Ia 1040 Form

What is the Ia 1040 Form

The Ia 1040 Form is a tax document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating the amount of tax owed or the refund due based on the taxpayer's financial activities over the year. It includes sections for reporting various types of income, deductions, and credits, ensuring that taxpayers meet their obligations while taking advantage of available tax benefits.

How to use the Ia 1040 Form

Using the Ia 1040 Form involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and records of deductible expenses. Next, accurately fill out the form by entering income details, claiming deductions, and applying any tax credits. After completing the form, review it for accuracy before submitting it to the IRS. The Ia 1040 Form can be filed electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Ia 1040 Form

Completing the Ia 1040 Form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Begin with personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, dividends, and any other earnings.

- Claim applicable deductions, such as mortgage interest, student loan interest, and charitable contributions.

- Apply any tax credits for which you qualify, such as the Earned Income Tax Credit or Child Tax Credit.

- Calculate your total tax liability or refund based on the information provided.

- Sign and date the form before submission.

Legal use of the Ia 1040 Form

The Ia 1040 Form is legally binding when completed and submitted according to IRS guidelines. It must be signed by the taxpayer, affirming that the information provided is accurate to the best of their knowledge. Failure to comply with tax laws can result in penalties, including fines or legal action. Therefore, it is crucial to ensure that all information is correct and that the form is submitted by the appropriate deadlines.

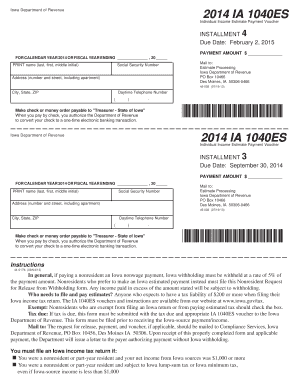

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the Ia 1040 Form. Typically, the deadline for filing is April 15 of each year, though this may vary slightly depending on weekends or holidays. If additional time is needed, taxpayers can request an extension, which generally allows for an extra six months to file. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Ia 1040 Form accurately, certain documents are necessary. These include:

- W-2 forms from employers detailing annual wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses, including medical bills and charitable contributions.

- Records of any tax credits applicable to the taxpayer's situation.

Form Submission Methods (Online / Mail / In-Person)

The Ia 1040 Form can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software, which often simplifies the process and speeds up refunds. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location. In-person filing is less common but may be available at designated IRS offices or tax assistance centers during tax season.

Quick guide on how to complete ia 1040 form 47159616

Complete Ia 1040 Form effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environment-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your files promptly without any hold-ups. Manage Ia 1040 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance your document-centric tasks today.

How to edit and eSign Ia 1040 Form with ease

- Find Ia 1040 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Edit and eSign Ia 1040 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1040 form 47159616

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ia 1040 Form?

The Ia 1040 Form is the state tax return form used by individuals to file their income taxes in Iowa. This form is crucial for reporting income, deductions, and taxes owed or refunds due. Knowing how to fill out the Ia 1040 Form correctly ensures compliance with state regulations and accurate tax filings.

-

How can airSlate SignNow help with the Ia 1040 Form?

airSlate SignNow makes it easy to send and eSign your Ia 1040 Form efficiently. With our user-friendly platform, you can securely collect eSignatures, ensuring your documents are processed quickly. This streamlines your tax filing process and helps you stay organized.

-

What features does airSlate SignNow offer for the Ia 1040 Form?

airSlate SignNow offers a variety of features to assist with the Ia 1040 Form, including customizable templates, secure eSignature collection, and document storage. These features simplify the submission process and keep all necessary tax documents in one place, enhancing your productivity.

-

Is there a cost associated with using airSlate SignNow for the Ia 1040 Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our cost-effective solution provides great value while ensuring that you can eSign and manage your Ia 1040 Form seamlessly. Consider a free trial to explore our offerings without commitment.

-

Can I integrate airSlate SignNow with other software for my Ia 1040 Form?

Absolutely! airSlate SignNow integrates with various platforms such as Google Drive, Dropbox, and CRM software. This allows you to efficiently manage and access your Ia 1040 Form alongside other important documents, ensuring a streamlined workflow.

-

What are the benefits of using airSlate SignNow for tax documents like the Ia 1040 Form?

Using airSlate SignNow for your Ia 1040 Form provides signNow benefits, including faster turnaround times, enhanced security, and improved compliance. Our electronic signature solution reduces paperwork hassle, allowing you to focus on more critical financial tasks.

-

Is airSlate SignNow suitable for small businesses needing the Ia 1040 Form?

Yes, airSlate SignNow is an ideal solution for small businesses needing to manage their Ia 1040 Form. Our platform is designed to be user-friendly and cost-effective, making it accessible for businesses of all sizes to simplify their tax processes.

Get more for Ia 1040 Form

- 1 of 23 state of florida department of business and form

- Construction industry licensing board form dbpr cilb 6 g

- Wwwnjcourtsgovforms10552namechgfamilyhow to ask the court to change a name in the chancery

- Fill free fillable emergent hearing order to show cause form

- Find your court forms formsandrules courtscagov

- Wwwfindformscomsingleformformfree application for waiver of fees costs and expenses and

- Wwwjudctgovwebformsformsexemption and modification claim form wage execution

- Supreme court reformcommon sense and ramblings in america

Find out other Ia 1040 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors