Fbmc Salary Reduction Agreement Form

What is the Fbmc Salary Reduction Agreement Form

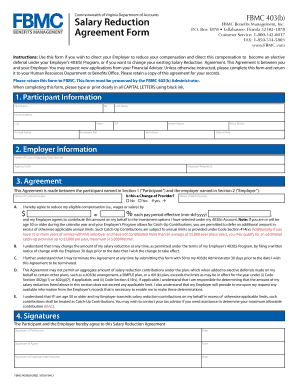

The Fbmc Salary Reduction Agreement Form is a legal document that allows employees to agree to a reduction in their salary for specific purposes, such as contributions to retirement plans or other benefits. This form is essential for ensuring compliance with federal regulations and internal company policies. By using this form, employees can formalize their choice to allocate a portion of their salary towards benefits, which can lead to tax advantages and enhanced financial planning.

How to use the Fbmc Salary Reduction Agreement Form

Using the Fbmc Salary Reduction Agreement Form involves several straightforward steps. First, employees should obtain the form from their employer or the designated HR department. Once acquired, the employee needs to fill in their personal details, including name, employee ID, and the specific amount or percentage of salary to be reduced. After completing the form, it should be submitted to the HR department for processing. It is advisable to keep a copy for personal records.

Steps to complete the Fbmc Salary Reduction Agreement Form

Completing the Fbmc Salary Reduction Agreement Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from your employer.

- Fill in your personal information, including your name and employee identification number.

- Specify the amount or percentage of salary to be reduced.

- Indicate the purpose of the salary reduction, such as retirement contributions.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your agreement.

- Submit the completed form to your HR department.

Key elements of the Fbmc Salary Reduction Agreement Form

The Fbmc Salary Reduction Agreement Form includes several critical elements that ensure its effectiveness and legality. Key components typically include:

- Employee Information: Personal details of the employee, including name and identification number.

- Salary Reduction Amount: The specific amount or percentage of salary to be reduced.

- Purpose of Reduction: A clear indication of what the salary reduction will be used for, such as retirement plans.

- Signatures: The employee's signature and date, confirming their consent.

Legal use of the Fbmc Salary Reduction Agreement Form

To ensure the legal validity of the Fbmc Salary Reduction Agreement Form, it must comply with relevant federal and state regulations. This includes adherence to the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. By following the prescribed guidelines and ensuring that all necessary information is accurately provided, the form can be considered legally binding. It is important for both employees and employers to understand the implications of the agreement to avoid potential disputes.

Eligibility Criteria

Eligibility to use the Fbmc Salary Reduction Agreement Form typically depends on employment status and the specific benefits offered by the employer. Generally, full-time employees are eligible to participate in salary reduction agreements for retirement plans or other benefits. Part-time employees may have different eligibility criteria, and it is essential to consult company policies or HR for specific details. Understanding these criteria helps ensure that employees can effectively utilize the form to their advantage.

Quick guide on how to complete fbmc salary reduction agreement form

Complete Fbmc Salary Reduction Agreement Form effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Fbmc Salary Reduction Agreement Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Fbmc Salary Reduction Agreement Form effortlessly

- Find Fbmc Salary Reduction Agreement Form and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or black out confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from your preferred device. Edit and eSign Fbmc Salary Reduction Agreement Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fbmc salary reduction agreement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fbmc Salary Reduction Agreement Form?

The Fbmc Salary Reduction Agreement Form is a document that allows employees to allocate a portion of their salary towards specific benefits pre-tax. This agreement can help maximize tax savings while ensuring compliance with IRS regulations. Using airSlate SignNow, you can easily create, send, and sign your Fbmc Salary Reduction Agreement Form.

-

How can I create an Fbmc Salary Reduction Agreement Form using airSlate SignNow?

Creating an Fbmc Salary Reduction Agreement Form with airSlate SignNow is straightforward. Simply log in to your account, choose ‘Create Document’, and utilize our templates to customize your agreement. Once ready, you can send it for signature to all involved parties quickly and efficiently.

-

What are the benefits of using the Fbmc Salary Reduction Agreement Form?

The benefits of using the Fbmc Salary Reduction Agreement Form include tax savings, increased take-home pay, and flexibility in managing employee benefits. This form simplifies the process of salary reduction, making it easier for both employers and employees to manage payroll deductions. Additionally, electronic signing through airSlate SignNow ensures a smooth and fast process.

-

Are there any costs associated with using the Fbmc Salary Reduction Agreement Form?

Using the Fbmc Salary Reduction Agreement Form on airSlate SignNow is part of our overall pricing plans, which provide cost-effective access to document signing and management features. You can choose from several subscription options based on your business needs. Each plan allows unlimited access to create and manage your forms efficiently.

-

Can I integrate the Fbmc Salary Reduction Agreement Form with other software?

Yes, airSlate SignNow allows integration with various software applications to enhance your workflow. You can connect your Fbmc Salary Reduction Agreement Form with HR platforms, payroll systems, and other productivity tools. This seamless integration streamlines the signing process and improves data accuracy.

-

Is the Fbmc Salary Reduction Agreement Form compliant with tax regulations?

Absolutely. The Fbmc Salary Reduction Agreement Form complies with IRS guidelines, making sure that any salary reductions adhere to tax regulations. By using airSlate SignNow, you can ensure the form is accurately filled out and legally binding, which mitigates compliance risks for your business.

-

How does airSlate SignNow ensure the security of my Fbmc Salary Reduction Agreement Form?

AirSlate SignNow prioritizes the security of your documents, including the Fbmc Salary Reduction Agreement Form, with advanced encryption methods and secure access controls. All data is stored in secure servers, ensuring that sensitive information remains confidential throughout the signing process. You can trust that your agreements are safe and protected.

Get more for Fbmc Salary Reduction Agreement Form

- I have not form

- Leased dwelling form

- Petition for dissolution of marriage with no minor or form

- I will again offer payment form

- Constitute sexual harassment form

- This notice is provided to you in accordance with the provisions of the fair housing act 42 form

- The circumstances of my departure from the leased premises as you know were as follows form

- Maintain the roof in good repair and watertight condition form

Find out other Fbmc Salary Reduction Agreement Form

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter