Wisconsin Form 804

What is the Wisconsin Form 804

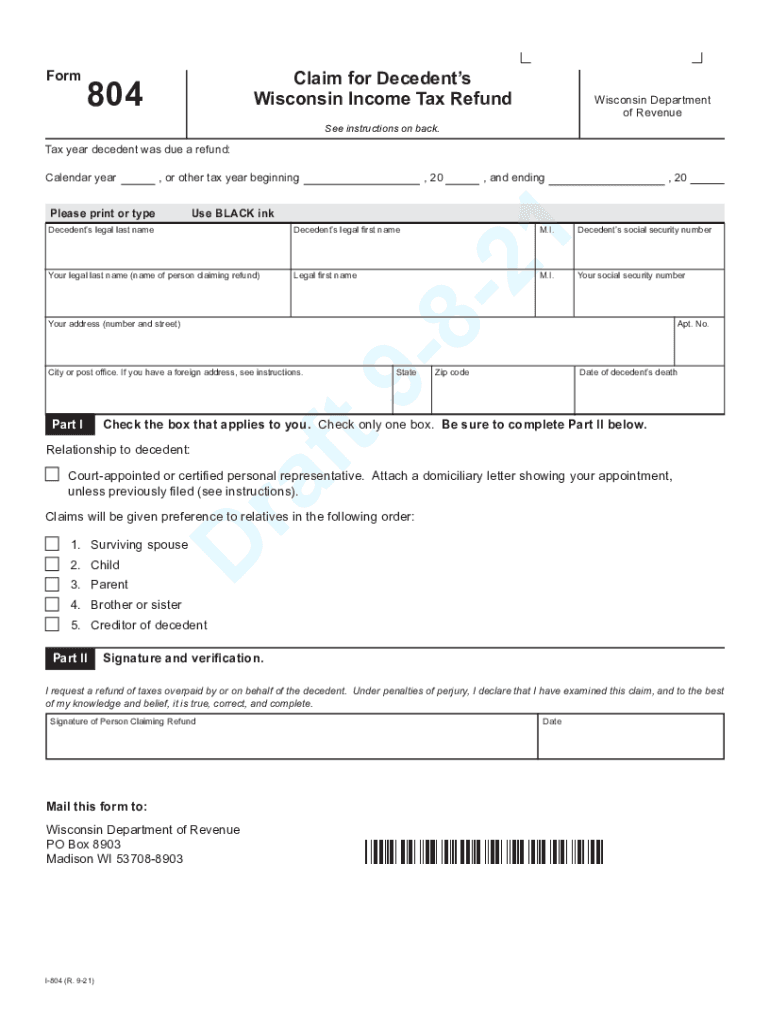

The Wisconsin Form 804 is a tax form used by individuals and businesses to report specific income and deductions for state tax purposes. This form is particularly relevant for those who have received income from various sources, including self-employment, rental properties, or investments. It serves as a means to calculate the tax owed to the state of Wisconsin and to ensure compliance with state tax regulations. Understanding the purpose and requirements of this form is essential for accurate tax reporting and to avoid potential penalties.

How to use the Wisconsin Form 804

Using the Wisconsin Form 804 involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all income sources and deductions are accurately reported. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or issues with the state tax authority. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Wisconsin Form 804

Completing the Wisconsin Form 804 requires a systematic approach to ensure accuracy. Here are the steps to follow:

- Collect Documentation: Gather all necessary income statements and deduction records.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately list all sources of income, including wages, self-employment income, and investment earnings.

- Claim Deductions: Identify and claim any applicable deductions to reduce your taxable income.

- Calculate Tax Liability: Follow the form's instructions to calculate the total tax owed.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: Choose your preferred submission method and send the form to the appropriate state tax authority.

Legal use of the Wisconsin Form 804

The legal use of the Wisconsin Form 804 is governed by state tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted on time. Compliance with all relevant tax regulations is crucial to avoid penalties or audits. The form must be signed by the taxpayer or an authorized representative, affirming that the information provided is true and complete to the best of their knowledge. This legal affirmation helps maintain the integrity of the tax reporting process.

Key elements of the Wisconsin Form 804

Several key elements are essential to the Wisconsin Form 804. These include:

- Personal Information: Name, address, and Social Security number of the taxpayer.

- Income Reporting: Detailed sections for reporting various types of income.

- Deductions: Areas to claim allowable deductions that can reduce taxable income.

- Tax Calculation: Instructions for calculating total tax liability based on reported income and deductions.

- Signature Section: A place for the taxpayer's signature, confirming the accuracy of the information provided.

Form Submission Methods

The Wisconsin Form 804 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail Submission: The form can also be printed and mailed to the appropriate state tax office.

- In-Person Submission: Taxpayers may choose to deliver the form in person at designated tax offices.

Quick guide on how to complete wisconsin form 804

Complete Wisconsin Form 804 effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Wisconsin Form 804 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Wisconsin Form 804 without any hassle

- Retrieve Wisconsin Form 804 and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow manages your document administration needs in just a few clicks from any device you prefer. Edit and eSign Wisconsin Form 804 and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form 804

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin Form 804 2021?

The Wisconsin Form 804 2021 is a specific tax form required for individuals or businesses in Wisconsin to report certain tax information. It is essential for ensuring compliance with state tax regulations. By using airSlate SignNow, you can easily eSign and securely send your Wisconsin Form 804 2021, streamlining your tax filing process.

-

How can airSlate SignNow help with Wisconsin Form 804 2021?

airSlate SignNow provides an intuitive platform to effortlessly eSign and manage your Wisconsin Form 804 2021. With our service, you can eliminate the hassles of printing, scanning, and mailing documents. This not only saves time but also enhances the security and efficiency of your tax submissions.

-

Is there a cost associated with using airSlate SignNow for Wisconsin Form 804 2021?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individual users and larger organizations. Our pricing is competitive and designed to provide value considering the benefits of eSigning documents like the Wisconsin Form 804 2021. You can evaluate our plans to find the one that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Wisconsin Form 804 2021?

airSlate SignNow includes features like customizable templates, automated workflows, and the ability to track document status. These tools make it easier to manage your Wisconsin Form 804 2021, ensuring you remain organized and compliant with tax deadlines. Our platform also allows you to collaborate with others involved in the signing process.

-

Can I integrate airSlate SignNow with other software for my Wisconsin Form 804 2021?

Absolutely! airSlate SignNow offers integrations with a variety of popular applications like Google Drive, Dropbox, and CRM systems. This means you can seamlessly manage your documents, including the Wisconsin Form 804 2021, within the tools you already use. These integrations enhance productivity and streamline your workflow.

-

Is it secure to eSign Wisconsin Form 804 2021 with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and secure access protocols to protect your sensitive information. By eSigning your Wisconsin Form 804 2021 with our platform, you can ensure that your documents are handled securely and in compliance with industry standards.

-

What are the benefits of using airSlate SignNow for tax documents like Wisconsin Form 804 2021?

Using airSlate SignNow for your tax documents, including Wisconsin Form 804 2021, can greatly reduce time and error associated with traditional signing methods. You'll benefit from increased efficiency, reduced paperwork, and enhanced document security. Our tool also facilitates quick collaboration, making tax preparation much smoother.

Get more for Wisconsin Form 804

- Cobra insurancehealth benefits after job loss form

- Dept of labor podcast home page alaska department of form

- Form 43 notice to administrative law judge and employee

- Arizona unemployment direct deposit form fill online

- Mr 4 form

- Electrician experience verification form tdlr

- Guide for articles of entity form

- Instructions for completing statement of information form

Find out other Wisconsin Form 804

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT