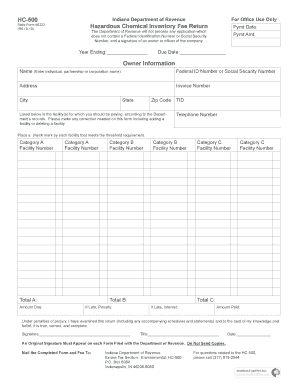

HC 500 Indiana Department of Revenue for Office Use Only Form

What is the HC 500 Indiana Department Of Revenue For Office Use Only

The HC 500 Indiana Department Of Revenue For Office Use Only form is a specific document utilized by the Indiana Department of Revenue for administrative purposes. This form is primarily used to collect essential information related to tax matters, ensuring that the department can manage records efficiently. The designation "For Office Use Only" indicates that this form is not intended for public distribution or general use, but rather serves internal functions within the department.

How to use the HC 500 Indiana Department Of Revenue For Office Use Only

Using the HC 500 form involves several steps, primarily focused on filling out the required fields accurately. Users should ensure that they have all necessary information at hand, including personal identification details and any relevant tax information. After completing the form, it should be submitted according to the instructions provided by the Indiana Department of Revenue, typically through designated channels for internal processing.

Steps to complete the HC 500 Indiana Department Of Revenue For Office Use Only

Completing the HC 500 form requires careful attention to detail. Follow these steps:

- Gather all necessary information, including your identification details and tax-related data.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate method as indicated by the Indiana Department of Revenue.

Legal use of the HC 500 Indiana Department Of Revenue For Office Use Only

The HC 500 form is legally recognized within the framework of Indiana tax regulations. It is essential for maintaining compliance with state tax laws. Proper completion and submission of this form can help ensure that all tax-related matters are handled correctly, thereby avoiding potential legal issues or penalties associated with improper filing.

Key elements of the HC 500 Indiana Department Of Revenue For Office Use Only

Key elements of the HC 500 form include:

- Identification fields for the individual or entity submitting the form.

- Specific tax-related information that must be provided.

- Signature lines for verification purposes, ensuring the authenticity of the submission.

Form Submission Methods

The HC 500 form can be submitted through various methods as specified by the Indiana Department of Revenue. Common submission methods include:

- Online submission through the department's official portal.

- Mailing the completed form to the designated office address.

- In-person delivery at local department offices.

Quick guide on how to complete hc 500 indiana department of revenue for office use only

Effortlessly prepare HC 500 Indiana Department Of Revenue For Office Use Only on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, enabling you to access the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage HC 500 Indiana Department Of Revenue For Office Use Only on any device using airSlate SignNow apps for Android or iOS and enhance any document-oriented procedure today.

How to modify and electronically sign HC 500 Indiana Department Of Revenue For Office Use Only effortlessly

- Find HC 500 Indiana Department Of Revenue For Office Use Only and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant parts of the documents or obscure confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and holds the same legal power as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would prefer to share your form, via email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, frustrating form searches, or errors that necessitate creating new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Adapt and electronically sign HC 500 Indiana Department Of Revenue For Office Use Only and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hc 500 indiana department of revenue for office use only

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HC 500 Indiana Department Of Revenue For Office Use Only form?

The HC 500 Indiana Department Of Revenue For Office Use Only form is a specific document required by the Indiana Department of Revenue for certain tax-related purposes. It is essential for individuals and businesses that need to submit information accurately to ensure compliance. Using airSlate SignNow can streamline the process of completing and electronically signing this form.

-

How can airSlate SignNow help with the HC 500 Indiana Department Of Revenue For Office Use Only?

airSlate SignNow simplifies the process of filling out and submitting the HC 500 Indiana Department Of Revenue For Office Use Only form. Our platform allows you to easily create, edit, and eSign documents, ensuring that you can manage your tax-related paperwork efficiently and securely. This minimizes errors and saves time.

-

Is there a cost associated with using airSlate SignNow for the HC 500 Indiana Department Of Revenue For Office Use Only?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features and number of users, the pricing may vary. Investing in a plan will provide you with the necessary tools to handle documents like the HC 500 Indiana Department Of Revenue For Office Use Only effortlessly.

-

What features does airSlate SignNow offer for managing the HC 500 Indiana Department Of Revenue For Office Use Only?

airSlate SignNow offers features such as document templates, electronic signatures, and advanced workflow capabilities tailored for forms like the HC 500 Indiana Department Of Revenue For Office Use Only. These functionalities help streamline document management and ensure compliance with legal standards. Additionally, our platform enhances collaboration among team members.

-

Can I integrate airSlate SignNow with other applications while handling the HC 500 Indiana Department Of Revenue For Office Use Only?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow while managing the HC 500 Indiana Department Of Revenue For Office Use Only. Whether you use CRM tools, project management software, or cloud storage services, our integrations allow for better efficiency and document coordination.

-

What benefits will I gain from using airSlate SignNow for tax forms like HC 500 Indiana Department Of Revenue For Office Use Only?

Utilizing airSlate SignNow for forms such as HC 500 Indiana Department Of Revenue For Office Use Only offers numerous benefits, including improved accuracy, decreased turnaround time, and secure document handling. By adopting our platform, you ensure that your forms are completed and submitted rapidly while maintaining data integrity across all submissions.

-

Is airSlate SignNow user-friendly for completing the HC 500 Indiana Department Of Revenue For Office Use Only?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users of all experience levels to navigate the platform and complete the HC 500 Indiana Department Of Revenue For Office Use Only form easily. Our platform also provides helpful resources and support for any questions you might have.

Get more for HC 500 Indiana Department Of Revenue For Office Use Only

- The state of delaware in and for county form

- Justice of the peace court of the state of delaware form

- Civil trials court of common pleas delaware courts state form

- State by state survey of process server form

- Justia statement of plaintiff in support of court forms

- System id form

- Civil 21 inv1doc form

- Service on non residents form

Find out other HC 500 Indiana Department Of Revenue For Office Use Only

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast