Form 8853

What is the Form 8853

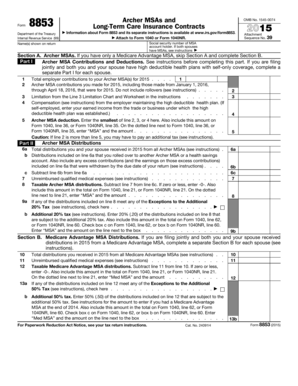

The Form 8853, officially known as the IRS Form 8853, is a tax document used by individuals to report Health Savings Accounts (HSAs) and Archer Medical Savings Accounts (MSAs). This form is essential for taxpayers who wish to claim deductions related to these accounts or report contributions and distributions. Understanding the purpose and requirements of Form 8853 is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

How to use the Form 8853

Using Form 8853 involves accurately filling out the necessary sections to report contributions to HSAs or MSAs. Taxpayers must provide details such as the account holder's information, the total contributions made during the tax year, and any distributions taken from the accounts. It is important to follow the IRS guidelines closely to ensure that all information is correct and complete, as errors can lead to delays in processing or potential penalties.

Steps to complete the Form 8853

Completing Form 8853 requires several steps:

- Gather all necessary documentation, including records of contributions and distributions.

- Fill out the taxpayer's information at the top of the form.

- Complete the sections related to HSAs and MSAs, providing accurate figures for contributions and distributions.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate it.

Following these steps carefully will help ensure that the form is completed correctly and submitted on time.

Legal use of the Form 8853

The legal use of Form 8853 is governed by IRS regulations. Taxpayers must ensure that they are eligible to claim deductions for HSAs or MSAs and that the information reported on the form is accurate. Misuse of the form or incorrect reporting can lead to penalties or audits by the IRS. It is advisable to consult with a tax professional if there are any uncertainties regarding the eligibility or reporting requirements associated with Form 8853.

Filing Deadlines / Important Dates

Form 8853 must be filed by the tax return due date, which is typically April 15 of the following year. If taxpayers require additional time, they may file for an extension, but they must still ensure that Form 8853 is submitted by the extended deadline. Keeping track of these important dates is essential to avoid late filing penalties and ensure compliance with IRS regulations.

Required Documents

To complete Form 8853, taxpayers should gather the following documents:

- Records of contributions made to HSAs or MSAs during the tax year.

- Documentation of any distributions taken from these accounts.

- Previous year's tax returns, if applicable, for reference.

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Quick guide on how to complete form 8853 100675374

Complete Form 8853 seamlessly on any device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Form 8853 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign Form 8853 effortlessly

- Obtain Form 8853 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 8853 and guarantee outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8853 100675374

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8853 and who needs it?

Form 8853 is a tax form used by individuals who have health savings accounts (HSAs) or medical savings accounts (MSAs). It is essential for reporting contributions, distributions, and other financial details associated with these accounts. Understanding how to use form 8853 is crucial for ensuring accurate tax reporting.

-

How can airSlate SignNow help with form 8853?

airSlate SignNow streamlines the process of signing and sending form 8853 electronically, making it quick and easy. With our platform, users can create, edit, and securely send their tax documents without the hassle of printing and mailing. This helps ensure timely submission and compliance with tax regulations.

-

What are the pricing options for using airSlate SignNow for form 8853?

airSlate SignNow offers a range of pricing plans to accommodate various business needs, starting with a free trial. Each plan provides features designed to simplify document management, including for form 8853. Customers can choose based on their usage and required functionalities.

-

Are there specific features in airSlate SignNow for completing form 8853?

Yes, airSlate SignNow includes features like templates, customizable fields, and e-signature capabilities that are particularly useful for completing form 8853. These tools help users fill out the necessary information accurately and efficiently. Additionally, the platform ensures compliance with legal requirements for electronic signatures.

-

Can I integrate airSlate SignNow with other applications for managing form 8853?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Dropbox, enhancing the management of form 8853. This allows users to import and export documents easily, creating a more cohesive workflow across various platforms.

-

What benefits does using airSlate SignNow provide when dealing with form 8853?

Using airSlate SignNow for form 8853 provides numerous benefits, including faster document processing, reduced paper waste, and enhanced security. The electronic signing process minimizes delays and helps users maintain a clear audit trail for their tax documents. Overall, it simplifies compliance with important tax regulations.

-

Is it easy to navigate the airSlate SignNow platform for form 8853?

Yes, the airSlate SignNow platform is designed with user-friendliness in mind, making it easy to navigate for tasks related to form 8853. Users can quickly locate templates and tools tailored for tax forms, enabling a smooth experience even for those who are less tech-savvy. Our support resources are also available for assistance.

Get more for Form 8853

- Wwwpdffillercom36174396 individual casefillable online jud state ct individual case report family form

- What is my email address how to find out doc template form

- Wwwnjcourtsgovforms11637appndxxifcivil action answer appendix xi f

- Wwwpinterestcom pin 361906520061017224httpsapi15ilovepdfcomv1download form

- Wwwfilliofinal judgment forms packet formsfillable final judgment forms packet forms required to

- Fillable online please submit one check for each attorney form

- Wwwcourtscagovdocumentsfl810fl 810 summary dissolution information california

- Wwwnjcourtsgovforms10547frznfundshow to ask the court to order a bank to turn over funds that

Find out other Form 8853

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online