City of Glendale SALESUSE TAX RETURN FormSend

What is the City Of Glendale SALESUSE TAX RETURN FormSend

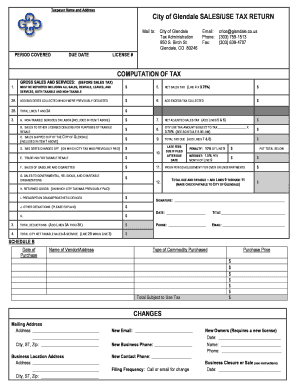

The City of Glendale SALESUSE TAX RETURN FormSend is a specific document required for businesses operating within Glendale to report their sales and use tax liabilities. This form is essential for ensuring compliance with local tax regulations and helps the city collect necessary revenue for public services. The form captures various details, including total sales, taxable sales, and any exemptions that may apply. Accurate completion of this form is crucial for both the taxpayer and the city to maintain transparent and lawful financial practices.

Steps to complete the City Of Glendale SALESUSE TAX RETURN FormSend

Completing the City of Glendale SALESUSE TAX RETURN FormSend involves several key steps. First, gather all relevant sales data for the reporting period, including total sales figures and any applicable exemptions. Next, accurately fill out the form, ensuring that all required fields are completed. Double-check your calculations for sales tax owed. After filling out the form, review it for accuracy before submission. Finally, submit the form electronically or via mail, depending on your preference and the guidelines provided by the city.

Legal use of the City Of Glendale SALESUSE TAX RETURN FormSend

The City of Glendale SALESUSE TAX RETURN FormSend is legally binding when completed and submitted in accordance with local regulations. It serves as an official record of your sales tax obligations and compliance with city tax laws. To ensure its legal standing, the form must be filled out accurately and submitted by the designated deadlines. Failure to comply with these requirements can lead to penalties or legal repercussions, making it essential to understand the legal implications of this document.

Filing Deadlines / Important Dates

Filing deadlines for the City of Glendale SALESUSE TAX RETURN FormSend are crucial for maintaining compliance. Typically, the form must be submitted quarterly or annually, depending on the volume of sales. It is important to check the specific deadlines for your reporting period, as late submissions may incur penalties. Keeping a calendar of these important dates can help ensure timely filing and avoid unnecessary fees.

Required Documents

To complete the City of Glendale SALESUSE TAX RETURN FormSend, several documents may be required. These typically include records of all sales transactions, receipts, and any documentation supporting tax exemptions. Having these documents organized and accessible will facilitate the accurate completion of the form and ensure compliance with local tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The City of Glendale SALESUSE TAX RETURN FormSend can be submitted through various methods, providing flexibility for businesses. Options typically include online submission via the city’s official website, mailing a physical copy to the designated tax office, or delivering it in person. Each method has its own guidelines and requirements, so it is important to choose the one that best suits your needs while ensuring compliance with submission protocols.

Penalties for Non-Compliance

Failure to submit the City of Glendale SALESUSE TAX RETURN FormSend by the deadline can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance underscores the importance of timely and accurate filing. Businesses should be aware of these penalties to avoid financial repercussions and maintain good standing with the city.

Quick guide on how to complete city of glendale salesuse tax return formsend

Prepare City Of Glendale SALESUSE TAX RETURN FormSend effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly and without complications. Manage City Of Glendale SALESUSE TAX RETURN FormSend on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign City Of Glendale SALESUSE TAX RETURN FormSend without difficulty

- Find City Of Glendale SALESUSE TAX RETURN FormSend and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools designed specifically for this purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether via email, SMS, invite link, or save it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Edit and eSign City Of Glendale SALESUSE TAX RETURN FormSend to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of glendale salesuse tax return formsend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the City Of Glendale SALESUSE TAX RETURN FormSend?

The City Of Glendale SALESUSE TAX RETURN FormSend is a digital solution designed to facilitate the easy submission of sales and use tax returns for businesses operating in Glendale. This form streamlines the filing process by allowing users to fill out, sign, and send their returns electronically through airSlate SignNow.

-

How does airSlate SignNow simplify the City Of Glendale SALESUSE TAX RETURN FormSend process?

airSlate SignNow simplifies the City Of Glendale SALESUSE TAX RETURN FormSend process by providing an intuitive platform for completing and sending tax forms. Users can easily input their information, eSign the document, and send it directly to the appropriate Glendale tax authorities, signNowly reducing paperwork hassle.

-

Is there a cost associated with using the City Of Glendale SALESUSE TAX RETURN FormSend?

Yes, while airSlate SignNow offers affordable pricing plans, specific costs for the City Of Glendale SALESUSE TAX RETURN FormSend are typically included in your chosen subscription. Various plans cater to different needs, ensuring that all users find a solution that fits their budget without compromising on features.

-

What features does airSlate SignNow offer for the City Of Glendale SALESUSE TAX RETURN FormSend?

airSlate SignNow provides a host of features for the City Of Glendale SALESUSE TAX RETURN FormSend, including customizable templates, secure eSignature options, and cloud storage. These tools enhance productivity and ensure compliance, making tax filing a breeze for business owners.

-

Can I integrate the City Of Glendale SALESUSE TAX RETURN FormSend with other software?

Yes, airSlate SignNow allows for seamless integrations with numerous third-party applications that can enhance your experience with the City Of Glendale SALESUSE TAX RETURN FormSend. This interoperability means you can streamline your workflow, manage documents more efficiently, and sync data across platforms.

-

What are the benefits of using the City Of Glendale SALESUSE TAX RETURN FormSend?

Using the City Of Glendale SALESUSE TAX RETURN FormSend through airSlate SignNow provides numerous benefits, including faster processing times and improved accuracy in tax filings. Additionally, the ability to track document status and receive notifications ensures that you never miss a deadline.

-

How secure is the City Of Glendale SALESUSE TAX RETURN FormSend when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the City Of Glendale SALESUSE TAX RETURN FormSend. The platform employs advanced encryption and authentication measures to keep your tax information protected throughout the filing process.

Get more for City Of Glendale SALESUSE TAX RETURN FormSend

Find out other City Of Glendale SALESUSE TAX RETURN FormSend

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture