Shdr Hsa Form

What is the SHDR HSA?

The SHDR HSA, or the Health Savings Account, is a tax-advantaged account designed to help individuals save for medical expenses. It is specifically tailored for those enrolled in high-deductible health plans (HDHPs). Contributions made to the SHDR HSA are tax-deductible, and the funds can grow tax-free. Withdrawals for qualified medical expenses are also tax-free, making it a beneficial tool for managing healthcare costs.

How to Use the SHDR HSA

Using the SHDR HSA involves several straightforward steps. First, ensure you are enrolled in a qualified high-deductible health plan. Next, you can open an SHDR HSA account through a financial institution or bank that offers HSAs. Once the account is established, you can contribute funds, which can be used for eligible medical expenses, such as doctor visits, prescriptions, and preventive care. It's important to keep receipts for all transactions to substantiate your claims in case of an audit.

Steps to Complete the SHDR HSA

Completing the SHDR HSA involves a series of steps to ensure proper management of the account. Start by determining your eligibility based on your health insurance plan. Then, open your HSA account and make contributions within the annual limits set by the IRS. Keep track of your medical expenses and use your HSA funds accordingly. At the end of the tax year, report your contributions and distributions on your tax return using IRS Form 8889.

Legal Use of the SHDR HSA

The legal use of the SHDR HSA is governed by IRS regulations. To maintain compliance, funds from the HSA must be used exclusively for qualified medical expenses. Non-compliance can result in penalties, including taxes on distributions not used for eligible expenses. It is crucial to stay informed about the IRS guidelines to ensure that the account is utilized correctly and to avoid any legal issues.

Eligibility Criteria

To qualify for an SHDR HSA, individuals must be enrolled in a high-deductible health plan. The IRS defines the minimum deductible and maximum out-of-pocket expenses for these plans annually. Additionally, individuals cannot be enrolled in Medicare or claimed as a dependent on someone else's tax return. Meeting these criteria is essential to ensure that contributions to the SHDR HSA are tax-deductible.

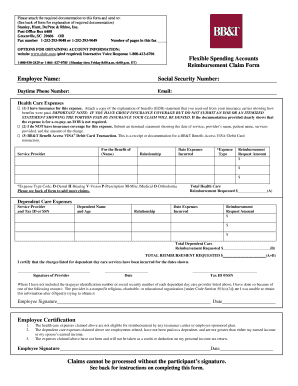

Required Documents

When managing an SHDR HSA, certain documents are necessary for compliance and record-keeping. These include proof of eligibility, such as a health insurance card showing enrollment in a high-deductible plan. Additionally, receipts for all medical expenses paid using HSA funds should be retained. It's also advisable to keep records of contributions made to the account for tax purposes.

Quick guide on how to complete shdr hsa

Complete Shdr Hsa effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the necessary form and store it safely online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents swiftly without delays. Handle Shdr Hsa on any device with the airSlate SignNow Android or iOS applications, and simplify any document-related process today.

How to modify and eSign Shdr Hsa with ease

- Locate Shdr Hsa and then click Get Form to begin.

- Make use of the tools provided to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your digital signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your updates.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Shdr Hsa to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the shdr hsa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the shdr login process for airSlate SignNow?

The shdr login process for airSlate SignNow is straightforward. Users need to visit the official SignNow website, click on the 'Login' button, and enter their credentials. Once logged in, you can easily access all features for eSigning and sending documents.

-

How can I reset my shdr login password?

If you need to reset your shdr login password, simply go to the login page and click on 'Forgot Password?'. You will receive an email with instructions to create a new password. This ensures that you can regain access to your account securely.

-

Is there a cost associated with using the shdr login feature?

Using the shdr login feature is part of the airSlate SignNow subscription, which is cost-effective. The pricing plans are designed to cater to various business needs, and you can choose a plan that fits your budget. SignNow also offers a free trial, allowing you to explore its features at no cost.

-

What features can I access after shdr login?

After shdr login, users gain access to a wide range of features, including document templates, team collaboration tools, and advanced eSigning capabilities. You can also track document status and manage workflows efficiently. These features enhance your document management experience.

-

Can I integrate other apps with my shdr login account?

Yes, airSlate SignNow allows integration with various apps to streamline your workflow. Once you complete your shdr login, you can connect SignNow with applications like Google Drive, Dropbox, and CRM systems. This integration improves productivity by centralizing your document management.

-

Is my information secure after shdr login?

Absolutely! airSlate SignNow prioritizes your security and employs advanced encryption methods to protect your information. After shdr login, your documents and data are safeguarded, ensuring compliance with industry standards and regulations.

-

How do I contact customer support for shdr login issues?

For any shdr login issues, you can easily contact airSlate SignNow's customer support. They offer multiple channels including live chat, email, and a comprehensive help center. Their dedicated support team is ready to assist you with any inquiries or problems you may encounter.

Get more for Shdr Hsa

- Fl 960 notice of withdrawal of attorney of record california form

- Change of name packet san diego superior court ca form

- Name change selfhelp center locaons superior form

- To conform to gender identity

- Nc 130 decree changing name california courts cagov form

- After my series on the top 10 changes to construction form

- Nc 130 decree changing name california courts form

- Form nc 230 download printable pdf decree changing name and

Find out other Shdr Hsa

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple