're using accounting software, CRMs, or document storage solutions, our integrations help you manage IRS Form 12451 and other documents more effectively.

-

What security measures does airSlate SignNow have in place?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods and secure data storage to ensure that your documents, including IRS Form 12451, are protected from unauthorized access. With our security features, you can eSign and send sensitive information with confidence.

-

What are the benefits of using airSlate SignNow for IRS Form 12451?

Using airSlate SignNow for IRS Form 12451 provides signNow benefits, including time savings and enhanced accuracy. Our platform simplifies the signing process, allowing you to manage multiple forms efficiently. Additionally, you receive notifications and reminders, ensuring that you never miss a submission deadline.

Get more for Irs Form 12451

- Lessee do hereby covenant contract and agree as follows form

- This financial statement disclosure is for use in connection with a premarital agreement form

- Hereby revoked and cancelled for all purposes form

- How to file arizona articles of incorporationharbor form

- Organized pursuant to the laws of the state of arizona hereinafter quotcorporationquot form

- For profit business corporation form

- Az 00llc 1 form

- Statement of correction clear form print form

Find out other Irs Form 12451

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form